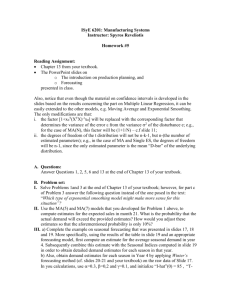

PowerPoint for Chapter 24

advertisement

Financial Analysis, Planning and Forecasting Theory and Application Chapter 24 Time-Series: Analysis, Model, and Forecasting By Alice C. Lee San Francisco State University John C. Lee J.P. Morgan Chase Cheng F. Lee Rutgers University Outline 24.1 Introduction 24.2 The Classical Time-Series Component Model 24.3 Moving Average and Seasonally Adjusted Time-Series 24.4 Linear and Log-Linear Time Trend Regressions 24.5 Exponential Smoothing and Forecasting 24.6 Autoregressive Forecasting Model Appendix 24A. The X-11 Model for Decomposing Time-Series Components Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series 24.2 The Classical Time-Series Component Model Table 24.1 Earnings per share of Philip Morris Year EPS 1977 $1.399 1978 1.698 1979 2.043 1980 2.315 1981 2.635 1982 3.115 1983 3.59 1984 3.62 1985 5.235 1986 6.2 1987 7.84 24.2 The Classical Time-Series Component Model Figure 24.1 Earnings per share of Philip Morris 24.2 The Classical Time-Series Component Model Table 24.2 Quarterly Earnings per share of IBM Corporation Quarter Year 1 2 3 4 1995 $2.12 $2.97 $-0.96 $3.09 1996 1.41 2.51 2.45 3.93 1997 2.37 1.46 1.38 2.16 1998 1.08 1.54 1.6 2.55 1999 1.61 1.32 0.97 1.16 2000 0.85 1.1 1.11 1.52 2001 1 1.17 0.92 1.35 2002 0.69 0.03 0.78 0.6 2003 0.8 0.99 1.04 1.59 2004 0.81 1.03 0.93 1.7 2005 0.86 1.14 0.95 2.02 2006 1.09 1.31 1.47 2.35 24.2 The Classical Time-Series Component Model Figure 24.2 Quarterly Earnings per share of IBM 24.2 The Classical Time-Series Component Model Figure 24.3 S&P 500 Composite Index, 76/1-88/3 24.2 The Classical Time-Series Component Model Figure 24.4 Three-Month Rate on Eurodollar Deposits, U.S. T-Bills, 1985-1988 (Quarterly Date) 24.2 The Classical Time-Series Component Model Figure 24.5 Time-Series Decomposition 24.2 The Classical Time-Series Component Model X t Tt Ct St I t (24.1) X t Tt Ct St It (24.2) where Tt = trend component Ct = cyclical component St = seasonal component It = irregular component 24.3 Moving Average and Seasonally Adjusted Time-Series 1 zt xt i 3 i 0 2 k 1 zi 1 k xt i i 0 k 1 zi wt i xt i i 0 t 3, , n (24.3) t k , , n (24.4) t k , , n (24.5) 24.3 Moving Average and Seasonally Adjusted Time-Series Table 24.3 24.3 Moving Average and Seasonally Adjusted Time-Series 1 3 zt xt i 4 i 0 t 4, , n (24.6) 0.3 0.2717 0.2967 0.215 0.27085 4 0.2717 0.2967 0.215 0.325 0.2771 4 24.3 Moving Average and Seasonally Adjusted Time-Series 24.3 Moving Average and Seasonally Adjusted Time-Series zt .5 zt .5 1 1 xt i 4 i 2 1 2 xt i 4 i 1 t 3, 4, t 2,3, , n 2 , n 2 (24.7) (24.7a) zt .5 zt .5 t 3, 4, , n 2 (24.8) z 2 z2.5 z3.5 x1 2 x2 2 x3 2 x4 x5 * t 3, z3 2 8 * t 24.3 Moving Average and Seasonally Adjusted Time-Series Figure 24.6 Earnings per Share Versus Moving-Average EPS for Johnson & Johnson 24.3 Moving Average and Seasonally Adjusted Time-Series xt (24.9) Percentage of moving average (PMA) = 100 * zt x3 0.2967 100 * 100 108.2945 0.273975 z3 24.3 Moving Average and Seasonally Adjusted Time-Series 24.3 Moving Average and Seasonally Adjusted Time-Series * Figure 24.7 Trend of 100 xt z t Ratio for Johnson & Johnson 24.3 Moving Average and Seasonally Adjusted Time-Series xt 100Tt Ct St It 100 * 100St It Tt Ct zt (24.10) 24.3 Moving Average and Seasonally Adjusted Time-Series Figure 24.8 Adjusted Earnings per Share (EPS) of Johnson & Johnson 24.4 Linear and Log-Linear Time Trend Regressions xt t t xt x0 e (24.11) gt log e xt log e x0e gt (24.12) loge x0 gt log e xt t ' ' ' t (24.13) 24.4 Linear and Log-Linear Time Trend Regressions 24.4 Linear and Log-Linear Time Trend Regressions xˆt ˆ ˆt 3239.9485 3167.1018t Figure 24.9 Ford’s Annual Sales (1968-1990) 24.4 Linear and Log-Linear Time Trend Regressions Figure 24.10 SAS Printout for Least-Squares Fit (Straight-Line Method) to x = Sales t Model: MODEL1 Department Variable: SALES Analysis of Variance Source DF Sum of Squares Mean Square F Value Prob>F Model 1 10150900144 10150900144 216.829 0.0001 Error 21 982834678.18 46801651.342 C Total 22 11133734822 Root MSE 6841.17324 R-square 0.9117 Dep Mean 41245.17000 Adj. R-sq 0.9075 C. V. 16.58660 24.4 Linear and Log-Linear Time Trend Regressions Figure 24.10 SAS Printout for Least-Squares Fit (Straight-Line Method) to x = Sales t (Cont’d) Parameter Estimates Variable DF Parameter Estimate Standard Error T for H0: Parameter=0 Prob >¦T¦ INTERCEP 1 3239.948538 2948.6230544 1.099 0.2843 PERIOD 1 3167.101789 215.05043838 14.727 0.0001 Durbin-Watson D (For Number of Obs.) 1st Order Autocorrelation 0.405 23 0.751 24.4 Linear and Log-Linear Time Trend Regressions Figure 24.11 Observation (Year 1-23) and Forecast (Year 24-30) Sales Using the Straight-Line Model 24.4 Linear and Log-Linear Time Trend Regressions ' ˆ loge xˆt ˆ t 9.4834 0.0827t 0.0516 0.0038 R 0.958 2 24.5 Exponential Smoothing and Forecasting s1 x1 s2 x2 1 s1 s3 x3 1 s2 st xt 1 st 1 (24.14) 24.5 Exponential Smoothing and Forecasting xˆt 1 st xt 1 st 1 (24.15) xˆ2 s1 0.35,000 1 0.35,100 5,070 units xˆt 1 st st 1 xt st 1 st 1 xt 1 1 st 2 st 2 xt 2 1 st 3 (24.16) 24.5 Exponential Smoothing and Forecasting st xt 1 st 1 xt 1 xt 1 1 st 2 2 xt 1 xt 1 1 xt 2 1 st 3 2 t 1 k t st 1 xt k 1 s0 0 1 k 0 3 (24.17) 24.5 Exponential Smoothing and Forecasting 24.5 Exponential Smoothing and Forecasting Figure 24.12 Annual Earnings per Share of J&J (Simple Exponential Smoothing) 24.5 Exponential Smoothing and Forecasting Figure 24.13 Annual Earnings per Share of IBM (Simple Exponential Smoothing) 24.5 Exponential Smoothing and Forecasting n MSE xt xˆt 2 t 1 n st xt 1 st 1 Tt 1 (24.18) (24.19a) Tt st st 1 1 Tt 1 (24.19b) 24.5 Exponential Smoothing and Forecasting xt a bt et s1 x1 T1 0 or b s2 x2 1 s1 T1 s1 xt 1 st 1 Tt 1 Tt st st 1 1 Tt 1 24.5 Exponential Smoothing and Forecasting Figure 24.14 Annual Earnings per Share of J&J with Forecasts Based on the Holt-Winters Model 24.5 Exponential Smoothing and Forecasting Figure 24.15 Annual Earnings per Share of IBM with Forecasts Based on the Holt-Winters Model 24.5 Exponential Smoothing and Forecasting xt m st mTt (24.20) 24.6 Autoregressive Forecasting Model xt a0 a1 xt 1 (24.21) xt a0 a1 xt 1 a2 xt 2 xt a0 a1 xt 1 a2 xt 2 (24.22) a p xt p (24.23) 24.6 Autoregressive Forecasting Model 24.6 Autoregressive Forecasting Model Figure 24.16 Quarterly Sales Data for Johnson & Johnson 24.6 Autoregressive Forecasting Model AR(1): Sales t = -17.7964 + 1.0333 sales t-1 (0.0353) (24.24) 2 R 0.9564 AR(2): Sales t = -62.2730 + 0.7065 Sales t-1 +0.3608 Sales t-2 (0.1575) R 0.9595 2 (0.1697) (24.25) AR(3): Sales t = - 88.6493 + 0.5945 Sales t-1 +0.0264 Sales t-2 (0.1555) + 0.4738 Salest-3 (0.1899) R 2 0.9608 (0.2082) (24.26) 24.6 Autoregressive Forecasting Model Sales43 17.7964 1.0333 2825 2901.2761 Sales43 62.2730 0.7065 2825 0.3608 2838 2957.5399 Sales43 88.6493 0.5945 2825 0.0265 2838 0.4738 2471 2836.78 MARPE S t St St (24.27) Summary In this chapter, we examined time-series component analysis and several methods of forecasting. The major components of a time series are the trend, cyclical, seasonal, and irregular components. To analyze these time-series components, we used the moving-average method to obtain seasonally adjusted time series. After investigating the analysis of time-series components, we discussed several forecasting models in detail. These forecasting models are linear time trend regression, simple exponential smoothing, the Holt-Winters forecasting model without seasonality, the Holt-Winters forecasting model with seasonality, and autoregressive forecasting. Many factors determine the power of any forecasting model. They include the time horizon of the forecast, the stability of variance of data, and the presence of a trend, seasonal, or cyclical component. Appendix 24A. The X-11 Model for Decomposing TimeSeries Components Ot2 It2 Ct2 St2 Pt 2 TDt2 Table 24A.1 (24A.1) Appendix 24A. The X-11 Model for Decomposing TimeSeries Components Figure 24A.1 Original Sales and the X-11 Final Component Series of Caterpillar, 1969-1980 Source: J. A. Gentry and C. F. Lee, “Measuring and Interpreting Time, Firm and Ledger Effect,” in Cheng F. Lee(1983), Financial Analysis and Planning: Theory and Application, A book of Readings Appendix 24A. The X-11 Model for Decomposing TimeSeries Components Table 24A.2 Appendix 24A. The X-11 Model for Decomposing TimeSeries Components O ' 2 2 I C S I I component = 2 ' 2 C 2 (O ) S component = (24A.2) 72.358 2 99.508 42.051 2 99.508 52.88% 2 ' 2 S 2 2 (O ) C component = 2 2 ' 2 (O ) 17.86% 53.831 2 99.508 2 29.27% Appendix 24A. The X-11 Model for Decomposing TimeSeries Components Table 24A.3 Relative Contributions of Components to Changes in Caterpillar Sales for 1-, 2-, 3-, and 4Quarter Time Spans Relative Contribution (in percent) Span in Quarters Trend-Cycle Seasonal Irregular Total 1 17.86 29.27 52.88 100 2 46.94 28.44 24.62 100 3 68.50 13.08 18.42 100 4 82.58 0.15 17.27 100 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series xt st 1 st 1 Tt 1 Ft L Tt st st 1 1 Tt 1 xt Ft st 1 Ft L xt m st mTt Ft m L (24B.1) (24B.2) (24B.3) (24B.4) Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series Table 24B.1 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series 24B.2 Quarter 1 = 1.130064 Quarter 2 = 1.128077 Quarter 3 = 1.037570 Quarter 4 = .704288 24B.3 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series d t 0.275977 0.003482t s0 a b 0 initial seasonal index for fourth quarter 0.275977 0.704288 0.194367 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series x10 s10 0.2 0.8 s9 T9 F10 4 x10 0.2 0.8 s9 T9 F6 0.38 0.2 0.8 0.341176 0.015552 1.161223 0.35083 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series T10 0.3 s10 s9 0.7T9 0.3 0.35083 0.341176 0.7 .015552 0.013783 x10 F10 0.3 0.7 F6 s10 0.38 0.3 0.7 1.161223 0.35083 1.137799 Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series Figure 24B.1 Quarterly Earnings per Share of J&J (Actual and Smoothed EPS) Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series Figure 24B.2 Quarterly Earnings per Share of J&J (Actual and Forecasted EPS) Appendix 24B. The Holt-Winters Forecasting Model for Seasonal Series x11 s10 T10 F7 0.350830 0.0137831.099288 0.400815