Capital availability questionnaire - Investors2.doc

advertisement

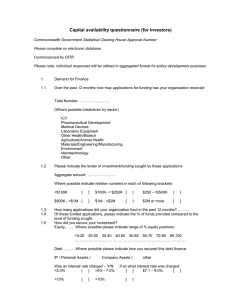

Capital availability questionnaire (for Investors) Commonwealth Government Statistical Clearing House Approval Number: Please complete on electronic database Commissioned by DITR Please note: individual responses will be utilized in aggregated format for policy development purposes. 1. Please indicate your investor type: private investor other (please indicate) ……………. business angel 2. Do you currently finance early stage technology companies Y N 3. Demand for Finance 3.1 Over the past 12 months how may applications for funding has your organization received: Total Number: …………………… None <10 <20 20 - <50 50 - <100 >100 (Where possible breakdown by sector) ICT Pharmaceutical Development Medical Devices Laboratory Equipment Other Health/Biotech Agriculture/Animal Health Materials/Engineering/Manufacturing Environment Nanotechnology Other 3.2 How many applications has your company received in the past 2 years? None 3.3 <10 <20 20 - <50 50 - <100 >100 Please indicate the levels of investment/funding sought by these applications Aggregate amount: ………………….. Where possible indicate relative numbers in each of following brackets: <$100K [ ] $100K- < $250K [ ] $250 - <$500K [ ] $500K - <$1M [ ] $1M - <$2M ] $2M or more [ ] [ 3.4 How many applications did your organization fund in the past 12 months in the following ranges? ……… <$100K [ ] $100K- < $250K [ ] $250 - <$500K [ ] $500K - <$1M [ ] $1M - <$2M [ ] $2M or more [ ] 3.5 Of these funded applications, please indicate the % of funds provided compared to the level of funding sought. Where possible please indicate numbers in each range. <25%, [ 4. ] up to 50% [ ] >50-75% [ ] >75-100% [ ] How did you secure your investment? Equity…….. Where possible please indicate range of % equity positions. 10-20 50-60 [ [ ] ] 20-30 60-70 [ [ ] ] 30-40 70-80 [ [ ] ] 40-50 [ 80-100 [ ] ] Please indicate the number in each range. .………………………………………………………………………. Debt ……….Where possible please indicate how you secured this debt finance. IP / Personal Assets Company Assets Other (please indicate) No: No: No: Was an interest rate charged – Y/N many: <5.0% [ ] >5% - 7.0% <10% 4.1 [ ] >10% If so what interest rate was charged and for how [ ] $7.1 – 9.0%. [ ] [ ] Of this investment, was there any proportion provided as provisional funding. Yes No If yes, please indicate if (eg) subject to raising of matching government/other grant funds Base level of funding allocated to specific activities such as market research, business plan development, consultants etc Base level of funding for first option to invest/due diligence activities etc Other 5. Of the unfunded applications, what was the criteria for rejection: Please rank by frequency of occurrence: Risk too high: Please specify: Technical / Business / Market / Management / Competition Too difficult to negotiate Management Capability, skills and experience – track record Untested market Unproven product Poor/inappropriate Business Plan Poor Market research Unrealistic valuation expectation Insufficient market analysis Insufficient Revenue streams No novelty in IP Insufficient funds requested Too much due diligence required for funds requested and resources available. Other 6. What is your expectation for timing of return on investment (ROI)? 7. Do you consider that there is a funding gap (range of finance) in which it is difficult to provide access debt/equity finance, and where it is most apparent? (more than one answer is acceptable). Not difficult [ ] <$100K [ ] $100K- < $250K [ ] $250 - <$500K [ ] $500K - <$1M [ ] $1M - <$2M ] $2M or more [ ] [ 7.1 Why? Please provide general reasons eg due diligence too high, risk vs reward insufficient, management input required too high, not investor ready etc 8. Based on your experience, do you think the current financial market adequately services the needs of those seeking commercialisation funding? Yes No If no, please briefly indicate why. All comments are welcome. 1.1 Of no, also please indicate if you believe that where alternate/additional funding/incentives programs were available for improving the presentation and business analysis of each application, that it would significantly improve the quality of prospective deals presented and that you would potentially invest in more if they were in an investor ready presentation. Also add question on what they provided funding for – see our survey Q1.3 Do they think the investees are investor ready? Explain why not if not See other comments in Karyn’s 16 June email