8241

advertisement

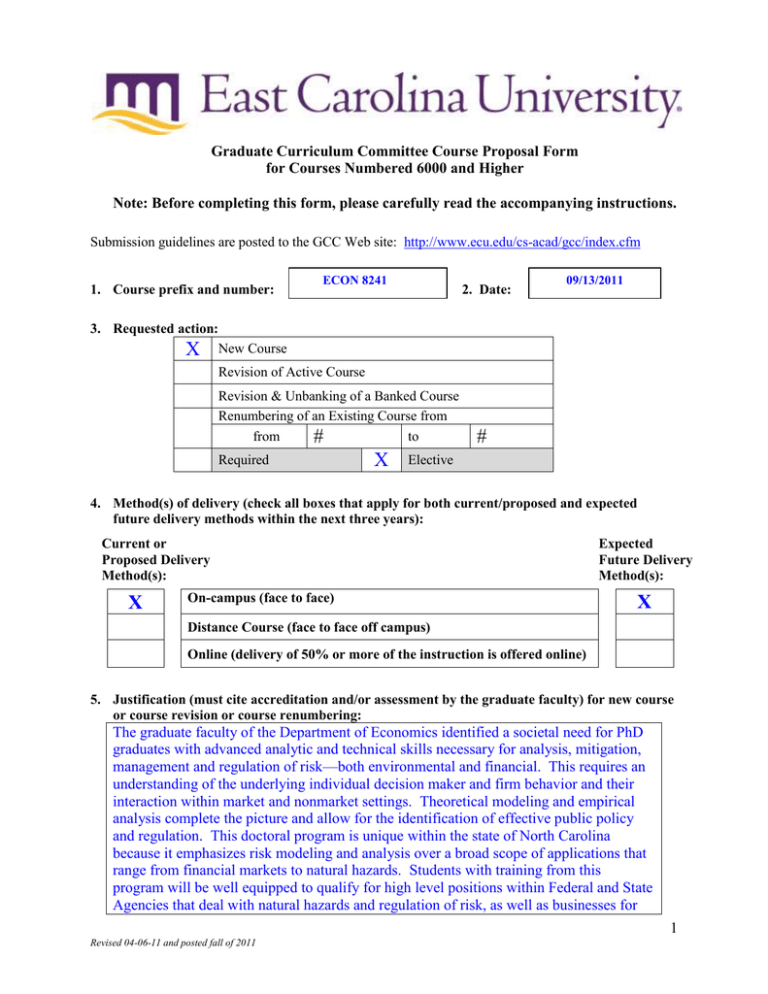

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 6000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. Submission guidelines are posted to the GCC Web site: http://www.ecu.edu/cs-acad/gcc/index.cfm 1. Course prefix and number: ECON 8241 2. Date: 09/13/2011 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # Required X # Elective 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): X On-campus (face to face) Expected Future Delivery Method(s): X Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification (must cite accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: The graduate faculty of the Department of Economics identified a societal need for PhD graduates with advanced analytic and technical skills necessary for analysis, mitigation, management and regulation of risk—both environmental and financial. This requires an understanding of the underlying individual decision maker and firm behavior and their interaction within market and nonmarket settings. Theoretical modeling and empirical analysis complete the picture and allow for the identification of effective public policy and regulation. This doctoral program is unique within the state of North Carolina because it emphasizes risk modeling and analysis over a broad scope of applications that range from financial markets to natural hazards. Students with training from this program will be well equipped to qualify for high level positions within Federal and State Agencies that deal with natural hazards and regulation of risk, as well as businesses for 1 Revised 04-06-11 and posted fall of 2011 management and mitigation of risk. The assessment process of the Economics Graduate Faculty has determined that this course should be the first in a two-course PhD field sequence in applied macroeconomics. 6. Course description exactly as it should appear in the next catalog: 8241. Applied Macro I (3) P: ECON 8211. Development of the models and statistical techniques used to study time series data with a special emphasis to applications in macroeconomics. 7. If this is a course revision, briefly describe the requested change: N/A 8. Course credit: Lecture Hours 3 3 Weekly OR Per Term Credit Hours s.h. Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Other (e.g., independent study) Please explain. s.h. 3 Total Credit Hours s.h. 6 9. Anticipated annual student enrollment: 10. Changes in degree hours of your programs: Degree(s)/Program(s) Changes in Degree Hours PhD/ Economics N/A 11. Affected degrees or academic programs, other than your programs: Degree(s)/Program(s) Changes in Degree Hours 12. Overlapping or duplication with affected units or programs: X Not applicable Documentation of notification to the affected academic degree programs is attached. 13. Council for Teacher Education (CTE) approval (for courses affecting teacher education): X Not applicable 2 Revised 04-06-11 and posted fall of 2011 Applicable and CTE has given their approval. 14. University Service-Learning Committee (USLC) approval: X Not applicable Applicable and USLC has given their approval. 15. Statements of support: a. Staff Current staff is adequate X Additional staff is needed (describe needs in the box below): b. Facilities X Current facilities are adequate Additional facilities are needed (describe needs in the box below): c. Library X Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Unit computer resources X Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): e. ITCS resources X ITCS resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software MATLAB Approval from the Director of ITCS attached 16. Course information (see: Graduate Curriculum and Program Development Manual for instructions): a. Textbook(s) and/or readings: author(s), name, publication date, publisher, and city/state/country. Include ISBN (when applicable). Textbooks: Hamilton, J.D. (1994). Time Series Analysis. Princeton University Press, Princeton, NJ. 3 Revised 04-06-11 and posted fall of 2011 Hayashi, F. (2000). Econometrics. Princeton University Press, Princeton NJ. Readings: Description of Macroeconomic Time Series Data: Baxter, M. and R. King. (1999). Measuring the Business Cycle: Approximate BandPass filters for Economic Time Series. Review of Economics and Statistics. Stock, J. and M. Watson. (1999). Business Cycle Fluctuations in US Macroeconomic Time Series. In: Taylor, J.B., Woodford, M. (Eds.). Handbook of Macroeconomics (15). Amsterdam; New York and Oxford: Elsevier Science, North-Holland. Ahmed, S., A. Levin, A., and B. A. Wilson. (2004). Recent U.S. Macroeconomic Stability: Good Policies, Good Practices, or Good Luck? The Review of Economics and Statistics (86: pp.824-832). MIT Press. Canova, F. (1998). Detrending and Business Cycle Facts. Journal of Monetary Economics (41, pp.475-512 ). Burnside, C. (1998). Detrending and Business Cycle Facts: A Comment. Journal of Monetary Economics (41, pp. 513-532). Shapiro, M. and M. Watson. (1988). Sources of Business Cycle Fluctuations. NBER MacroAnnual. Vector Autoregression: Watson, M. (1994). Vector Autoregressions, Handbook of Econometrics (4). Elsevier Kilian, L. (1998). Small Sample Confidence Intervals for IRFs. Review of Economics and Statistics. Pesavento, E. and B. Rossi. (2006). Impulse Response Confidence Intervals for Persistent Data: What Have We Learned? Journal of Economic Dynamics and Control. Rossi, E. and E. Pesavento. (2005). Do technology shocks drive hours up or down? A little evidence from an agnostic procedure. Macroeconomic Dynamics. Christiano, L., M. Eichenbaum, and C. Evans. (1999). Monetary Policy Shocks: What Have We Learned and to What End? In: Taylor, J.B., Woodford, M. (Eds.). Handbook of Macroeconomics (15: pp. 65-148). Amsterdam, New York and Oxford: Elsevier Science, North-Holland. Structural Breaks and Model Selection: Andrews, D.W.K. (1993), Tests for Parameter Instability and Structural Change with Unknown Change Point. Econometrica (61, pp. 821-856). 4 Revised 04-06-11 and posted fall of 2011 Bai, J. & Perron, P. (1998). Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica (66, pp. 47-78). Bai, J. (1997). Estimating Multiple Breaks One at a Time. Econometric Theory (13: 315-52). Rossi, B. (2005). Optimal Tests for Nested Model Selection in the Presence of Underlying Parameter Instability. Econometric Theory. Forecasting: West, K. (1996). Asymptotic Inference about Predictive Ability. Econometrica (64, pp. 1067-1084). Chao, J., Corradi, V. & Swanson, N. (2001). An Out-of-sample Test for Granger Causality. Macroeconomic Dynamics. Clark, T. & McCracken, M. (2001). Tests of Equal Forecast Accuracy and Encompassing for Nested Models. Journal of Econometrics (105, 85-110). b. Course objectives for the course (student – centered, behavioral focus) Upon completion of this course, students will be able to: Understand the econometric theory of time series analysis, with an emphasis on recent developments: analyze selected recent works in theoretical macroeconomic modeling with an emphasis on their empirical implications and analysis; and integrate time series data into their PhD research with the tools they need for state-of-the-art empirical research. c. Course topic outline I. Time series models, filtering, and applications to leading indicators and the business cycle. II. Vector Auto-Regressions and impulse responses, with applications to monetary policy analysis and the dynamics of aggregate demand and supply shocks. III. Modeling and inference in persistent time series, with applications to trends and random walks, and price convergence. IV. Forecasting and structural breaks, and applications to the Phillips curve and the Term Structure as predictors of future GDP growth and inflation dynamics. d. List of course assignments, weighting of each assignment, and grading/evaluation system for determining a grade 5 Problem sets: Midterm Exam: Course Paper: Final Exam: 25% 25% 25% 25% 5 Revised 04-06-11 and posted fall of 2011 Evaluation system is A for outstanding performance, B for acceptable performance, C for inadequate performance, and F for failure. 6 Revised 04-06-11 and posted fall of 2011