Current issues in General Insurance – Regulations and Opportunities Reinsurance

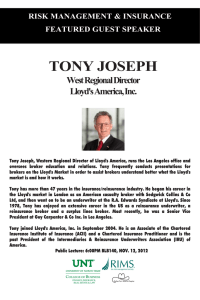

advertisement

< Picture to go here > Current issues in General Insurance Reinsurance – Regulations and Opportunities 3 July 2015 © Lloyd’s 2012 Disclaimer ► Our understanding is that India is looking to develop itself as an international (re)insurance center besides, having SEZ as a (re) insurance hub, seeking to attract (re) insurers to underwrite both onshore and offshore business ► There’s also an objective to promote Ease of Doing Business in line with the International Best Practices ► India is also looking ensure that it benchmarks with the other Hubs – Hong Kong, Singapore and also with Dubai International Financial Centre ► The following comments are therefore to accommodate these objectives rather than to cater to any external entity © Lloyd’s 2012 < Picture to go here > Regulations for Registration and Operations of Branch Offices of Foreign Reinsurers (excluding Lloyd’s) ► Procedure for registration ► Requisition for registration application ► Eligibility norms ► Consideration of requisition for registration application ► Application for registration and its consideration ► Conditions governing the registration of branches of foreign reinsurers ► Manner of computation of annual fee ► Operational issues pertaining to Branch offices of foreign reinsurer © Lloyd’s 2012 < Picture to go here > Regulations for Registration and Operations of Branch Offices of Foreign Reinsurers (excluding Lloyd’s) ► Operational issues pertaining to Branch offices of foreign reinsurer – Geographical Scope – Appointment of Chief Executive Officer and Key Management Personnel < Picture to go here > – Outsourcing – Accounting and Investments – Reinsurance and Retrocession – Order of preference for cessions by Indian Insurers – Repatriation of surplus – Delegated authorities – Supervision and Control © Lloyd’s 2012 IRDAI (IFSC) Guidelines 2015 ► Reinsurance Business – Eligibility Criteria – Application and consideration for registration – Scope of Operations < Picture to go here > – Assigned Capital ► Direct insurance Business in SEZ ► Terms, conditions and requirements of Certification of Registration ► Applicability of the provisions of Insurance Act, 1938 © Lloyd’s 2012 Building a successful (re)insurance hub: Lessons from Dubai and Singapore ► Dubai and Singapore are the undisputed reinsurance centers for Middle East and Emerging Asia ► It’s a consequence of acute foresight and careful economic engineering ► Ingredients of a reinsurance hub – Economic and political stability – Quality of local legislation and regulation < Picture to go here > – Ease of Doing Business – Cosmopolitan environment – Availability (importability) of highly skilled finance professionals – Adequate education and training facilities – Competitive tax environment – Convenient geographical location ► Available capacity for mainline and niche segments ► Cluster of services – specialized lawyers, Loss adjusters, Risk Engineers, forensic Accountants and HR Consultants etc. © Lloyd’s 2012 DIFC – A purposefully built free zone ► DIFC offers its member companies major benefits – Full foreign ownership – Zero tax rate – No restrictions on capital convertibility – No restrictions on profit repatriation – Cluster of reinsurers, Lloyd’s cover holders, MGAs and other specialized service providers ► The Free Zone has its own independent regulator: DFSA – Committed to risk and principles based approach – Offers independent common law judiciary with jurisdictions over civil and commercial disputes ► Cluster of 18 (re) insurers, 37 intermediaries and 16 specialized services © Lloyd’s 2012 < Picture to go here > Singapore – a nation wide regulatory framework ► The (re)insurance hub of Singapore offers a common, nation- wide legal and regulatory framework for both onshore and offshore business ► Singapore has become world’s most competitive economy – English common law system < Picture to go here > – Sophisticated regulatory environment – Competitive tax rules (10% corporate tax for offshore business) – Superior quality of living and a deep talent pool – Removal of foreign ownership limits and Risk Based Capital framework – Singapore has 78 direct insurers, 31 reinsurers, 64 captives, and 73 Brokers – operators regulated through SIF & OIF © Lloyd’s 2012 < Picture to go here > ►Thank You © Lloyd’s 2012