Budget Format Guidelines_ 2013-14

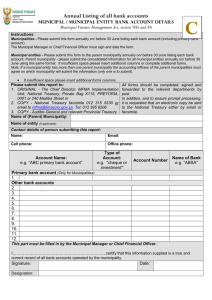

advertisement