Document 15476573

advertisement

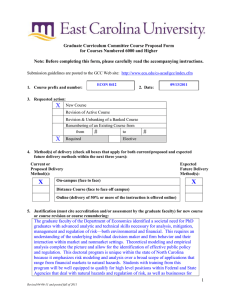

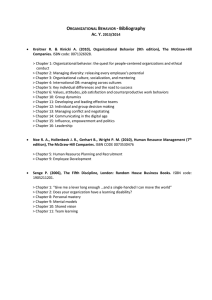

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 6000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. Submission guidelines are posted to the GCC Web site: http://www.ecu.edu/cs-acad/gcc/index.cfm 1. Course prefix and number: ECON 8412 2. Date: 09/13/2011 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # X Required # Elective 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): X On-campus (face to face) Expected Future Delivery Method(s): X Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification (must cite accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: The graduate faculty of the Department of Economics identified a need in government, the private sector, and in academia for PhD graduates with advanced analytic and technical skills necessary for analysis, mitigation, management and regulation of risk— both environmental and financial. This requires an understanding of the underlying individual decision maker and firm behavior and their interaction within market and nonmarket settings. Theoretical modeling and empirical analysis complete the picture and allow for the identification of effective public policy and regulation. This doctoral program is unique within the state of North Carolina because it emphasizes risk modeling and analysis over a broad scope of applications that range from financial markets to natural hazards. Students with training from this program will be well equipped to qualify for high level positions within Federal and State Agencies that deal with natural 1 Revised 04-06-11 and posted fall of 2011 hazards and regulation of risk, as well as businesses for management and mitigation of risk. The assessment process of the Economics Graduate Faculty has determined that a field in risk and uncertainty, particularly one dealing with natural and environmental hazards, requires a course presenting and developing the alternatives to classical expected utility analysis. 6. Course description exactly as it should appear in the next catalog: 8412. Risk Analysis II (3) P: ECON 8411. Analysis of models relevant to natural hazards risks. 7. If this is a course revision, briefly describe the requested change: N/A 8. Course credit: Lecture Hours 3 3 Weekly OR Per Term Credit Hours s.h. Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Other (e.g., independent study) Please explain. s.h. 3 Total Credit Hours s.h. 6 9. Anticipated annual student enrollment: 10. Changes in degree hours of your programs: Degree(s)/Program(s) Changes in Degree Hours PhD/Economics N/A 11. Affected degrees or academic programs, other than your programs: Degree(s)/Program(s) Changes in Degree Hours 12. Overlapping or duplication with affected units or programs: X Not applicable Documentation of notification to the affected academic degree programs is attached. 13. Council for Teacher Education (CTE) approval (for courses affecting teacher education): X Not applicable Applicable and CTE has given their approval. 2 Revised 04-06-11 and posted fall of 2011 14. University Service-Learning Committee (USLC) approval: X Not applicable Applicable and USLC has given their approval. 15. Statements of support: a. Staff Current staff is adequate Additional staff is needed (describe needs in the box below): X Specialist in theories of risk and uncertainty and applications to hazards related risks. b. Facilities X Current facilities are adequate Additional facilities are needed (describe needs in the box below): c. Library X Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Unit computer resources X Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): e. ITCS resources X ITCS resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software MATLAB Approval from the Director of ITCS attached 16. Course information (see: Graduate Curriculum and Program Development Manual for instructions): a. Textbook(s) and/or readings: author(s), name, publication date, publisher, and city/state/country. Include ISBN (when applicable). Required: Gilboa, I. (2009). The Theory of Decision under Uncertainty. Cambridge, UK: Cambridge. ISBN: 978-0521741231 3 Revised 04-06-11 and posted fall of 2011 Gilboa, I. (2010). Making Better Decisions: Decision Theory in Practice. New York: Wiley. ISBN: 978-1444336528 Kreps, D. (1988). Notes on the Theory of Choice, Boulder: Westview). ISBN: 9780813375533 Selected Readings from: Dow, J. & Werlang, S. (1992). Uncertainty Aversion, Risk Aversion, and the Optimal Choice of Portfolio. Econometrics (60, pp.179-204). ISBN: 978-0691010182 Ellsberg, D. (1961). Risk, Ambiguity, and the Savage Axioms. Quarterly Journal of Economics (75, pp. 643-669). Embrechts, P., Klüppelberg, C., & Mikosch, T. (2003). Modeling Extremal Events, Berlin: Springer-Verlag. ISBN: 978-3642082429 Falconer, K. (1990). Fractal Geometry: Mathematical Foundations and Applications, New York: Wiley. ISBN: 978-0470848623 Geweke, J. (Ed.). (1992). Decision Making under Uncertainty---New Models and Empirical Findings. Amsterdam: Kluwer. ISBN: 978-0792319047 Gilboa, I. & Schmeidler, D. (2001). A Theory of Case-Based Decisions. Cambridge, UK: Cambridge. ISBN: 978-0521003117 Kahneman, D. & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica (47, pp.263-291). Kahneman, D. & Tversky A. (Eds.). (2000). Choices, Values, and Frames. Cambridge, UK: Cambridge. ISBN: 978-0521627498 Karni, E. (1985). Decision Making Under Uncertainty: The Case of State Dependent Preference. Cambridge, MA: Harvard. ISBN: 978-0674195257 Machina, M.J. (1987). Choice Under Uncertainty: Problems Solved and Unsolved. Journal of Economic Perspectives (1, pp.121-154). Mukerji, S. & Talon, J.M. (2001). Ambiguity /Aversion and the Incompleteness of Financial Markets. Review of Economic Studies (68, pp. 883-904). Rigotti, L. & Shannon, C. (2005). Uncertainty and Risk in Financial Markets. Econometrica (73, pp.203-243). Wakker, P.P. (2008). Prospect Theory, Cambridge, UK: Cambridge. ISBN: 9780521748681 And recent research papers on alternatives to, and extensions of, expected utility theory. 4 Revised 04-06-11 and posted fall of 2011 b. Course objectives for the course (student – centered, behavioral focus) Upon completion of this course, students will be able to: Compare and contrast alternative approaches to understanding decision-making in the face of uncertainty; Utilize behavioral models to evaluate the impact of risk, ambiguity, true uncertainty on decision-making; Model risks with “fat tails”, and extremal events; Analyze “optimal” decisions in the face of extreme events, and natural catastrophes; Apply these models to analyze natural hazards risks and their consequences. c. Course topic outline 1. Difficulties with Expected Utility Theory: Behavioral Contradictions. 2. Behavioral Models of Choice under Risk and Uncertainty. 3. Non-expected Utility Models: Sets of distributions; capacities; purely finitely additive measures. 4. Optimal Decisions with ‘fat-tailed’ risks, extremal events. 5. Applications to finance and the pricing of market securities. 6. Fractal Models of risky/uncertain decision environments. d. List of course assignments, weighting of each assignment, and grading/evaluation system for determining a grade Problem sets (42%) Survey Paper (25%) Comprehensive Final Exam (33%) Evaluation System A 90% to 100% B 89% to 80% C 79% to 70% F Below 70% Outstanding Performance Acceptable Performance Inadequate Performance Failure 5 Revised 04-06-11 and posted fall of 2011