SET Overview and Exploration of Regional Data Session 1

advertisement

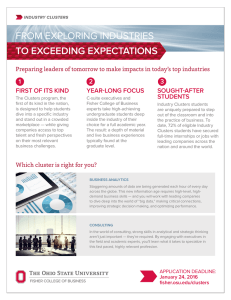

SET Overview and Exploration of Regional Data Session 1 The SET Process You are here Today, We Will • Review the Regional SET Forum • Explore the regional economic data: • Regional industry clusters • Employment and occupation • Chart the next steps SET Purpose: Doing Better Together The regional team develops and implements a High Quality Regional Economic Development Plan that builds on the region’s current and emerging economic strengths. High Quality Plan: Essential Components Evidence-Based Aligned with Goals Practical Team’s Regional Plan Focused on Regional Economic Development Broadly Supported Guiding Principles for Our Discussions Sample ideas: • Enter into the discussion enthusiastically. • Give freely of your experience. • Allow and encourage others to contribute. • Listen attentively and take accurate notes. • Ask questions when you don’t understand. • Appreciate the other person’s point of view. • Provide constructive feedback and receive it willingly. • Keep confidences and assume others will. • Confine your discussion to the topic. Round I: Forum Review Civic Engagement Forum Review • Regional Strengths & Challenges • Data Snapshot Reactions • Opportunities Round II: Economic Data Data Scavenger Hunt: Thriving Businesses • Number of employees • Workforce skills needed • Type of business (i.e. manufacturing, retail, health services) • Average earnings • County • Size • Large=over 100 employees • Small= under 100 • Other businesses/industries for which it is providing support Getting the Big Picture in Mind • What are the region’s largest businesses and industries? • What goods and services to they purchase? • Are these products/services available within the region? • What other businesses connect to each of these larger ones? Round III: Explain, Examine, and Explore COACHES: Insert regional data in place of sample tables throughout this section Industry & Occupation Industry and occupation Establishments An establishment is a physical business location. Components of Change for Establishments 2000-2013 Establishments Launched 11,395 Establishments Closed 9,475 Net Change 1,920 Net Migration (Establishments moving into minus Establishments moving out of the region) 110 Total Change 2,030 Percent Change 39.3% Branches, standalones and headquarters are all considered types of establishments. Definition of Company Stages 0 2 Selfemployed 10-99 employees 4 1 3 2-9 employees 100-499 employees 500+ employees section 02 * The difference in “total change” between year-by-year and year-to-year is because of the residuals. Source: Youreconomy.org database 14 Industry and occupation Establishments Number of Establishments by Company Stages 2000 Stage Establishments 2013 Proportion Establishments Proportion Stage 0 1,396 27.0% 1,942 26.9% Stage 1 2,986 57.8% 4,399 60.9% Stage 2 719 13.9% 822 11.4% Stage 3 55 1.1% 57 0.8% Stage 4 7 0.1% 4 0.1% 5,163 100.00% 7,224 100.00% Total Questions: • What stage businesses have shaped the region’s economic growth in the last 10 years? • Which ones are growing or declining the most? • Which stage of establishments are likely to shape the region’s future economic growth? section 02 Source: Youreconomy.org database 15 Industry and occupation Establishments Number of Jobs by Company Stages Year 2000 Questions 2013 % Change • What establishments are the most numerous based on company stages? Stage 0 Stage 1 Stage 2 Stage 3 Stage 4 1,396 10,376 18,387 9,326 4,695 1,942 13,586 22,427 10,038 3,380 39.1% 30.9% 22.0% 7.6% -28.0% Total 44,180 51,373 16.3% • What company stage employs the largest number of people? % Change • What stage captures the most sales? Sales ($ 2013) by Company Stages Year 2000 2013 Stage 0 $160,094,654 $129,728,731 -19% Stage 1 $1,538,525,539 $896,863,710 -41.7% Stage 2 $1,860,277,679 $1,618,057,361 -13.0% Stage 3 $883,353,578 $933,867,601 5.7% Stage 4 $573,792,680 $236,475,100 -58.8% $ 5,016,044,130 $3,814,992,503 -23.9% Total • What stages have experienced the largest growth? The greatest decline? • Which ones have experienced the greatest percentage loss over the 2000-13 period? section 02 Source: Youreconomy.org database 16 Industry and occupation Top nine industry sector employment growth NAICS Description 2009 Jobs 2014 Jobs Change Change (%) State Change (%) 21 Mining, Quarrying, and Oil and Gas Extraction 185 326 141 76% 50% 61 Educational Services 351 514 163 46% 11% 53 Real Estate and Rental and Leasing 1,619 1,898 279 17% 6% 44 Retail Trade 6,068 6,545 477 8% 4% 52 Finance and Insurance 2,299 2,458 159 7% 5% 62 Health Care and Social Assistance 5,506 5,789 283 5% 5% 54 Professional, Scientific, and Technical Services 1,497 1,535 38 3% 4% 81 Other Services (except Public Administration) 3,318 3,388 70 2% 4% 42 Wholesale Trade 979 986 7 1% 11% Questions: • What regional industry sectors have seen the greatest growth? • Did they grow at the same rate as the state? • What factors are causing the growth? section 02 Source: EMSI Class of Worker 2015.4 (QCEW, non-QCEW, self-employed and extended proprietors) 17 Industry and occupation Top ten industry sector employment decline NAICS Description 2009 Jobs 55 Management of Companies and Enterprises 31 2014 Jobs Change Change (%) State Change (%) 427 237 -190 -44% 35% Manufacturing 3,184 2,577 -607 -19% 8% 71 Arts, Entertainment, and Recreation 1,073 928 -145 -14% 9% 48 Transportation and Warehousing 1,221 1,096 -125 -10% 6% 23 Construction 4,095 3,829 -266 -6% 4% 56 Administrative and Support and Waste Management and Remediation Services 2,034 1,942 -92 -5% 9% 11 Crop and Animal Production 6,632 6,343 -289 -4% -3% 22 Utilities 205 197 -8 -4% 4% 90 Government 16,909 16,336 -573 -3% -2% 72 Accommodation and Food Services 3,560 3,531 -29 -1% 11% Questions: • How does the industry sector make-up of the region compare to the rest of the state? • Which industry sectors are growing and declining the most in employment? section 02 Source: EMSI Class of Worker 2015.4 (QCEW, non-QCEW, self-employed and extended proprietors) 18 Exploring Industry Clusters Industrial Clusters Clusters are groups of inter-related industries that drive wealth creation in a region, primarily through export of goods and services. Vertical Clusters Horizontal Clusters • Represents the entire value chain of a broadly defined industry from suppliers to end products. • Groups of similar industries that use the same resources including raw materials and/or labor • Examples: • Examples: • Auto manufacturing (glass, paint, engine, plastic, etc. that goes into making a car) • Healthcare (service providers, equipment, medical supplies, pharmaceuticals) • Silicon Valley • Wall Street Financial District • Napa Valley Wine Region Example of a Vertical Cluster Example of a Horizontal Cluster LIST OF CLUSTERS • Advanced Materials • Agribusiness, Food Processing & Technology • Apparel & Textiles • Arts, Entertainment, Recreation & Visitor Industries • Biomedical/Biotechnical (Life Sciences) • Business & Financial Services • Chemicals • Computer & Electronic Product Manufacturing • Defense & Security • Education & Knowledge Creation • Electrical Equip, Appliance & Component Manufacturing • Fabricated Metal Product Manufacturing • Energy (Fossil & Renewable) • Forest & Wood Products • Glass & Ceramics • Information Technology & Telecommunications • Machinery Manufacturing • Manufacturing Super-cluster • Mining • Primary Metal Manufacturing • Printing & Publishing • Transportation & Logistics • Transportation Equipment Manufacturing How to interpret cluster data results Contains clusters that are more concentrated in the region but are declining (negative growth). These were likely the anchor industries for the region in the past. Mature (strong but declining) Transforming Contains clusters that are under-represented in the (weak and region (low concentration) declining) and are also losing jobs. Clusters in this region may indicate a gap in the workforce pipeline if local industries anticipate a future need. In general, clusters in this quadrant show a lack of competitiveness. Contains clusters that are more concentrated in the region and are growing. These clusters are strengths that help a community stand out from the competition. Small, high-growth clusters (strong and can be expected to become more dominant over time. advancing) Stars Emerging (weak but advancing) Contains clusters that are under-represented in the region but are growing, often quickly. If growth trends continue, these clusters will eventually turn into stars. Modified from: http://www.charlestonregionaldata.com/bubble-chart-explanation/ 24 Industry cluster analysis Star Clusters Mature Clusters Electrical Equip, App. & Comp. Mfg. (442) Level of Specialization Agribusiness, Food Proc., & Tech. (6,913) Mining (236) Glass & Ceramics (108) Forest & Wood Products (949) Percent Growth in Specialization Transforming Clusters Emerging Clusters Energy (Fossil And Renewable) (2,840) Fabricated Metal Product Mfg. (435) Arts, Ent., Rec, & Visitor Industries (1,487) Biomedical/Biotech (3,776) Transportation & Logistics (1,082) Business & Financial Services (3,857) Manufacturing Supercluster (1,148) Printing & Publishing (383) Machinery Mfg. (194) Apparel And Textiles (156) Defense & Security (984) Advanced Materials (507) Chemicals (273) Edu. & Knowledge Creation (399) IT & Telecommunication (821) Primary Metal Mfg. (30) Transportation Equipment Mfg. (39) Computer & Electronic Product Mfg. (7) section 03 NOTE: The first number after each cluster represents the number of total jobs (full and part time jobs by place of work) in that cluster in the region in 2014. The clusters are sorted in decreasing order by location quotient as shown in the bubble chart. 25 Forest and Wood Products: Contribution by Counties (Jobs 2014) section 03 Source: EMSI 2015.4 (QCEW Employees, Non-QCEW Employees, Self-Employed, and Extended Proprietors); Industry cluster definitions by PCRD 26 Glass and Ceramics: Contribution by Counties (Jobs 2014) section 03 Source: EMSI 2015.4 (QCEW Employees, Non-QCEW Employees, Self-Employed, and Extended Proprietors); Industry cluster definitions by PCRD 27 Mining: Contribution by Counties (Jobs 2014) section 03 28 Source: EMSI 2015.4 (QCEW Employees, Non-QCEW Employees, Self-Employed, and Extended Proprietors); Industry cluster definitions by PCRD Industry Clusters: Components to Assess Electrical Equipment Mining Forest & Wood Products Glass & Ceramics -32 (negative value) 50 (61% of job change) 122 (110% of job change) 36 (90% of job change) Export value, 2013 $87,709,304 $52,330,425 $44,996,070 $11,767,446 Leakage, 2013 $22,103,619 $27,203,369 $95,882,681 $9,023,274 Number of establishments 1 7 32 7 Only in 1 county All 4 counties All 4 counties All 4 counties Regional Performance, 2009-2014 (Shift-share analysis) Contribution by counties Business input Seek input from businesses Resident’s value Review Civic Forum Input from Residents section 02 Source: EMSI 2015.4 (QCEW Employees, Non-QCEW Employees, Self-Employed, and Extended Proprietors); Industry cluster definitions by PCRD 29 Exploring Occupations Industry and occupation Top five occupations in 2014 Questions: • What are the education and skill requirements for these occupations? • Do the emerging and star clusters align with the top occupations? • What type salaries do these occupations typically provide? section 04 Source: EMSI Class of Worker 2015.4 (QCEW, non-QCEW, self-employed and extended proprietors) 31 Industry and occupation Science, Technology, Engineering & Math Job change in STEM occupations* 67,592 61,527 869 CBR, OK Rest of Oklahoma 9.9% 770 -11.4% 2009 2014 Change Questions: • How do STEM jobs compare to the state? • What has been the trend of STEM jobs over time? • How important are STEM jobs to the region’s Star and Emerging clusters? section 04 *Note: STEM and STEM-related occupation definitions from BLS (2010) Source: EMSI Class of Worker 2015.4 (QCEW, non-QCEW, self-employed and extended proprietors) 32 Workforce Data • What are the region’s unemployment trends? • Are more people commuting into the region or commuting out? • How do regional earnings compare to the state or nation? Honing in on Key Clusters Based on the assets of the region and current industrial trends… What clusters should this region explore further? Shift-Share Analysis Export Value Resident’s Values Industry Input Contribution by Counties Key Clusters Leakage Number of Establishments Reality Check and Next Steps Did the data reveal: • Any new opportunities that should be considered? • The need to eliminate previously considered opportunities? • New partners that need to be included in the planning process. Actions: Begin Writing the Plan • Describe and summarize the Civic Engagement Forum process and results. • Summarize key strengths and challenges based on the data • Describe the selected clusters: • Why were these clusters selected for further exploration? • What are the strengths and challenges associated with the selected clusters? • Which suggested opportunities are associated with each selected cluster? Reflections