Document 15476562

advertisement

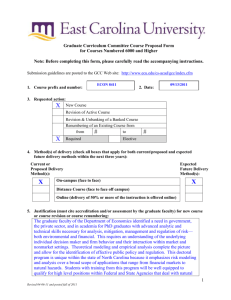

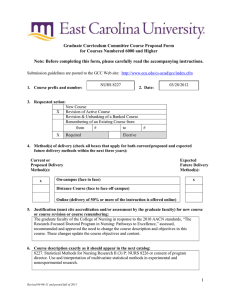

Graduate Curriculum Committee Course Proposal Form for Courses Numbered 6000 and Higher Note: Before completing this form, please carefully read the accompanying instructions. Submission guidelines are posted to the GCC Web site: http://www.ecu.edu/cs-acad/gcc/index.cfm 1. Course prefix and number: ECON 8212 2. Date: 09/13/2011 3. Requested action: X New Course Revision of Active Course Revision & Unbanking of a Banked Course Renumbering of an Existing Course from from to # Required X # Elective 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): X On-campus (face to face) Expected Future Delivery Method(s): X Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification (must cite accreditation and/or assessment by the graduate faculty) for new course or course revision or course renumbering: The graduate faculty of the Department of Economics identified a need in government, the private sector, and in academia for PhD graduates with advanced analytic and technical skills necessary for analysis, mitigation, management and regulation of risk—both environmental and financial. This requires an understanding of the underlying individual decision maker and firm behavior and their interaction within market and nonmarket settings. Theoretical modeling and empirical analysis complete the picture and allow for the identification of effective public policy and regulation. This doctoral program is unique within the state of North Carolina because it emphasizes risk modeling and analysis over a broad scope of applications that range from financial markets to natural hazards. Students with training from this program will be well equipped to qualify for high level positions within Federal and State Agencies that deal with natural hazards and 1 Revised 04-06-11 and posted fall of 2011 regulation of risk, as well as businesses for management and mitigation of risk. The assessment process of the Economics Graduate Faculty has determined that this course will be part of the core theory sequence. 6. Course description exactly as it should appear in the next catalog: 8212. Macroeconomic Theory II (3) P: ECON 8211. Analysis of business cycles using canonic positive macroeconomic models; disequilibrium macroeconomic dynamics; normative analysis of monetary and fiscal policy using macroeconomic models. 7. If this is a course revision, briefly describe the requested change: N/A 8. Course credit: Lecture Hours 3 3 Weekly OR Per Term Credit Hours s.h. Lab Weekly OR Per Term Credit Hours s.h. Studio Weekly OR Per Term Credit Hours s.h. Practicum Weekly OR Per Term Credit Hours s.h. Internship Weekly OR Per Term Credit Hours s.h. Other (e.g., independent study) Please explain. s.h. 3 Total Credit Hours s.h. 6 9. Anticipated annual student enrollment: 10. Changes in degree hours of your programs: Degree(s)/Program(s) Changes in Degree Hours PhD in Economics N/A 11. Affected degrees or academic programs, other than your programs: Degree(s)/Program(s) Changes in Degree Hours 12. Overlapping or duplication with affected units or programs: X Not applicable Documentation of notification to the affected academic degree programs is attached. 13. Council for Teacher Education (CTE) approval (for courses affecting teacher education): X Not applicable Applicable and CTE has given their approval. 2 Revised 04-06-11 and posted fall of 2011 14. University Service-Learning Committee (USLC) approval: X Not applicable Applicable and USLC has given their approval. 15. Statements of support: a. Staff Current staff is adequate X Additional staff is needed (describe needs in the box below): b. Facilities X Current facilities are adequate Additional facilities are needed (describe needs in the box below): c. Library X Initial library resources are adequate Initial resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition of required initial resources): d. Unit computer resources X Unit computer resources are adequate Additional unit computer resources are needed (in the box below, give a brief explanation and an estimate for the cost of acquisition): Six additional computers e. ITCS resources X ITCS resources are not needed The following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Software MATLAB Approval from the Director of ITCS attached 16. Course information (see: Graduate Curriculum and Program Development Manual for instructions): a. Textbook(s) and/or readings: author(s), name, publication date, publisher, and city/state/country. Include ISBN (when applicable). Required: Ljungqvist, L. & Sargent, T. J. (2000). Recursive Macroeconomic Theory. Cambridge: MIT Press. ISBN: 978-0262122740 3 Revised 04-06-11 and posted fall of 2011 Lucas, R. E., Stokey, N., & Prescott, E. C. (1989) Recursive Methods in Economic Dynamics. Harvard University Press. ISBN:978-0674750968 Recommended: Barro, R. J. and Sala-I-Martin, X. (1998) Economic Growth. New York: McGraw Hill. ISBN: 978-0674750968 Romer, D. (2001). Advanced Macroeconomics. New York: McGraw Hill. ISBN: 9780073511375 Walsh, C. E. (1998). Monetary Theory and Policy. Cambridge: MIT Press. ISBN: 9780262013772 Barro, R. J. (1997). Macroeconomics. Cambridge: MIT Press. ISBN: 978-1429218870 b. Course objectives for the course (student – centered, behavioral focus) Upon completion of this course, students will be able to: Evaluate business cycle regularities in modern developed economies Demonstrate mastery of canonic macroeconomic models and apply those models to analyze business cycles Utilize normative models in analyzing monetary and fiscal policies. c. Course topic outline 1. Business cycle regularities 2. Economic intuition in finite-horizon models: Consumer behavior and the consumption demand Labor-leisure choices 3. Positive macroeconomic theory with infinite-horizon models Efficient allocations (without uncertainty) Equilibrium concepts (without uncertainty) Growth theory Real business cycle analysis (with uncertainty and labor-leisure choices) 4. Normative macroeconomic theory Optimal fiscal policy Optimal monetary policy Optimal fiscal and monetary policy Time consistency d. List of course assignments, weighting of each assignment, and grading/evaluation system for determining a grade Assignments 60% Midterm 20% Comprehensive Final 20% Evaluation System A 90% to 100% B 89% to 80% C 79% to 70% F Below 70% Outstanding Performance Acceptable Performance Inadequate Performance Failure 4 Revised 04-06-11 and posted fall of 2011