Chronicles III

advertisement

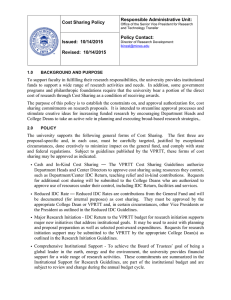

Chronicles III: Indirect Costs (IDC) or Follow the Money Most of us faced the new millennium with a mixture of enthusiasm and trepidation. Could the technology revolution continue to push the NASDAQ ever upward? Might airplanes really fall out of the sky? Would terrorists spoil the party? Grant and Contract (G&C) personnel at Sonoma State University (SSU) evicted by President Arminana from their long-term home within the Academic Foundation on 1 January 2000 had additional concerns: Had CFO Schlereth made adequate arrangements for their new home within Administration & Finance (A&F)? Would they be able to do business as usual when the doors opened after the holidays? The simple answer was no; the advance planning preceding this important event was woefully inadequate; the transition was mandated by the President and accomplished through crisis management by the CFO. The problems identified prior to the transition (the subject of Chronicles II) have yet to be resolved to this day and have wrecked havoc on SSU’s reputation and finances. This installment of the Chronicles will look at one important, outcome of the G&C transition—the transfer of the flow of Indirect Cost (IDC) Revenue from the schools, institutes, and centers to A&F. IDC and How Was It Used through 1999 in the Foundation The term IDC originated with the federal government’s Office of Management and Budget (OMB), which now uses a new phrase Facilities and Administrative costs (F&A). OMB Circular A-21 (Cost Principles for Educational Institutions, revised 8/8/00) distinguishes between Direct and F&A costs. Direct costs are those that can be identified specifically and accurately with a particular sponsored project (such as project wages). F&A costs are associated with maintaining the infrastructure of universities, with common or joint objectives that cannot be readily identified with a particular sponsored project. According to OMB, these F&A costs include facilities (IT, utilities), general administration (A&F, library), departmental administration (schools), and sponsored project administration (centers and institutes). Using a complex set of procedures, SSU documents their F&A costs and negotiates a Federally approved F&A rate. SSU’s current rate of 45.6% (on wages and fringe benefits) is designed to cover all of the F&A costs identified on campus. Of course, SSU has been awarded very few projects that actually pay this rate. As of March 2007, the average effective IDC rate on campus was only 1 about 12% (on total direct costs). And this is where the problem resides. Costs identified by A&F are recovered in such a way that little remains to be distributed to the schools, centers, and institutes that the generate the funds and manage the projects. Before discussing these costs, let us return once more to the good ole days in the Foundation. During Dr. David Walls’ administration, he understood that it was important to leave a substantial share of IDC with the grant administrator. Walls tried to keep 50% of IDC revenue within the Foundation for its administration, but was unable to do so. A grant accountant described Indirect Shares in a memo the very end of 1999: At that time, “when a grant or contract has an indirect rate of at least 15% of the total direct costs, we share back 10% of the monthly, recovered indirect with the appropriate School or Center. The transfers typically serve to increase the Fund Balance of the Dean’s Discretionary Accounts. For CIHS, we shareback 15% on Projects with a rate of 8 to 14%, and 23% on Projects where the rate is 15% or greater, and 10% to the School of Social Science. At the end of each Fiscal Year if the CIHS has generated more than $186K, we share 73% of that back to CIHS and Soc Sci. For the Anthro Studies Center, we have been sharing 50% of the monthly recovered indirect.” In short, the Foundation made a concerted effort to share costs among the various parties that developed, administered, and managed projects. The Foundation had explicit agreements and distributed IDC funds on a monthly basis to fund post-award management. A&F’s New Vision of IDC and Its Purpose This all changed with the dawning of the year 2000. Enter CFO Larry FurukawaSchlereth with a new vision of the use of IDC revenue: According to the CFO, the decision as to how distribution would now occur “after ALL expenditures by the tax payers via its SSU general fund are reimbursed for services provided to the overall grants and contract function is a decision that rests with the Provost. We need to keep in mind that the whole notion of IDC is to reimburse the University for services it provides to a grant or contract that are of an institutional support nature. If IDC exists after all appropriate reimbursements are made that is great but we cannot loose site [sic] of why IDC exists” (email March 2000). Despite the OMB Circular, the CFO’s definition of appropriate uses of IDC did not extend beyond facilities and general administration (library not included) and did not encompass the essential post-award activities undertaken by the 2 awards’ recipients. In his vision, schools and centers only received funds to manage their projects after the end of the fiscal year, if there were funds remaining that weren’t distributed to the General Fund, and subject to the Provost’s discretion. Thus, managing awards at the department or project level was effectively reclassified as non-essential. Despite the many problems identified within A&F’s post-award management of G&C—from huge problems like the absence of policies and procedures to annoyances surrounding the lack of institutional support and inadequate communication protocols—the CFO’s first order of business was to allocate the IDC. Thus began a series of “Nuts and Bolts” meetings. In July 2000, the CFO presented an IDC Recovery Plan that set the stage for the next seven years: SSU Institutional Support [Accounting, Contracts Human Resources, General Oversight, Checks and Balances] …. .$575,000 SSU Facilities Services [Plant, Landscape, Engineering, Custodial, Utilities, based on sq. ft.]……………………… $50,000 SSU Technology Services [Network Maintenance, Technology Support] $75,000 Common Management Systems [Self-sustaining fund’s pro-rata share of CMS to be assessed over 7 years]…………………………………………………… …$150,000 Programmatic Compliance [ORSP costs for grants external to CIHS and ASC] $15,000 CIHS Administration [General Administration, Programmatic Compliance] $500,000 ASC Administration [General Administration, Programmatic Compliance] $300,000 Academic Foundation [operating expenses for grants in the Foundation] $100,000 Operating Reserves $100,000 Assumed IDC Revenue $1,620,000 Total Expenses $1,865,000 Projected Expense Over Revenue $245,000 Additionally, there was a need for $60,000 to fund cash flow and $500,000 to $700,000 to establish a Working Capital Reserve. “These resources existed at one time but were allocated to Academic Affairs for higher priority needs in the instructional program” (“Nuts and Bolts” Group Agenda, July 6, 2000). Thus, from the beginning, the G&C program operated out of a $1 million dollar deficit establish by its new caretakers within A&F. Also noteworthy is the fact that the 3 Schools were not included anywhere in this Plan—their 10% had been eliminated altogether. Executive Order 753 as Interpreted at SSU Chancellor’s Office Executive Order 753—Allocation of Costs to Auxiliary Enterprises (July 2000)—was cited by the CFO as the rationale for these costs. EO 753 mandates that the CFO “ensure that auxiliary enterprises are charged for allowable direct costs plus an allocable portion of indirect costs associated with facilities, goods, and services provided by the University through the General Fund.” “Auxiliary enterprise” refers to a University-related entity (program, activity, or fund source) that furnishes facilities, goods, or services to students, faculty, staff, or incidentally to the general public typically charging a fee and essentially self-supporting. Examples at SSU would be the dorms, parking, bookstore, food service, Foundation, and projects housed in the Special Project Fund, where the G&C program had been recently moved. The Order mandated that indirect costs be allocated according to a cost allocation Plan that: Describes the facilities, goods, or services provided Identifies the units rendering and receiving the facilities, goods, or services Lists the items of expense included in the cost of providing the facilities, goods, or services Identifies the method used to describe the cost of the facilities, goods, or services Provides a summary schedule showing the allocation of the facilities, goods, or services (EO 753). In addition, the Plan should be rewritten annually preferably prior to, but not later than the end of the period covered. The cost allocations must be adequately supported by documentation that could be independently verified, signed by the CFO, and monitored during the course of the year (CO Report Number 05-13, May 19, 2006). The Indirect Cost Recovery Plans prepared each year by the CFO would seem to fall broadly under EO 753 guidelines. However, a similar plan using the same formulas should also be in place for the OTHER campus auxiliaries, including the Foundation. In other words, EO 753 mandates a Cost Allocation Plan covering the entire campus and all its auxiliaries and that they should all be treated the same. There should be documentation for each line item and the Plan should be communicated to the campus community during its year of operation. 4 In April 2003, the CSU Financial Officers Association (FAO) developed Guidelines for General Fund Allocation Plans. Of interest are the following Principles: 3.1. Auxiliary organizations are formed to provide essential functions that are an integral part of the educational mission of the California State University. It is appropriate to recognize these interdependencies between the General Fund and auxiliary enterprises in the cost allocation plans. 3.2. No more than the full costs of a General Fund activity may be allocated. 3.5. Allocation of indirect costs should be based on a process that is reasonable relative to the activity and the related costs. The Plans should identify a simple and equitable cost allocation methodology for each of the services that is reasonable relative to the activity and related costs. Sponsored research activity in University space should be reimbursed on some reasonable basis that recognizes the research benefit to the instructional program. The University may limit the cost allocation for space utilized for research activity to significant incremental costs (i.e., new construction). The University should offset use of auxiliary space constructed with auxiliary funding when the space is used for General Fund purposes. General Fund allocations may also be offset with unrecovered costs incurred by an auxiliary enterprise on behalf of the General Fund (e.g., teaching) (FAO Project, April 2003). Thus, the Cost Allocation Plan does not require recovery of “full” costs, recognizing the essential functions that occur within auxiliary organizations, particularly those related to sponsored programs. The costs must be reasonable, documented, and can be offset in various ways. The 05-06 Grants and Contracts Expenditure Plan is the most recent one available for review. Despite being a record year in terms of Total Volume (ca. $30 million) and IDC (ca. $3.2 million), the Plan did not cover all expenses. It contained two types of expenditures: mandatory—those costs overseen by the CFO (facilities and A&F)—and discretionary—those costs stemming from the Provost (schools and centers). It was clear from the beginning of the fiscal year that there would not be sufficient funds to cover the “discretionary” costs, those for departmental and sponsored projects administrations. Ultimately, no funds were distributed to the Provost. The reasons given by the CFO for this are (1) the cost of Post-Retirement Health Benefits (PRHBs) and (2) the ongoing CIHS audit. Neither of these problems had been identified in July 5 2006 when the fiscal year ended, however, the PRHB bill did not arrive until mid September 2006 and problems within CIHS did not surface until February 2007. The lack of predictable IDC shareback lead to the demise of CIHS. The Institute did not receive any operating funds from A&F for 18 months prior to its takeover by A&F. When asked by faculty at the President’s Budget Advisory Committee (PBAC) meeting in April 2007 if this was the case, Larry Furukawa-Schlereth answered that “IDC associated with CIHS’s delegated authority had been allocated not only over the past 18 months but in every year that CIHS had delegated authority from Administration and Finance” (PBAC minutes, April 17, 2007). What he did not say was that CIHS’s delegated authority money for 06-07 was only distributed in March 2007, after A&F had taken control of the Institute (CMS Journal Entry). The Provost clarified that his office also had an understanding with CIHS whereby additional IDC was distributed, “assuming that there was IDC to distribute. The problem was that the cost structure changed and there was no longer IDC to distribute. This was communicated” (PBAC minutes, April 17, 2007). It was, indeed, communicated. But as “discretionary” funds are only distributed at the end of the fiscal year, it was communicated a year too late. There is much that is troubling in A&F’s 05-06 Expenditure Plan. This is a pivotal document in understanding how G&C works at SSU. Working Capital, which paid over $400,000 into the Foundation in 05-06 alone @ 8% interest, merits attention as other CSUs float their grants programs at no charge and Special Projects Fund 947, where SSU’s sponsored programs resides, permits the “expenditures of the Special Projects Fund from the campuses’ general checking account” (Financial Records System Code Book Section E947.391). In this installment, however, we will focus on only two components—facilities/infrastructure and department/program administration because A&F unwisely chose to fund the former and ignore the latter. (Your chroniclers have prepared a detailed list of questions on Expenditure Plans from 05-06 through 07-08, which are available upon request and may be the subject of a future installment.) Over the past seven years, nearly $2 million has been charged to G&C for CMS, over 45% more than the original pro-rata sum assigned to G&C in 1999-2000. CMS, Network, IT, custodial, maintenance, and utilities, and on-campus space rental for the past seven years total well over $3.5 million. It is difficult to get a figure for the dollar amount returned to Schools since they get their share late and last, but somewhere in the range of $1.2 million for the same time period is a good guess, with no allocations since the 04-05 fiscal year. Reimbursed costs for 6 infrastructure (which ended in A&F coffers) outpaced costs for departmental administration by about 3:1. The OMB Circular is quite specific about how to pay for the cost of departmental administration: “Salaries and fringe benefits attributable to the administrative work (including bid and proposal preparation) of faculty (including department heads), and other professional personnel conducting research and/or instruction, shall be allowed at a rate of 3.6 percent of modified total direct costs. No documentation is required to support this allowance” (OMB Circular A-21 F.6.2.a). Documentation is required, however, per EO 753, for all of the costs on the Expenditure Plans, including wages within A&F. These have never been forthcoming. When asked about this recently at a FSSP meeting, Larry Furukawa-Schlereth acknowledged, “that details of the administrative costs have not been communicated/displayed as clearly as might be desirable.” He went on to suggest the “possibility of creating a separate auxiliary to handle grants in order to make the costs more explicit, but this would probably lead to increased costs due to the need for separate audit and other business expense” (FSSP meeting, May 11, 2007). One wonders if the CFO doesn’t know the costs of the G&C program, how he can legitimately assess charges per EO 753? Other Visions It doesn’t have to work this way. Even CFO Schlereth recently “acknowledged that there are other models within the CSU, including some campuses that return all IDC to Academic Affairs to support sponsored projects”(FSSP minutes, May 4, 2007). According to Sacramento State University’s Research Administration and Contract Administration webpage, “Recovered F&A [IDC] costs are used for many purposes throughout the University. Much of the recovered funds are returned to the college deans and principal investigators.” And what of the “forgone” or unrecovered F&A costs? At Sacramento State these costs are “covered from the University and or UEI [University Enterprises] funds.” In choosing to fund facilities and general administration to the exclusion of department and program administration, the CFO has created a dangerous situation forcing the programmatic, overarching day-to-day management of sponsored projects to operate without financial support. CIHS may not be the only group on campus to have been forced to allocate as direct costs some costs more appropriately considered program overhead. This, however, is the guidance and model provided by A&F. Auditors will soon be visiting the campus to audit other projects for their adherence to time-and-effort 7 certifications and appropriate cost allocations. It is expected that more problems will be found in the G&C program at SSU. Despite numerous warnings, the CFO failed to develop policies and procedures or to fund the first line of post-award defense in the schools, institutes, and centers. As recently as April 2006, ORSP cautioned that “It is in the best interests of SSU to support the full range of pre- and post-award activities needed to effectively administer grants and contracts in compliance with SSU, CSU, and funder requirements. Not doing so puts the University at risk of noncompliance” (ORSP Perspective on the Allocation of IDC at Sonoma State University). Nevertheless, IDC continues to evaporate into the General Fund supposedly to repay general administration and facilities charges but more likely used to fund the President’s wish list. The consequences of this lapse in judgment have only begun to be realized and will continue to haunt SSU into the foreseeable future. Coming soon This installment of the Chronicles has only begun to explore IDC. “Chronicles IV: IDC Wars From ‘Nuts and Bolts’ to Simply Nuts” will continue the saga. 8