Class 4 powerpoint

advertisement

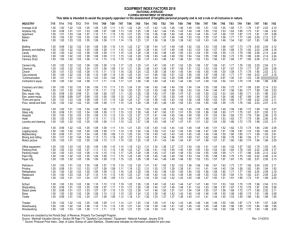

4 From theory to empirics 1. Review & consolidation of the TEF approach 2. Empirical shortcomings of generic models 3. Development, resources and environmental pressures in Asia 1 Review & consolidation of the TEF approach • ‘Macro’ approach (Copeland, Ulph) helps define growth/policy issues at broadest level – Links to welfare measures – Second-best analyses • Recovery of critical quantities and prices – From (p, v, t, s) recover prod’n & input dd, factor shadow prices, cons. dds, etc. – Extrapolate to environmental/NR outcomes 2 Extensions & issues • Production externalities • Endog. factor endowments & comm. prices – E.g. double dividend argument • Heterogeneous consumers & inc. distb’n – And aggregation problems • Political constraints on economic or environmental policy 3 Applications of generic approach • Back-of-envelope GE calculations – E.g. Implications of US reduction of barriers to Pakistan/African textile exports • Economic effects – Wages and employment • Environmental effects – Composition effects (TRI indices) – Scale and income (technique) effects 4 Apparel 3220 | | V <--- Figur e 4.1 Linea rly Weighted Acute Human Tox ic Intensit y Index 5 (Source: Hettige et al 1994: IPPS) Empirical shortcomings of generic models • Market failures and distortions • Spatial heterogeneity and transporttransactions costs • Dynamic specification: transition to eq’m; non-convexity, irreversibility. 6 Market failures • Land markets and property rights in natural resources • Capital markets – Financial repression as a development policy • Labor markets – Wage rigidity and unemployment • Insurance markets 7 Spatial heterogeneity • Watersheds and ‘airsheds’ – E.g. Doolette and MacGrath (WB report, 1990) – E.g. Rains-ASIA model • Frontiers and margins (forests, coastlines) 8 Spatial heterogeneity y =distance off-road p/b x = distance a long road p/a A • r(x0, y0) p=ax+by • r(x1, y1) p/b Figur e 3.1 The spa tial expan sion o f the market (adapted from Gersowit z 1989 ). 9 Development, resources and environmental pressures in Asia • Growth and structural change • Trade and trade intensity • Capital accumulation and FDI 10 Table 3.1: GDP sha res (%) major sectors, deve loping A sian countries GDP growtha Years Agric. Indus try (Mfg) Services China 6.42 1960-80 1981-90 1991-00 35 29 20 40 44 48 31 36 37 25 27 32 Indones ia 3.97 1960-80 1981-90 1991-00 42 22 18 23 37 43 10 16 24 35 40 40 Malays ia 4.12 1960-80 1981-90 1991-00 29 20 13 30 39 42 14 21 27 41 41 45 Phil ipp ines 1.04 1960-80 1981-90 1991-00 28 24 20 31 36 32 23 25 23 41 40 48 Thail and 4.34 1960-80 1981-90 1991-00 29 17 11 25 33 39 17 24 29 46 50 50 Vietnamb 5.37 Country 1960-80 .. .. .. .. 1981-90 40 29 26 32 1991-00 29 30 20 41 a. Real per capita inco me (1995 US$), annua l average 1970-2000. b. 1991-2000 . .. = not avail able. Sourc e: World Bank : World Development Indicators 2001 11 Table 3.3: Total expo rts (X, % of GDP), manu factured expor ts (MFG, % of expor ts), and trade/GDP ratio (per cent), deve loping Asian coun tries Trade as % of Country Item 1961-70 1971-80 1981-90 1991-00 GDP, 2000) China X MFG 2 .. Indones ia X MFG 10 2 Malays ia X MFG Myanmar 4 .. 11 62 22 83 44.5 24 2 25 18 31 49 67.0 42 5 46 14 59 34 97 73 219.7 X MFG 13 1 6 6 5 6 1 10 1.1 Phil ipp ines X MFG 16 6 22 14 25 29 42 60 91.0 Thail and X MFG 16 3 20 16 27 42 46 71 108.8 Vietnam X .. .. 14 36 94.1 MFG 1 11 5 .. .. = not avail able. Source: World Bank : World Development Indicators 2001 12 Table 3.2: Gross fi xed capit al formation (per cent of GDP) and foreign direct inve stme nt (per cent of GFCF), deve loping A sian count ries Country Item 1961-80 1981-90 1991-00 China GFCF FDI 29 0 29 2 34 11 Indones ia GFCF FDI 22 3 25 1 26 2 Malays ia GFCF FDI 20 13 30 11 36 15 Myanmar GFCF FDI 12 .. 15 .. 13 .. Phil ipp ines GFCF FDI 20 1 22 4 22 8 Thail and GFCF FDI 22 2 30 4 34 10 Vietnam GFCF .. 12 Sour ce: World Bank , World Development Indicators 2001 25 13 Real GDP growth and growth of industrial emissions, 1975-87 14 Table 3.4: Agricultural land use trends in developing Asian economies Percent of total land area: Coun try/Region Arable land a 1980 Permanen t cropsb 1997 1980 1997 Agricult ura l Areac 1980 1997 Cambod ia 11.3 21 0.4 0.6 11.7 21.6 India 54.8 54.5 1.8 2.7 56.6 57.2 Indones ia 9.9 9.9 4.4 7.2 14.3 17.1 Lao PDR 2.9 3.5 0.1 0.2 3.0 3.7 Malays ia 3.0 5.5 11.6 17.6 14.6 23.1 Phil ipp ines 14.5 17.2 14.8 14.8 29.3 32.0 Sri Lanka 13.2 13.4 15.9 15.8 29.1 29.2 Thail and 32.3 33.4 3.5 6.6 35.8 40.0 Vietnam 18.2 17.4 1.9 4.7 20.1 22.1 Low-mi d. inc. LDC 9.4 10.3 1.0 1.2 10.4 11.5 E. Asia and Pacific 10.0 12.0 1.5 2.6 11.5 14.6 Latin A m & Car. 5.8 6.7 1.1 1.3 6.9 8.0 ME & N. Africa 4.4 5.2 0.4 0.7 4.8 5.9 42.4 42.5 1.5 2.1 43.9 44.6 S. Asia Sub- Saharan A frica 5.4 6.4 0.7 0.9 6.1 Sour ce: World Bank , World Development Indicators 2000. a Arab le area is defined as land unde r temporary c rops, temporary p astures, and sho rtterm fall ow. Exclude s land abandoned as the result of shifting cult ivation . b Permanen t crops area is defined as land cultivated wit h crops that occupy the land for long p eriods and need no t be replanted after each harve st (flowering shrubs , fruit trees, nuts trees, vines, etc). Excludes areas of trees grown for wood or tim ber. c Sum of a rable area and permanen t crops 7.3 15 Economic & policy heterogeneity in ‘representative’ economies • Manufacturing industry policies – Broadly, ISI vs. EOI • Food policies – Exporter/importer; trade-based self-sufficiency policies • Nature of economic activity at land/forest margin – Subsistence, plantation, comm’l food & fiber 16 Economic & policy heterogeneity Manufa cturing Econo my indus try Type orientation Upland Land Use by Market for Crop Type (%) staple cereals 0-----25-----50-----75----100 Jeepney Importsub stit uting (ISI) Nontraded Non-traded food crop s Becak Plantation crops Proton Non-traded Expor toriented (EOI) Tuk- Tuk Traded Traded food & fibre Figur e 3.2: Schematic summary of econo mi c structure in representative econo mies 17 Endog. prices, tax interactions and the ‘double dividend’ • In a second-best world, will an environmental tax raise or reduce welfare? – Gains from reduced pollution – Possible losses from tax interactions • E.g. Bovenberg & Goulder, AER 1996: energy producers pass on carbon taxes as higher prices, which reduces real eff. wage and labor supply, narrowing base of labor tax. – What about trade taxes? • Coxhead 2000, http://www.feem.it, paper # 88.2000 18 Private and social marginal costs P1 SMC B P0 A PMC MB Z1 Z0 Emissions 19 Labor mkt response to eff. wage Wg0 C D Wn0 Wn1 L1 L0 Labo r hours 20 Is there a double dividend? • Pollution tax raises revenue (area A) and improves welfare by area B – Can use A to reduce income tax rate --> DD through reduction in DWL (area C) • But fall in real net wage when tax costs are passed on – RNW = W(1 - t)/P, so tax/price equivalence – If |dP| > |dt| excess burden could increase (area D) <--- 21