The Governance Directorate at ACCA wrote to all ACCA and... UK at the beginning of March 2014 to explain that... CREDIT-RELATED REGULATED ACTIVITIES

advertisement

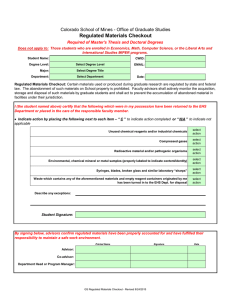

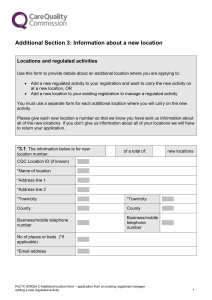

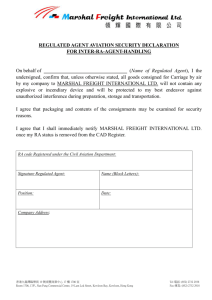

CREDIT-RELATED REGULATED ACTIVITIES The Governance Directorate at ACCA wrote to all ACCA and AAPA practices in the UK at the beginning of March 2014 to explain that the ACCA Consumer Credit Group Licence would no longer be valid as from 1 April 2014. The letter also explained the options available to those firms and asks all firms to reply to the Authorisation Department , using the form enclosed , as to which option they are taking. Firms that currently rely on the ACCA Consumer Credit Group Licence will need to take action before 1 April 2014. If they undertake credit related regulated activities after 31 March 2014 without authorisation to do so could amount to a criminal offence. As from 1 April 2014 the Financial Conduct Authority (FCA) will take responsibility for regulating consumer credit activities, before 1 April 2014 this is the responsibility of the Office of Fair Trading (OFT). A new framework for consumer credit authorisation has been laid down by Government, which brings some credit-related regulated activities with Part XX of the Financial Services and Markets Act 2000. The FCA is committed to authorising professional firms under the Designated Professional Body (DPB) regime for these credit-related regulated activities. ACCA is required to have regulations (approved by the FCA) allowing its firms to carry out credit-related regulated activities under Part XX of the Act. This is being effected through a change to ACCA’s Designated professional Body Regulations 2001. If ACCA firms choose to be authorised for credit-related regulated activities under ACCA’s Designated Professional Body Regulations an increased level of professional indemnity insurance will not be required (unlike some other activities which come within the DPB Regulations). Set out in appendix A below are the credit-related regulated activities that would be covered by DPB authorisation and in appendix B are the credit-related regulated activities covered by ACCA’s Consumer Credit Group Licence up to 31 March 2014. The letters and reply forms sent to all ACCA and AAPA practices in March 2014 on credit-related regulated activities (with blank names and addresses) can be found in Appendices E, C, D and F at the following address: http://www.accaglobal.com/uk/en/technical-activities/technical-resourcessearch/2014/january/changes-to-consumer-credit.html Appendix A Credit-related regulated activities to be covered by DPB authorisation from 1 April 2014 ACCA Rulebook changes were required to amend the Designated Professional Body Regulations for firms in relation to credit-related regulated activities. Firms authorised under ACCA’s Designated Professional Body Regulations will be required to comply with the conduct provisions of the FCA’s Consumer Credit sourcebook as applicable to the credit-related regulated activities being performed or offered by the firm. Firms so authorised may carry on the following activities: (a) Entering into a regulated credit agreement as lender (article 60B of the draft Regulated Activities Order) (b) Exercising, or having the right to exercise, the lender’s rights and duties under a regulated credit agreement (c) Credit broking (article 36A of the draft Regulated Activities Order) (d) Debt adjusting (article 39D(1) and (2) of the draft Regulated Activities Order) (e) Debt counselling (article 39E(1) and (2) of the draft Regulated Activities Order) (f) Debt administration (article 39G(1) and (2) of the draft Regulated Activities Order) (g) Providing credit information services (article 89A of the draft Regulated Activities Order) (h) Agreeing to carry on a regulated activity so far as relevant to any of the activities in (a) to (g) above. Firms may not carry on the following credit-related regulated activities under authorisation by ACCA: (i) Debt collecting (article 39F(1) and (2) of the draft Regulated Activities Order) (j) Entering into a regulated consumer hire agreement as owner (article 60N of the draft Regulated Activities Order) (k) Exercising, of having the right to exercise, the owner’s rights and duties under a regulated consumer hire agreement (l) Providing credit references (article 89B of the draft Regulated Activities Order) (m)Operating an electronic system in relation to lending (article 36H of the draft Regulated Activities Order). Direct authorisation from the FCA is required for activities (i) to (m) from 1 April 2014. The draft Order is available at: http://www.legislation.gov.uk/ukdsi/2013/9780111100493 The relevant sections of The Financial Services and Markets Act 2000 (Regulated Activities)(Amendment)(No2) Order 2013, referred to above, are reproduced as follows: Regulated Credit Agreements 60B. (1) Entering into a regulated credit agreement as lender is a specified kind of activity. (2) It is a specified kind of activity for the lender or another person to exercise, or to have the right to exercise, the lender’s rights and duties under a regulated credit agreement. (3) In this article— “credit agreement” means an agreement between an individual or relevant recipient of credit (“A”) and any other person (“B”) under which B provides A with credit of any amount; “exempt agreement” means a credit agreement which is an exempt agreement under articles 60C to 60H; “regulated credit agreement” means any credit agreement which is not an exempt agreement. Credit broking 36A. (1) Each of the following is a specified kind of activity— (a)effecting an introduction of an individual or relevant recipient of credit who wishes to enter into a credit agreement to a person (“P”) with a view to P entering into by way of business as lender a regulated credit agreement (or an agreement which would be a regulated credit agreement but for any of the relevant provisions); (b)effecting an introduction of an individual or relevant recipient of credit who wishes to enter into a consumer hire agreement to a person (“P”) with a view to P entering into by way of business as owner a regulated consumer hire agreement or an agreement which would be a regulated consumer hire agreement but for article 60O (exempt agreements: exemptions relating to the nature of the agreement) or 60Q (exempt agreements: exemptions relating to the nature of the hirer); (c)effecting an introduction of an individual or relevant recipient of credit who wishes to enter into a credit agreement or consumer hire agreement (as the case may be) to a person who carries on an activity of the kind specified in sub-paragraph (a) or (b) by way of business; (d)presenting or offering an agreement which would (if entered into) be a regulated credit agreement (or an agreement which would be a regulated credit agreement but for any of the relevant provisions); (e)assisting an individual or relevant recipient of credit by undertaking preparatory work with a view to that person entering into a regulated credit agreement (or an agreement which would be a regulated credit agreement but for any of the relevant provisions); (f) entering into a regulated credit agreement (or an agreement which would be a regulated credit agreement but for any of the relevant provisions) on behalf of a lender. (2) Paragraph (1) does not apply in so far as the activity is an activity of the kind specified by article 36H (operating an electronic system in relation to lending). (3) For the purposes of paragraph (1) it is immaterial whether the credit agreement or consumer hire agreement is subject to the law of a country outside the United Kingdom. (4) For the purposes of this article, the “relevant provisions” are the following provisions— (a) article 60C (exempt agreements: exemptions relating to the nature of the agreement); (b) article 60D (exempt agreements: exemptions relating to the purchase of land for non-residential purposes); (c) article 60E (exempt agreements: exemptions relating to the nature of the lender); (d) article 60G (exempt agreements: exemptions relating to the total charge for credit); (e) article 60H (exempt agreements: exemptions relating to the nature of the borrower). Debt adjusting 39D. (1) When carried on in relation to debts due under a credit agreement— (a) negotiating with the lender, on behalf of the borrower, terms for the discharge of a debt, (b) taking over, in return for payments by the borrower, that person’s obligation to discharge a debt, or (c) any similar activity concerned with the liquidation of a debt, is a specified kind of activity. (2) When carried on in relation to debts due under a consumer hire agreement— (a) negotiating with the owner, on behalf of the hirer, terms for the discharge of a debt, (b) taking over, in return for payments by the hirer, that person’s obligation to discharge a debt, or (c) any similar activity concerned with the liquidation of a debt, is a specified kind of activity. Debt-counselling 39E. (1) Giving advice to a borrower about the liquidation of a debt due under a credit agreement is a specified kind of activity. (2) Giving advice to a hirer about the liquidation of a debt due under a consumer hire agreement is a specified kind of activity. Debt administration 39G. (1) Subject to paragraph (3), taking steps— (a) to perform duties under a credit agreement or relevant article 36H agreement on behalf of the lender, or (b) to exercise or enforce rights under such an agreement on behalf of the lender, is a specified kind of activity (2) Subject to paragraph (3), taking steps— (a) to perform duties under a consumer hire agreement on behalf of the owner, or (b) to exercise or enforce rights under such an agreement on behalf of the owner, is a specified kind of activity. (3) Paragraphs (1) and (2) do not apply in so far as the activity is an activity of the kind specified by article 36H (operating an electronic system in relation to lending) or article 39F (debt-collecting). (4) In this article, “relevant article 36H agreement” means an article 36H agreement (within the meaning of article 36H) which has been entered into with the facilitation of an authorised person with permission to carry on a regulated activity of the kind specified by that article. Providing credit information services 89A. (1) Taking any of the steps in paragraph (3) on behalf of an individual or relevant recipient of credit is a specified kind of activity. (2) Giving advice to an individual or relevant recipient of credit in relation to the taking of any of the steps specified in paragraph (3) is a specified kind of activity. (3) Subject to paragraph (4), the steps specified in this paragraph are steps taken with a view to— (a) ascertaining whether a credit information agency holds information relevant to the financial standing of an individual or relevant recipient of credit; (b) ascertaining the contents of such information; (c) securing the correction of, the omission of anything from, or the making of any other kind of modification of, such information; (d) securing that a credit information agency which holds such information— (i) stops holding the information, or (ii) does not provide it to any other person. (4) Steps taken by a credit information agency in relation to information held by that agency are not steps specified in paragraph (3). (5) Paragraphs (1) and (2) do not apply to an activity of the kind specified by article 36H (operating an electronic system in relation to lending). (6) “Credit information agency” means a person who carries on by way of business an activity of the kind specified by any of the following— (a) article 36A (credit broking); (b) article 39D (debt adjusting); (c) article 39E (debt-counselling); (d) article 39F (debt-collecting); (e) article 39G (debt administration); (f) article 60B (regulated credit agreements) disregarding the effect of article 60F; (g) article 60N (regulated consumer hire agreements) disregarding the effect of article 60P; (h) article 89B (providing credit references). Appendix B Credit-related regulated activities covered by the ACCA Consumer Credit Group Licence before 1 April 2014 The ACCA Consumer Credit Group Licence currently covers the following categories of business: Category A Category C Category D Category E Category G Category H1 Consumer credit Credit brokerage Debt adjusting Debt counselling Debt administration Provision of credit information services (including credit repair) The following examples highlight common activities that accountancy firms could undertake and as a result come within the above categories and require a licence: Category A (Consumer Credit) An accountancy firm is likely to need a consumer credit licence for this category of business if it sells on credit to individuals or partnerships for more than three months. However, a firm does not generally need a consumer credit licence to offer credit to limited companies. Also a firm can allow customers (individuals and partnerships) to pay in four or fewer instalments, within a year, without needing a consumer credit licence. Category C (Credit Brokerage) An accountancy firm is likely to need a consumer credit licence for this category of business if it introduces or recommends an individual, sole trader or partnership to a third party so they can obtain credit. Category D (Debt Adjusting) An accountancy firm is likely to need a consumer credit licence for this category of business if it negotiates with creditors on someone’s behalf. Category E (Debt Counselling) An accountancy firm is likely to need a consumer credit licence for this category of business if it counselled or advised the individual relating to adjusting its debt. Therefore if debt adjusting services are provided then debt counselling is also likely to be provided. However it is possible for debt counselling to be provided without providing debt adjusting services. Category G (Debt Administration) An accountancy firm is likely to need a consumer credit licence for this category of business if it performs duties under a consumer credit agreement or a consumer hire agreement on behalf of a creditor or owner or enforces rights under such an agreement on behalf of a creditor or owner so far as the taking of such steps is not debt-collecting (which is a category F activity). A firm will not need this category if it is acting in its own interest, for example administering loans where the firm is the creditor or owner. Category H1 (Provision of credit information services (including credit repair)) An accountancy firm is likely to need a consumer credit licence for this category of business if it seeks to obtain information on behalf of an individual about his financial standing (e.g. credit rating information), including asking a credit reference agency if it holds the information. Also providing advice to individuals on how to seek to alter, or secure the omission of, the information or how to seek to restrict the availability of the information.