09/14 RARA River Rats Presentation 2

advertisement

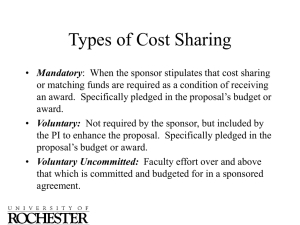

The Consolidation of the OMB Circulars: Exploring the “New” Administrative Rules OMB Uniform Guidance 2 CFR 200 Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards http://www.gpo.gov/fdsys/pkg/FR-2013-12-26/pdf/201330465.pdf 2 OMB Uniform Guidance • Issued as final December 26, 2013 and as guidance to federal agencies • Effective December 26, 2014 • Audits only—effective with first fiscal year after December 26, 2014 • Agencies required to implement; must have submitted their implementation plans to OMB by June 26, 2014 3 A-21 A110 A-87 2 CFR 200 A122 A-50 A133 A-89 A102 The OMB Guidance is a combined, “simplified” version of 8 previous circulars 2 CFR 200 Subpart A – Acronyms and Definitions Subpart B – General Provisions Subpart C - Pre-award Requirements & Contents of Federal Awards Subpart D – Post Federal Award Requirements Subpart E – Cost Principles Subpart F – Audit Requirements Appendix 4 OMB GuidanceCirculars Subpart A, Acronyms and DefinitionsA-110, -21, -133 Subpart B, General Provisions A-110, -21, -133 Subpart C, Pre-award Requirements and Contents of Federal AwardsA-110 Subpart D, Post Federal Award Requirements A-110, -133 Subpart E, Cost Principles A-21 Subpart F, Audit Requirements A-133 Appendices A-110, -21, -133 5 Remember…. As with the old Circulars, the Guidance provides: • MAXIMUM REQUIREMENTS THAT THE FEDERAL AGENCIES CAN IMPOSE • MINIMUM STANDARDS FOR AWARDEES 6 Effective Date of the UG: • AS OF THE FEDERAL AWARD DATE TO NEW AWARDS AND, FOR AGENCIES THAT CONSIDER INCREMENTAL FUNDING ACTIONS ON PREVIOUSLY MADE AWARDS TO BE OPPORTUNITIES TO CHANGE AWARD TERMS AND CONDITIONS, THE FIRST FUNDING INCREMENT ISSUED ON OR AFTER 12/26/14. • [REGARDING THE LATER,] FEDERAL AWARDING AGENCIES MAY APPLY THE UG TO THE ENTIRE FEDERAL AWARD THAT IS UNCOMMITTED OR UNOBLIGATED AS OF THE FEDERAL AWARD DATE OF THE FIRST INCREMENT RECEIVED ON OR AFTER 12/26/14. • ONE YEAR GRACE PERIOD FOR PROCUREMENT REQUIREMENTS7 Subpart A – Definitions of Note • 200.12 Capital assets – includes software • 200.20 Computing devices • 200.48 General purpose equipment – includes information technology equipment and systems • 200.58 Information technology systems – includes computing devices and software 8 Subpart A – Definitions of Note • 200.75 Participant Support Costs – stipends or subsistence allowances, travel, and registration fees paid to or on behalf of participants or trainees (but not employees) in connection with conferences or training projects • 200.80 Program Income – includes license fees and royalties on patents and copyrights. • 200.89 Special purpose equipment • 200.94 Supplies – clarifies when a computing device is a supply 9 Subpart E – Cost Principles PREDICATED ON FACT THAT THE GOVERNMENT PAYS ONLY ITS FAIR SHARE (NO CHANGE) 200.400 Policy Guide • Continues the acknowledgement of dual role of students 200.401 Application • Incorporates CAS provisions 10 Subpart E – Cost Principles 200.403 Factors affecting the allowability of costs 200.404 Reasonable costs 200.405 Allocable costs Still in play; for a cost to be allowable it must be necessary, reasonable, and allocable; conform to award limitations; be uniformly consistent with policies and procedures; and be accorded consistent treatment 11 Allowability of Costs: Allocation Methods • Distribution methods must be reasonable and must be documented. • The basis for the allocation should relate to the work being performed. 12 Subpart E – Cost Principles 200.413 Direct Costs, (c) relating to administrative and clerical salaries “The salaries of administrative and clerical staff should normally be treated as indirect (F&A) costs. Direct charging of these costs may be appropriate only if all of the following conditions are met: 1. 2. 3. 4. Administrative or clerical services are integral to a project or activity; Individuals involved can be specifically identified with the project or activity; Such costs are explicitly included in the budget or have the prior written approval of the Federal awarding agency; and The costs are not also recovered as indirect costs.” • Removal of “major project” requirement • Recognition of administrative workload 13 Immediate Impact • Effective immediately, if there is a potential to directly allocate administrative and clerical effort to a project, a justification must be included in the proposal. • The justification must address the four items on the prior slide. • For existing awards that qualified as “major” under A-21, prior approval to continue directly charging such costs during the next incremental award period might be needed. Refer to the terms and conditions of the award or specifically ask the federal awarding agency. 14 Case Study – Administrative and Clerical Salaries • Dr. Yunau’s research study involves interviews with study participants. The interviews need to be transcribed for purposes of data analysis. The transcription will be done by one of the department administrative staff person. Each of the 100 participants will have three 60-minute interviews over a sixmonth period. The administrative staff person will spend approximately one-third of her time performing the transcriptions during the six-month period. • Are the UG criteria met, thus supporting direct charging onethird of the staff person’s compensation to Dr. Yunau’s study? 15 Case Study – Administrative and Clerical Salaries • Dr. Evergreen’s research study involves questionnaire completion by study participants. The questionnaires need to be printed and mailed. Once returned, the responses need to be entered into a special database that will be used for data analysis. The tasks will be done by one of the department administrative staff person. The administrative staff person will spend approximately ten percent of his time performing the transcriptions during the next year. • Are the UG criteria met, thus supporting direct charging ten percent of the staff person’s compensation to Dr. Evergreens study? 16 Subpart E – Cost Principles Selected Items of Cost 200.453 Materials and supplies costs, including costs of computing devices • acknowledgement of computing devices as a supply cost • Note wording “In the specific case of computing devices, charging as direct costs is allowable for devices that are essential and allocable, but not solely dedicated, to the performance of a Federal award.” 17 Case Study – Computing Devices • Dr. Sturtevant has a sponsored project whose study participants are nursing home residents. The project involves assessing participant cognitive skills using special gaming software. A laptop will have the special gaming software. Dr. Sturtevant’s research assistants will take the laptop to nursing homes. During the next two years, approximately 70% of the time the laptop will be used for the project. The rest of the time the laptop will be used for general research purposes. • Does the laptop qualify as a direct cost for Dr. Sturtevant’s project? 18 IS THIS ALLOWABLE? While I’m traveling to collect data. I need to keep in touch with my office so I need an I-Phone. 19 IS THIS ALLOWABLE? I need a new laptop. I want to buy it on my grant which runs for another year. What if the grant terminates in 2 months? 20 IS THIS ALLOWABLE? I have just purchased a laptop for use on my grant and other administrative work for the University. I will charge 50% of the laptop to my grant. 21 Subpart E – Cost Principles Selected Items of Cost 200.463 Recruiting Costs • Requirement to repay if employee resigns within twelve months after hire remains • Short-term visa costs (as opposed to longer-term, immigration visas) are generally allowable. • Short-term visas are issued for a specific period and purpose and should be clearly identified as directly connected to work performed on the award. • Must be critical and necessary for the conduct of the project 22 IS THIS ALLOWABLE? My foreign graduate student will be conducting research on one of my grants. I want to charge the costs of her J-1 visa to the grant. 23 Immediate Impact • For federal grants with effective dates of 12/26/14 or later, the Uniform Guidance provisions are applicable to the preaward spending (i.e. spending 90 days prior to award effective date). • Pre-award spending is at the entity’s own risk, since the terms and conditions of the award are not yet known. 24 One Last Thing…. Order of Precedence Statute Administrative Regulations OMB Circulars/ Guidance FAR Program Regulations Special Terms and Conditions of Award 25