Department Cash Handling Procedures

advertisement

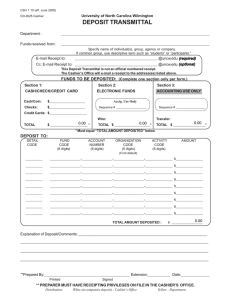

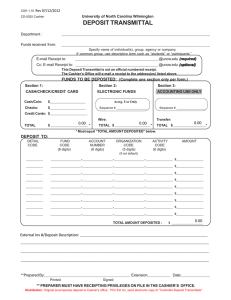

CONTROLLER’S OFFICE PROCEDURE Procedure Number C-CA-006 Subject Departmental Cash Procedures Effective Date Revised Date 01/01/2006 08/26/2010 DEPARTMENTAL CASH CONTROL PROCEDURES Department heads and managers of units that collect University funds remain primarily responsible for ensuring that adequate control procedures have been put in place and maintained to secure University collections and change funds. This policy has been established to provide a framework for guidance and coordination in this area and for establishing minimum control standards relative to cash handling. Only those departments or units who have applied for and have received approval will be authorized to function as a University Cash Collection Point. DEFINITIONS Cash For purposes of this policy cash is defined to include currency, checks, money orders, and credit/debit card collections. Cash Collection Point A cash collection point is defined as a department, event, club or other entity which collects more than $1,000 annually and the source of the revenue is other than recovery of expenditures such as telephone, copies, etc., unless these types of reimbursements occur frequently. All Cash Collection points must be authorized by the University Controller’s Office before collections begin. Internal Controls Internal controls generally comprises the plan of organization and all of the coordinated methods and measures adopted within a business to safeguard its assets, check the accuracy and reliability of its accounting data, promote operational efficiency, and encourage adherence to prescribed managerial policies. For purposes of this policy the emphasis on controls will generally be related to the methods and practices necessary to ensure the safeguarding of University cash collections and change funds. CASH COLLECTION POINT Approval Only those departments or University related entities that can demonstrate the ability to establish appropriate control procedures and comply with prescribed cash handling guidelines will be approved as Cash Collection Points. Responsibilities The Controller’s Office will make periodic reviews of the cash collection points and/or request that managers of the areas attend periodic training and/or submit completed internal control questionnaires relative to their cash handling procedures. Additionally, the University Inspector General and the staff of the State Auditor General's Office routinely conduct audits of cash collection points. Failure to follow appropriate procedures may result in an audit criticism and the loss of authority to serve as an authorized cash collection point. Any department functioning as a cash collection point without receiving the required approval by the Controller’s Office incurs the risk of losing budgetary spending authority for the funds collected, in addition to the possibility of incurring other appropriate disciplinary action. Any significant changes within a cash collection point relating to personnel duties or procedures should be brought to the attention of the University Controller’s Office. Additionally, the Controller’s office will make periodic unannounced visits to audit the cash-inhand at various collection points. INTERNAL CONTROL REQUIREMENTS General It is recognized that no one control model effectively or efficiently fits the needs of all cash collection areas. However, there are certain standard control procedures that will be in place. In such cases, there would be an expectation that alternative or compensating control procedures be put in place. The standard control procedures generally expected to be established at each cash collection point are as follows: For collections not received through the mail, but rather in person, proper receipting devices, such as cashiering terminals, are to be used to receipt funds at the initial point of collection so that all customers are provided with a receipt or cash register tape. Cash registers should have appropriate control features and the operator should not have the ability to reset totals. An employee with no cash handling responsibilities (who does not collect or deposit funds) should ensure that all funds receipted for have been properly deposited and recorded. This separation of duties is key to an effective control process. The individual that provides this check and balance is someone with the accounting responsibility. Persons with the responsibility for maintaining and billing accounts receivable should not be given responsibility for collecting payments. Collections received through the mail must be receipted or logged and restrictively endorsed for deposit only at the earliest point in the collection process. These receipts or logs must subsequently be compared with the deposit and collections recorded. One copy of the completed log must be placed in the mail-log notebook and another copy of the log is to be returned to the office manager. Different employees must not work simultaneously out of the same cash drawer and whenever funds are transferred among employees responsibility should be fixed through some receipting mechanism. Cash collections and change funds must be adequately secured at all times. Cash drawers must be locked when a cashier must be away from his or her workstation. Safe combinations are to be changed periodically or when someone leaves. Persons with assigned cash handling responsibilities must be given clear written procedures regarding their responsibilities with regard to the handling and control of cash collections or change funds. It must be made absolutely clear to such individuals that personal loans or the cashing of personal checks from cash collections or change funds is prohibited. At a minimum, persons handling cash must be required to read these cash handling procedures and sign a copy acknowledging that they have read and understand them. Processing Payments Cash Cash is always counted in front of the customer and a receipt given to the customer. Checks A. Checks received should be made payable to UNF. B. The following information must be recorded on checks received from students, faculty or staff: 1. Name 2. Current address and phone number 3. Driver’s License number and state of issue C. For checks received from individuals other than students, faculty, or staff, the following information regarding the identity of the person presenting the check must be written on the check (Does not apply to checks received through the mail): 1. The presenter's full name 2. Residence address 3. Home phone number 4. The driver's license number or state identification number, specifying the state of issuance of the person presenting the check. (Ref. 832.07(2)(b), F.S.) D. The Cashier’s Office will return any check that cannot be accepted if it is incorrectly written or there is a previous NSF check. Checks must be restrictively endorsed immediately upon receipt. Restrictive endorsement stamps will be provided by the Cashier’s Office. Voids Voided receipts or transactions must generally be approved by supervisory personnel. All copies of the voided receipt form must be retained or returned with the deposit. Payments Received by ACH or wire transfer Prior to initiating the receipt of payments by ACH or wire transfer, appropriate arrangements must be made with the Treasurer’s Office and Accounting Services section of the Controller's Office. PREPARING AND TRANSMITTING DEPOSITS As noted earlier, daily sales reports must generally be prepared and overages and shortages appropriately noted. Deposits must be made intact and agree with the totals of the daily sales reports. Cash is to be counted by two employees and placed in the deposit bag. Two tapes are run on the checks. One tape is attached to the checks and the other tape is attached to the transmittal (cash-out sheet). Cash and checks are separated & enclosed in disposable deposit bags furnished by the Cashier’s Office and sealed after verification. Both employees verifying the deposit are to initial the transmittal (cash-out sheet). Each deposit slip is to bear the amount of cash or checks along with the department name, deposit bag number, and cashier name/ID. Place the white copy of the deposit slip in the deposit bag with the cash or checks; attach the yellow copy to the transmittal (departments retain the pink copy for their records). Credit card payments and the settlement tape should be attached to the transmittal also. For those departments using Remote Deposit Capture (RDC) the checks are scanned and a copy of the detail report is kept with the checks for 14 days before destroying. There is no deposit bag for checks. A copy of the detail report is sent to the Cashier’s Office with the transmittal (via the Q:Drive) Transmittals must designate the foapal information—index, fund, organizational code, account code, & program code number that the funds are to be deposited to. The transmittal must include the total of each payment type that comprise the deposit. Notification will be given of any discrepancies in the deposit and the funds will be charged back to the department, if necessary. The deposit is to be forwarded to the Cashier’s Office or directly to the bank (if armored car service is available). Deposits should not be transmitted to the Cashier’s Office through campus mail or placed in a mail box. Departments should ensure that deposit bags are sealed and appropriate security is provided when deposits are transported across campus or from off-campus sites. Departments must submit a University deposit slip (or RDC detail report for scanned checks) and a transmittal form to the Cashier’s Office regardless of how the deposit is routed to the bank. Individuals delivering deposits to the Cashier’s Office should obtain a validated receipt at the time the deposit is delivered except during the week of drop/add (due to the heavy volume of students). There is a drop box on campus for departments to deposit their deposit bags and transmittals. Make sure deposit bags are sealed before placing in the drop box. These are retrieved each morning by Cashier Office personnel. Departments using the Wachovia RDC (Remote Deposit Capture) system, will scan the detail report and post it and their transmittal on the Q:Drive in their unprocessed folder within the Controller Transmittal Forms folder. Once the Cashier Office staff process the transmittal, the department will be able to view the receipt in their processed folder. All files names contain the transmittal date. Do not delete files in the Controller Transmittal Forms folder. Credit and debit card collections are transmitted at the point of sale. The totals for each type of credit card must be indicated on the transmittal to ensure proper recording by the Cashier Office staff. A copy of the summary total report along with a University deposit slip and transmittal must be forwarded to the Cashier’s Office daily. Deposits must be made daily. Online Departmental Deposits Those departments posting their deposits online via the iPayment portal must adhere to the same cash handling and internal control procedures as noted above. Different employees cannot share the same payfile or cash drawer. Deposits are completed in the same manner as noted above. Departments must prepare their deposits and send the necessary back-up information to the Cashier’s Office to process the daily cash receipts package. AUTHORIZATION TO ESTABLISH A PETTY CASH OR CHANGE FUND If a department has a need for a petty cash or change fund, appropriate arrangements must be made through the Controller’s Office. Temporary funds for special events can be arranged through the Cashier’s Office as well with timely notification. SALES AND UNRELATED BUSINESS INCOME TAXES University departments or related entities must be aware that the sale of certain goods or services may be subject to State sales tax and/or Federal Unrelated Business Income Taxes (UBIT). Concerns or questions regarding tax issues must be addressed to the Accounting Services section within the Controller's Office. AUTHORIZATION TO ESTABLISH BANK ACCOUNT All University funds are required to be deposited through appropriate University accounts. The establishment of bank accounts by State entities outside the State Treasury is tightly regulated and is only authorized under very limited circumstances. University departments should never open an account with a private bank or credit union without the expressed written authorization from the University Controller. RESOURCES Deposit slips, endorsement stamps, transmittals and cash count will be provided by the Controller’s Office. Bags are available at the Cashier’s Office. Training will be provided by the Cashier’s Office as needed. Any questions, comments or requests for supplies should be directed to the Bursar (or designee) or via e-mail cashier@unf.edu.