Cost Sharing Policy

advertisement

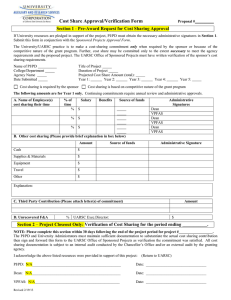

OFFICE OF RESEARCH AND PROJECTS Effective:December 18, 2002 SIUE Policy on Cost Sharing Regulations require the University to substantiate, through adequate records, cost sharing expenditures for both direct and indirect (facilities and administrative) cost associated with all external grants and contracts. The records must reflect that direct cost sharing expenditures are appropriate, necessary and incurred within the related project period. Records must also provide evidence that the cost sharing expenditures incurred in a particular fiscal year are included in the development of the University’s facilities and administrative cost rate for the same fiscal year. The SIUE Policy on Cost Sharing has been developed to ensure that the University remains in compliance with State and Federal regulations governing cost sharing arrangements. This policy will enable the University to recover the full amount of program or project costs that it expects to receive from Federal or State sponsoring agencies. Definition of Cost Sharing The federal government through the Office of Management and Budget (OMB Circular A-110) “Uniform Administrative Requirements for Grants and Contracts with Institutions of Higher Education and Other Non-Profit Organizations has defined cost sharing as “that portion of project or program costs not borne by the federal government.” Most State of Illinois agencies define cost sharing similarly and define cost sharing in grants and contract agreements as project or program costs not borne by the state agency. The Office of Management and Budget (OMB Circular A-21) “Cost Principals for Institutions of Higher Education” defines specific categories of cost sharing as follows: 1. Mandatory Cost Share a) Mandated by law or regulation b) Stated in program or project announcement 2. Voluntary Committed Cost Share a) Solicited or suggested in the program or project announcement b) Cost sharing specifically pledged in the proposal’s budget or award by the institution 3. Voluntary Uncommitted Cost Share a) Faculty/senior researcher effort that is over and above that which is committed and budgeted for in a sponsored agreement. Cost sharing may be in the form of in-kind, cash or both. In-kind may include the following cost elements: a. b. c. d. e. Salary and Wages Employee Benefits Other Expenses Indirect Costs associated with direct costs listed above Unrecovered indirect costs 1 Cost sharing must be: a. b. c. d. Directly identifiable with the project Incurred during the period of performance of the award Financed from non-federal funds Meet OMB A-21 Cost Principal guidelines Cash cost sharing contributions include: 1. 2. Cash contributions from unrestricted accounts and/or third-party sources Matching Funds – Cash contributions from unrestricted accounts and/or third party sources. (Matching funds typically require a dollar-for-dollar ratio to qualify for funding) OMB A-21 (Cost Principals for Institutions of Higher Education) requires that mandatory and voluntary committed cost share be properly documented for cost accounting purposes. OMB A-21 also states that faculty must properly document compensated effort for projects funded by the federal government and private agencies/corporations in order for those costs to be properly allocated by salary and associated Facilities and Administrative costs. OMB A-21 states that voluntary uncommitted cost sharing should be treated differently from committed effort and should not be included in the organized research base for computing the F&A rate or reflected in any allocation of F&A costs. It also states that voluntary uncommitted cost sharing is excluded from the effort reporting requirement in section J.8 of A-21 (General Provisions for Selected Items of Costs/Compensation for Personnel Services) “ This treatment is consistent with the guidance in section J.8.b (1). c, "Payroll Distribution," that a precise documentation of faculty effort is not always feasible, nor is it expected, because of the inextricably intermingled functions performed by the faculty in an academic setting (i.e., teaching, research, service and administration.)” Policy University policy requires that the Office of Research and Projects review agency program guidelines and policy requirements to determine whether cost sharing is necessary. In instances where program guidelines require a level of mandatory cost share and a commitment is made to cost share funds to a project, the Dean, Department Chair and/or Director of the school or department must verify the availability of such funds before submitting the proposal. When a sponsor does not provide rules or guidelines that require cost sharing, but encourages it in writing, the Dean and/or Director shall consult with the Dean or the Assistant Dean of Graduate Studies and Research to determine if cost sharing is appropriate and, if so, at what level. The principal investigator/project director’s academic unit should demonstrate its support of a proposed project by providing resources either partially or in total of the cost share requirement. Other units’ central to the university may provide some of the cost sharing requirements. An example would be that the Office of Graduate Studies and Research might provide Graduate Student Tuition Waivers, State Matching Grant Funds Program for Research Projects and Travel Awards. The Office of Graduate Studies and Research and the Office of the Provost and Vice Chancellor for Academic Affairs will not provide additional cost sharing funds for commitments in excess of the sponsor’s stated requirements. The University permits faculty members to devote a reasonable portion of their time and effort, paid by the University, to accomplish their extramural sponsored projects. The most appropriate cost sharing contributions, for instance, are University funded salaries and wages, any applicable fringe benefits and associated indirect costs for faculty and staff directly engaged in the sponsored project. Percentage of effort devoted to a sponsored program must be reasonable. Total effort devoted to sponsored programs and University-related duties may not exceed 100%. When cost sharing is required and/or proposed on an award, the program or project budget will specifically identify the source of University funds (budget purpose account numbers and name) that will be used to 2 satisfy the cost sharing commitment on the Grant Proposal and Grant Acceptance Routing Form. Grant accounts will not be activated and/or spending will not be permitted on an award until all cost sharing resources are identified. In order to identify and document cost sharing expenditures required under State and Federal grants, each school or unit will establish a State (2) ledger cost share account which will clearly be identified as such in the university’s financial accounting system and where cost sharing expenditures for each sponsored program within that school or unit will be recorded. The school or department will be responsible for maintaining separate records and supporting documentation of cost sharing expenditures posted in this account for each sponsored program. Post award certification reports on cost share expended on each sponsored program must be submitted to Research and Projects Fiscal Management on a quarterly basis and/or at the conclusion of the sponsored project. The University will not waive or reduce facilities and administrative costs (indirect costs) in order to meet sponsor cost share requirements. All cost sharing commitments are subject to audit and will require the appropriate documentation of cost sharing commitments and expenditures in support of those commitments. Responsibilities and Authority: Principal Investigator/Project Director is responsible for securing all necessary cost sharing and matching funds commitment from their academic units and the Office of Graduate Studies and Research in accordance with federal and state requirements and funding agency program requirements. The Principal Investigator/Project Director is also responsible for completing Faculty/Professional Staff Activity Reports and identifying the sponsored program by account name and account number in the appropriate “Professional Activity” area of the report and recording the appropriate level of effort devoted to the sponsored program. He/she is also responsible for insuring that other faculty and project staff that are compensated through the sponsored program record their level of effort devoted to the project on their individual “Activity Reports” as described above. The Principal Investigator/Project Director is also responsible for insuring that the Cost Share Certification is completed and signed by his/her unit head and School Dean and submitted to Research and Projects Fiscal Management quarterly and/or prior to conclusion of the sponsored project. Department Chairs/Department Directors are responsible for verifying and insuring that all cost share commitments will be met. Department Chairs/Department Directors are responsible for determining the percentage of faculty and/or staff time committed as cost share or in-kind contribution is reasonable and that the total level of effort expended on sponsored programs and University-related duties does not exceed 100%. The signature of the Department Chairs/Department Director on Cost Share Certifications and Grant/Contract Routing forms will serve as evidence of review and approval of the commitment. School Dean is responsible for verifying and insuring that academic unit cost sharing commitments will be met and will not interfere with other approved instructional and research activities. The School Dean will verify and insure all cost sharing commitments are met by approval and signature of Cost Share Certification and Grant/Contract Routing Forms. Dean and/or Assistant Dean of Graduate Studies and Research is responsible for verifying and insuring that all cost sharing commitments made by the Office of Research and Projects are met. He/she is responsible for reviewing and approving cost share requests and securing cost sharing resources above the resources committed by the academic unit. The Dean and/or Assistant Dean of Graduate Studies and Research is responsible for determining the necessity and appropriate level of cost sharing in the absence of a sponsors written requirements and negotiating appropriate cost sharing levels with the funding agency. Research and Projects Fiscal Management is responsible for reviewing program specific guidelines and agency requirements for the recording and reporting of cost share to sponsor. RPFM is responsible for 3 verifying the approval of all cost share commitments and for preparing reports to sponsor with regard to cost share expenditures. 4