subrecipinternalprocedure.doc

advertisement

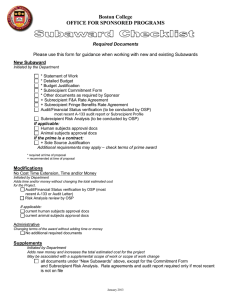

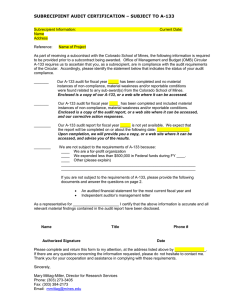

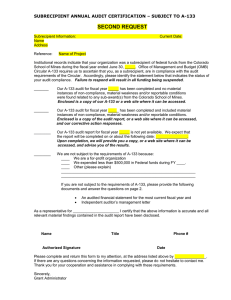

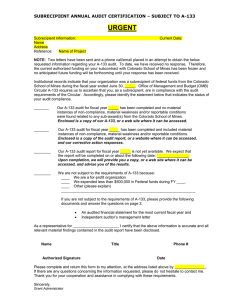

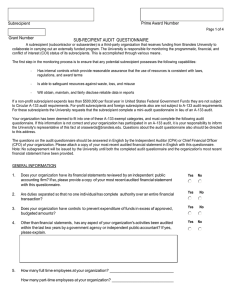

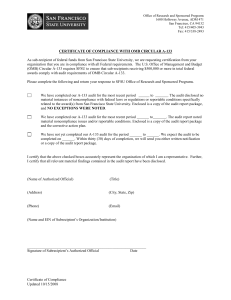

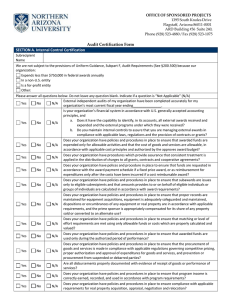

San Francisco State University Office of Research and Sponsored Programs Subrecipient A-133 Internal Procedure Prepared By: Huron Consulting Group Date: 6/30/2016 Business Process Description: A subrecipient is any institution that receives a subcontract from San Francisco State University (SFSU) for a portion of a sponsored project. For subcontracts that include any Federal money, SFSU requires the subrecipient institution to make an annual disclosure of any sponsored research audit findings. As a recipient of federal sponsored projects, SFSU must comply with the guidelines outlined in OMB Circular A-133 Audits of States, Local Governments, and Non-Profit Organizations (A-133). A-133 Subpart D (A-133.400 (d)(1-7)), includes the following subrecipient monitoring requirements: Ensure that subrecipients expending $500,000 ($300,000 for fiscal years ending before December 31, 2003) or more in Federal awards during the subrecipient's fiscal year have met the audit requirements of this part for that fiscal year. Issue a management decision on audit findings within six months after receipt of the subrecipient's audit report and ensure that the subrecipient takes appropriate and timely corrective action. Consider whether subrecipient audits necessitate adjustment of the pass-through entity's own records. Roles and Responsibilities: Compliance Officer (the Officer): The Officer has primary oversight responsibility for ensuring that subrecipients complete an annual certification to disclose any sponsored research audit findings. Business Process: Maintaining the Subcontract Log: 1. Upon receipt of an executed subcontract (where SFSU is issuing the subcontract), the Compliance Officer makes an entry into the Subrecipient Log (Log) containing information about the Federal award, the subrecipient, and certain A-133 audit monitoring information. See Attachment II for instructions on populating and maintaining the Log, and Attachment III for a sample Log. A. If a new subrecipient entry is necessary, go to the first blank row at the bottom of the Log and enter the required information as outlined by the Log instructions in Attachment II. B. If an amendment is made to the subcontract, update the Log with the applicable changes to maintain accurate information about the agreement. Sending an Audit Certification Form: 2. An Audit Certification Form, see Attachment I, should be sent to each subrecipient 9 months after their fiscal year end*. (Most Higher Education institution’s fiscal year end is June 30, so the majority of the letters will be sent around March 31.) During the first 5 business days of each month, the Officer will sort the Log by “Expected Audit Completion” to determine each institution that should be sent an Audit Certification Form. See Attachment II for instructions on how to sort the Log. Page 1 DRAFT – HURON PROGRESS THROUGH 6/30/2016 San Francisco State University Office of Research and Sponsored Programs Subrecipient A-133 Internal Procedure A. Additionally, the Officer should follow-up with any institutions that have an outstanding Audit Certification Form sent previously. Delinquent Audit Certification Forms are addressed in more detail in Business Process Step 4 of this document. * Entities subject to OMB Circular A-133 are required to have an audit report completed nine (9) months after their fiscal year-end. Reviewing the Audit Certification Form: 3. For each institution identified in the Log, the Officer will send an Audit Certification Form requesting their compliance certification. The following steps will be completed during this process: A. The Officer will update the Log to indicate the date the letter was sent and retain a copy of the letter to be filed in a central file sorted by subrecipient. B. Upon receipt of a completed Audit Certification Form, review the documentation to ensure that it was completed correctly and signed. If an actual A-133 audit was sent instead of an Audit Certification Form, review the actual audit to determine if there are relevant findings and update the Log accordingly. C. Based on the section of the Audit Certification Form completed by the subrecipient (A, B, or C), update the log with the following information: Section A (Not subject to A-133) Go to the Log and enter the received date in the column "Certification Received" and in the column "Not Subject to A-133." File the letter in the prime award account file and keep a copy in the central file. Section B (Subject to A-133 with no findings) Go to the Log and enter the received date in the column "Certification Received" and an 'N' in the column "Finding (Y/N)." File the letter in the prime award account file and keep a copy in the central file. Section C (Subject to A-133 with findings related to prime award) Go to the Log and enter the received date in the column "Certification Received" and an 'Y' in the column "Finding (Y/N)." Give a copy of the letter to the ORSP Director. The Officer should obtain assurance from the subrecipient that corrective action efforts have been made. This may include reviewing the adequacy of the corrective action plan and determining whether substantive action has been taken to implement the plan. When the appropriate information is gathered, the Officer will discuss the information with the ORSP Director. Together, they will make a decision on how to best address the situation. This may include requesting additional documents, contacting the sponsor to address plan inadequacies, Page 2 DRAFT – HURON PROGRESS THROUGH 6/30/2016 San Francisco State University Office of Research and Sponsored Programs Subrecipient A-133 Internal Procedure or terminating the subcontract. A memorandum should be drafted by the Officer and included with all documentation received and be placed in the prime award account file, and keep a copy in the central file. Add the details in the comments section of the Log and discuss the resolution, correspondence, agreements, and other pertinent information. Section C (Subject to A-133 with findings not specifically related to prime award) Go to the Log and enter the received date in the column "Certification Received" and an 'Y' in the column "Finding (Y/N)." Give a copy of the letter to the ORSP Director. The Officer should obtain assurance from the subrecipient that corrective action efforts have been made. This may include reviewing the adequacy of the corrective action plan and determining whether substantive action has been taken to implement the plan. When the appropriate information is gathered, the Officer will discuss the information with the ORSP Director. Together, they will make a decision on how to best address the situation. This may include requesting additional documents, contacting the sponsor to address plan inadequacies, or terminating the subcontract. All documentation received should be placed in the prime award account file and keep a copy in the central file. Add the details in the comments section of the Log and discuss the resolution, correspondence, agreements, and other pertinent information. Section C (Subject to A-133 and audit not yet completed) Keep the letter in a "Pending File" and update the log with the pending information. Once the completion date specified has past, send another Audit Compliance Certification Form. Delinquent Audit Certification Form: 4. Each month, the Officer should follow-up with outstanding Audit Certification Forms to determine the reason of the delay. See Attachment II for instructions on generating monthly reports from the Log. When the subrecipient is contacted, a note should be made in the comments section of the Log. If the subrecipient has not returned the Audit Certification Form by the end of the third month (2 contacts have already been made), the ORSP Director should be notified. The ORSP Director should contact the subrecipient, and based on his or her discretion, request that Fiscal Affairs withhold payment of invoices until the Audit Certification Form is completed. Subrecipient Monitoring Records Retention Requirements: 5. OMB Circular A-110, Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and other Non-Profit Organizations, section A-110.53 (a-g) lists the records retention requirements for federal awards. Subcontract agreements are not excluded from the A-110 records retention requirements, and therefore, are subject to the same retention requirements as standard federal awards. The Officer should maintain all records from the Log, subrecipient audit reports, Audit Certification Forms, and related correspondence for a period of Page 3 DRAFT – HURON PROGRESS THROUGH 6/30/2016 San Francisco State University Office of Research and Sponsored Programs Subrecipient A-133 Internal Procedure three (3) years after termination of the subcontract. Related Processes/Events: Subrecipient Monitoring Invoicing Internal Procedure Page 4 DRAFT – HURON PROGRESS THROUGH 6/30/2016