– Effective April 2013 GUIDANCE

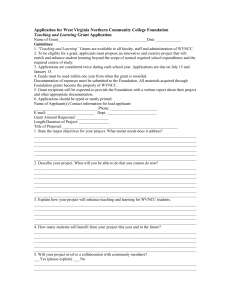

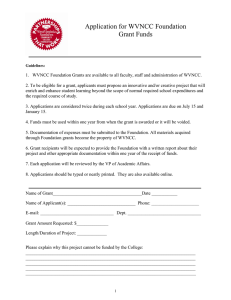

advertisement