click here for the PowerPoint Presentation

advertisement

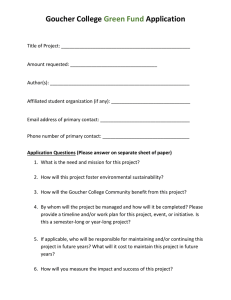

You Can Afford College! 1 GOUCHER COLLEGE A D M I T T E D S T U D E N T S D AY 2016 Goals of Financial Aid Primary goal is to assist students in paying for college and is achieved by: Evaluating families’ ability to pay educational costs Distributing limited resources in an equitable manner Providing balance of gift aid and self-help aid Financial Aid Basics 3 Gift Aid Self-Help Aid Grants Work Study Scholarships Loans Sources of Financial Aid 4 Federal • Grants • Work Study • Loans State- MD and others • Scholarships • Grants Institutional- from Goucher • Grants • Scholarships Private • Scholarships • Tuition reimbursement Federal Financial Aid 5 Grants Pell Grant Supplemental Education Opportunity Grant (SEOG) Teach Grant Work Study Need based award provides funds earned through part-time employment on and off campus Student receives paycheck to help with expenses Federal Financial Aid, cont. 6 Loan Programs Types Federal Direct Student Loan– student’s name, fixed interest rate 4.29%, 6 mo grace period Subsidized- need-based= government pays interest while student is in school Unsubsidized- non need-based= interest starts accruing Parent PLUS – parent’s name, fixed interest rate- 6.84%, credit check required (looks at ‘adverse’ credit) New Interest rates are released each July. State Aid from the Maryland Higher Education Commission 7 Grants and Scholarships Parent and student must be a MD Resident Some programs require an additional application Samples of State Aid Need-based (file FAFSA by March 1st each year): Howard P. Rawlings Educational Excellence Awards Legislative: Senatorial Delegate MD State Aid 8 Goucher Institutional Aid 9 Need Based or Merit Based Aid awarded by GC Merit scholarships- based on academics Leadership/Talent scholarships- required audition/interview Operating funds- need-based grants, required CSS Profile Endowment and Foundation funds- replace operating funds in future years with $ from donors Private Sources 10 Funding that comes from private organizations Civic Organizations Professional Associations Private Businesses Employers Deadlines and application procedures can vary widely Use reliable scholarship search services Awards 11 Awards are based on enrollment status 12+ credits = F/T Most awards require F/T status Awards are based on housing status On-campus, With Parent, Off-Campus (upperclassman) Determining Financial Need 12 The Cost of Attendance (COA) 13 Calculating your Cost Of Attendance (COA) Tuition and Fees (direct average cost) Room and Board (direct or indirect average cost) Books and Supplies (indirect average cost) Transportation (indirect average cost) Miscellaneous Expenses (indirect average cost) Cost of Attendance (COA) Undergraduate 16-17 On Campus Off Campus With Parent Tuition $42,600 $42,600 $42,600 Fees $816 $816 $816 Room & Board $12,300 $8,000 $2,000 Books $1,200 $1,200 $1,200 Transportation $1,000 $1,200 $1,200 Personal $1,500 $1,500 $1,500 Total $59,416 $55,316 $49,316 Resident Budget 14 15 The Free Application for Federal Student Aid (FAFSA) takes into account: FM EFC Expected Family Contribution To consider you for federal and state aid Income (parent(s) and student) Assets (parent(s) and student) Number in Household Number in College State of Residence Marital Status Dependency Status 16 The CSS Profile: IM EFC Expected Family Contribution To consider you for institutional aid Looks at what makes up AGI Looks at primary home value Looks at business/farm value Looks at noncustodial parent Fee- $25 What happens next? 17 Make sure to list GC’s school code on the FAFSA and CSS Profile (002073 and 5257) GC will import your information GC may ask you for additional information (ex. tax forms, citizenship documents…) GC will send you an award letter Visit our website for an award guide FASTS (Financial Aid Student Tracking System) Provides current information about the status of financial aid View their financial aid award Accept/decline/decrease financial aid awards Check the status of required financial aid documents Download financial aid documents View messages associated with the financial aid award Access FASTS at www.goucher.edu/fasts - use Goucher ID and user-created pw What to do once you deposit! Accept or decline awards on FASTS Make sure all documents needed are turned in Report outside assistance If accepting students loans: Complete an entrance interview Complete a Master Promissory Note (MPN) Loan funds are credited by semester directly to the student’s tuition account. A origination fee is deducted prior to disbursement. Parent Loan Information Federal Direct PLUS loans All parents may apply. A FAFSA must be on file for the student. To apply: Complete a credit check and application at www.studentloans.gov Sign a Master Promissory Note online at www.studentloans.gov Borrow for the full academic year. Federal Work Study (FWS) FWS is a federal need-based program. Students earn wages and receive biweekly paychecks for hours worked. Students should attend the job fair in late August to meet directly with employers and schedule interviews. Jobs are not assigned to students and are not guaranteed. A student can still work on-campus if they don’t have FWS, however the jobs may be more limited. Report Outside Assistance Students who receive aid from outside sources, must report them to our office. Use the online Outside Scholarship Notification form on the New Student Website to report. Packages may be adjusted as a result. If so, a revised award notice will be sent via email if adjustments are made. Special Situations If your family experiences a recent change in circumstances (ex. unemployment, high unreimbursed medical expenses, change in marital status…) the financial aid award may be reviewed. To request a review, complete a Professional Judgment Request (found on our website) and provide the appropriate supporting documentation. Non-custodial information (needed for CSS Profile) may be waived if circumstances exist. Study Abroad Federal and institutional financial aid is transferable for Goucher sponsored study abroad programs. Institutional financial aid is not available for a 3-week long program or a non Goucher sponsored program. OIS offers additional scholarships for programs. Financial Aid and Billing Any FA awarded for the semester will appear as anticipated aid on the billing statement. Anticipated aid is deducted from the balance to arrive at the amount due for the fall semester. Enrollment and housing deposits will be deducted from fall bill. Loan origination fees will be deducted (1.068%/4.272%) FWS won’t be deducted from the tuition account balance. Students will be paid bi-weekly for actual hours worked. FA will be credited to a student’s tuition account after add/drop only after the financial aid file is complete. Failure to submit required documents may result in cancelation of awarded aid. E-Billing Information July 8, 2016: Students and their billing parties will be notified via e-mail that their billing statement is available. Students need to set up third-parties (ex. parents) with access to their E-Bill. FERPA reminder- new student portal August 3, 2016: Fall semester balance is due (unless aid covers) A billing worksheet is available to help you figure things out! http://olympus.goucher.edu/billing/ugbillingworksheet.aspx Insurance Plans HEALTH INSURANCE Required for all full-time students Information mailed in summer Students must select or waive this insurance online $1,798 TUITION REFUND INSURANCE Reimburses families if student has to withdraw for medical reasons Information mailed in summer Monthly Payment Plan Payments are spread out over 9-10 months beginning in May or June. Annual fee ($55) for enrolling in the plan. No interest is charged. A credit for half of the plan amount is applied to the students’ account at the beginning of the fall and spring semesters. Information will be mailed to deposited students. Other Ways to Pay for College 29 Your Own Savings 529 Savings & Prepaid Tuition Programs Employer Tuition Reimbursement Plans Veterans Benefits/Military Tuition Assistance Alternative Loans What happens with my financial aid? 30 Students may receive FA up to their COA FA will pay for your direct costs (tuition and fees and room and board if living on-campus) If your FA is in excess of your T&F you will receive a refund check (to help pay for indirect expenses) Example= $20,000 bill, $25,000 in FA, $5,000 refund Future Years… Student must maintain full-time enrollment and required GPA for merit scholarships. Must file FAFSA and CSS Profile each year to renew need-based aid. Need-based aid will stay the same unless significant change in EFC. Contact Us! Financial Aid- 410-337-6141 (finaid@goucher.edu) http://www.goucher.edu/financialaid Billing- 410-337-6022 (billing@goucher.edu) http://www.goucher.edu/billing We are located in Student Administrative Services (next to Admissions in the Dorsey Courtyard) Questions? 33 We look forward to welcoming the CLASS OF 2020!