Oregon Government Ethics Law Reform

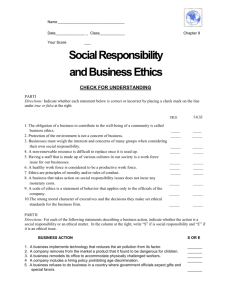

advertisement