Cost Transfer Request Form

advertisement

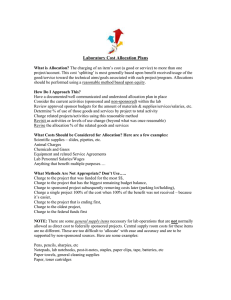

COST TRANSFERS A cost transfer is a movement of cost associated with a transaction between two indexes, of which at least one must be a sponsored project (21xxxx-23xxxx). This includes salary and non-salary costs. One exception is allocating charges from a non-sponsored project to a federal sponsored project. These are considered original or initially recorded charges if they are transferred within 90 days of the initial charge. Expenditures should be charged initially to the correct Banner index for the sponsored project. However, occasionally expenses are charged erroneously. When an erroneous entry affects a restricted sponsored project, the correction must be made on a timely basis and provide sufficient information to allow for a clear audit trail back to the initially recorded expense. Errors in recording costs indicate the need for improvement in the accounting process and/or internal controls. When errors occur, departments are required to evaluate these areas and make the necessary improvements. Cost transfer documentation and timeliness of corrections involving federal sponsored projects is the responsibility of the Principal Investigator. Cost Transfer Examples: Allocating charges BETWEEN sponsored project indexes is considered a cost transfer. For example, if lab supplies are incorrectly charged to a sponsored project (21xxxx- 23xxxx) and are moved to the correct sponsored project (21xxxx – 23xxxx). Allocating charges FROM a sponsored project index TO a non-sponsored index (such as departmental index or an IPD index) are cost transfers. For example, if meeting expenses are erroneously charged to a grant index (21xxx-23xxx) and later moved to a departmental index (6xxxx). The following are NOT Cost Transfers UNLESS they are late (more than 90 days after the initial charge). If any of these transactions are late, then they need to be coded as cost transfers and the late documentation requirements apply. Allocating charges FROM a non-sponsored index TO a sponsored project index are considered original or initially recorded charges; they are not cost transfers. Examples include allocation of procurement card (P-card) communication/postal charges and other service center bills that can not be allocated at the time of purchase. Unallowable cost transfers A cost transfer from one sponsored project to another may not be processed simply to cover cost overruns with funds in other sponsored projects, to avoid restrictions incorporated by the Sponsor, or for other reasons of convenience. Before an expense can be charged to a sponsored project it must first meet all the requirements of direct costing of sponsored projects. The Office of Research and Sponsored Programs (ORSP) periodically tests cost transfers covered by this procedure for compliance. ORSP will coordinate corrective action with the PI and Department. PROCEDURE: Principal Investigator(s) must complete a Cost Transfer Request Form with an attached Payroll Change/Correction Form for transfer of payroll expenses or a Cost Transfer Journal Voucher Form for transfer non-payroll expenses. SPECIAL CONDITIONS: Timeliness A cost transfer should be processed promptly after the error is discovered. Untimely cost transfers may raise serious questions concerning the propriety of the cost transfer and may be subject to a cost disallowance. A cost transfer is considered “untimely” when it is not processed within 90 days after the initially recorded charge. DOCUMENTATION: A cost transfer is documented by processing a Cost Transfer Request Form with a Payroll Change/Correction Form or Cost Transfer Journal Voucher Form. COST TRANSFER REQUEST FORM This form must be completed when requesting to transfer expenses (costs) to or from a sponsored project. Section 1 – Identification of Cost Check one and attach appropriate documents. � This is a transfer of personnel costs (attach Payroll Change/Correction Form) � This is a transfer of non-personnel costs (attach Cost Transfer Journal Entry Form) Section 2 – Justification for Transfer Complete the following section in the space provided. Attach additional pages if necessary. (a) Specifically, fully explain why the expense(s) was not originally charged to the correct project. (b) Fully explain how the expense(s) benefits the project. Section 3 – EXCEPTION – Late Cost Transfer Request Complete this section in the space provided only if you are requesting the transfer of expenses older than 90 days. Attach additional pages if necessary. (a) Explain why the error was not identified and corrected timely. (b) Approved by: ________________________________ Department Chair ____________________________________ Dean ________________________________ ORSP ____________________________________ AVP for Research Section 4 – Certification I certify that the above-mentioned costs are appropriate charges to the project and project to which the costs are being transferred. Principal Investigator on correct project: ________________________________ Printed name __________________ Extension _______________ Fax number ________________________________ Signature Date For ORSP Use Only: Approved for Processing:_____________________Journal #:________________Date:________________ Last updated: September 23, 2006 COST TRANSFER REQUEST FORM – INSTRUCTIONS Justification for Transfer Since the federal regulations assume that cost transfers are exceptions, it is imperative to appropriately justify in writing: (1) the reason why the cost was not charged to the correct project and (2) how it benefits the project to be charged. This justification should be fully documented on the form which will serve as the audit source document. The following are examples of inappropriate justifications: Charged a sponsored project for a bulk purchase and are moving costs to the appropriate sponsored projects Charged another sponsored project in anticipation of future funding To move costs to a sponsored project with available budget If an expense is being moved to a sponsored project, it is necessary to explain how that cost benefits the project. If the cost is typically considered an indirect cost (See Direct and Indirect Charging Policy), additional justification must be provided as to why directly charging the expense to the project is appropriate. EXCEPTION – Late Cost Transfer It is required that cost transfers be requested within 90 days of the original charge. Only in cases of exceptional circumstances will cost transfers be permitted more than 90 days after the original charge. Additional explanation is required here to document the reason for the lateness of the request. The department chair, the Dean of the College, ORSP and the Assistant Vice President for Research must approve all Late Cost Transfers.