Spring 2014 ACNT 1329 CRN 81023.doc

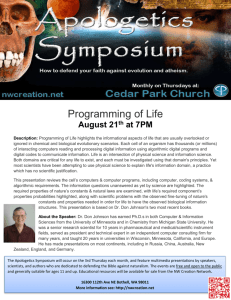

advertisement

SYLLABUS – ACNT 1329 Payroll & Business Tax Accounting (CRN 81023) M (5:30p-7:30pm) 3 credit hour course Second 8 weeks/ March 17- May 11, 2014 Dean of Career & Technology Education: Program Chair: Dr. Arnold Goldberg Dr. Marina Grau Prerequisite: ACNT 1303 (Introduction to Accounting) FREQUENT REQUISITES MATH 0306 (Basic Math Pre-Algebra) GUST 0342 (9th -11th Grade Reading) ENGL 0300 or 0347 Course Description: ACNT 1329 is a study of payroll procedures, taxing entities, and reporting requirements of local, state, and federal taxing authorities in a manual and computerized environment. Course Goals: The primary purpose of Payroll and Business Tax Accounting is to provide the students with a comprehensive and in depth course in payroll and business tax accounting. The course is designed to meet the needs of those students who are preparing for a career in accounting. Instructor Information: Instructor: Office Location: Office Hours: Phone #: Email: Vickie Smith West Loop By appointment 713-718-5218 ( after 5pm) vickie.smith@hccs.edu Textbook and Related Material (Required): See page 8. 1 Students with Disabilities: Any student with a documented disability (e.g. physical, learning, psychiatric, vision, hearing, etc.) who needs to arrange reasonable accommodations must contact the Disabilities Services Office at the respective college at the beginning of each semester. Faculty is authorized to provide only the accommodations requested by the Disability Support Services Office. Academic Honesty: Scholastic dishonesty is treated with the upmost seriousness by the instructor and the college. Students are responsible for conducting themselves with honor and integrity in fulfilling course requirements. Penalties and/or disciplinary proceedings may be initiated against a student accused of scholastic dishonesty. “Academic dishonesty” includes, but is not limited to the willful attempt to misrepresent one’s work, cheating, plagiarism, and collusion. Cell Phone: All cell phones must be in silent mode during class. Cell phone activity during class is considered disruptive to the learning environment and will not be tolerated. If you need to make or receive an Emergency call, please excuse yourself from the classroom. Class Attendance: Students are expected to attend class regularly, and to be on time for every class period. Students are responsible for materials covered during their absences, and it is the student’s responsibility to consult with the instructor or classmates for any make-up assignments. Although it is the responsibility of the student for non-attendance, the instructor has full authority to drop a student for excessive absences. A student may be dropped from any course for excessive absences after the student has accumulated absences of 12.5% of the hours of instruction. For example, in a 3 credit hour lecture class meeting 3 hours per week, a student may be dropped after 6 hours of absence. Drops and Withdrawals: It is the responsibility of each student to officially drop or withdraw from a course. Failure to officially withdraw may result in the student receiving a grade of F in the course. Procedures for withdrawing from a class are found in the Student Handbook. A student may officially withdraw by: 1.) Completing a withdrawal from at any campus 2.) Drop via the internet (www.hccs.edu). 3.) Send a letter in writing to : Registrar, Houston Community College System PO Box 667517 Houston, TX 77266-7517 International Students: Receiving a W in a course may affect the status of your student visa. Once a W is given for the course, it will not be changed to an F because of visa considerations. Course Repeater Policy: 2 Students who repeat a course three or more times will face significant tuition/fee increases at HCC and other Texas public colleges and universities. Please ask your instructor and/or counselor about opportunities for tutoring or other assistance prior to considering course withdrawal or if you are not receiving passing grades. Evaluation Requirements: Activity 2 Sectional Exams Final examination Homework and quizzes Project Total Points 200 points 150 points 125 points 25 points 500 points Percent 40% 30% 25% 5% 100% Grading Scale: Percentage 90 - 100% 80 - 89% 70 - 79% 60 - 69% BELOW 60% = = = = = Grade A B C D F Points 447 - 500 397 - 446 347 - 396 297 - 346 0 - 296 Students are expected to read all assigned chapters, complete and submit all assignments on due dates, and attend all classes. The nature of the course is such that perfect attendance is essential for mastery of the course content. A missed class can never be duplicated. Your final grade for this course will be based on how well you do in meeting the evaluation requirements listed on your assignment schedule and applying the grading scale which is listed below. Examinations: There will be a total of two sectional examinations (there will be no make-up examinations). The two highest grades received on these exams will be used to compute the student’s final grade for the course. The lowest score will be dropped. If a student misses an exam, that becomes the dropped exam. No cell phones will be used on exam. Bring a calculator. Homework and Quizzes: This course requires that the student complete homework using the Cengage CNOW (online software). It is the student’s responsibility to complete homework and quiz assignments each week. Homework will be due prior to each exam and will not be extended for any reason. Accounting is best learned through doing. This will require a considerable commitment of time and effort from the student. Typically, the successful student in college can count on 3 hours of independent study for every hour in the classroom. 3 Extra Credit: The amount that, and manner in which, if any, extra credit contributes to your grade is at the sole discretion of the instructor. If the student is absent from class when extra credit assignments are given the student will not be entitled to the extra credit. Incompletes: The grade of “I” (incomplete) is conditional and at the discretion of each instructor. If you receive an “I,” you must arrange with your instructor to complete the course work by the end of the following term (excluding Summer). After the deadline, the “I” becomes an “F.” Instructor Website: From the HCCS homepage, choose Southwest College, choose “The Learning Web,” choose Faculty, type in your instructor’s name. Your instructor will have a copy of the syllabus and other pertinent information for you. Tutoring/Lab Hours: This will be posted in The Learning Web during the second week of the semester. SCANS – Secretary’s Commission for Achieving Necessary Skills: Detailed SCANS information on this course is available from your instructor. For additional information about SCANS, go to: wdr.doleta.gov/SCANS/teaching Assignment Schedule: An assignment schedule is attached to this syllabus. This schedule will be followed throughout this course. The syllabus is subject to change. When changes occur the instructor will advise the students during class time. It is the student’s responsibility to, if absent, to ascertain from other students what was missed. 4 Assignment Schedule ACNT 1329 – Payroll & Business Tax Accounting Week 1 Date 3/17 Chapter Topic Class Introduction Assignments See below 2 3/24 1 2 3 3/31 3 The Need for Payroll and Personnel Computing Wages and Salaries Social Security Taxes See below 4 4/7 4 Income Tax Withholding See below Homework due @ 5:30 pm See below 5 4/14 5 Unemployment Taxes See below Exam 1- Chapters 1-2 Project assignment 6 4/21 7 4/28 8 05/06 6 Exam 2 –Chapters 3 –4 Homework due @ 5:30 pm Analyzing and Journalizing Payroll Payroll Project Final Exam - Chapters 5-6 See below Project Assignment Due Homework due @ 5:30 pm This course will use the book publisher Cengage CNOW Learning Module for all of your on line work. Registration information will follow. Below are your assignments in Cengage CNOW All chapter grades in CNOW are normally 100 points for simplicity. Chapter Type CNOW Pts 1 Quiz Matching Animated Total MC 60 30 8 98 20 MC @ 3 10 @ 3 4@2 2 Quiz Matching Animated Problems Problems Problems Problems Problems Total MC 40 20 8 6 3 9 6 9 101 20 MC @ 2 10 @ 2 4@2 Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic 3 Quiz Matching 2A 6A 13A 14A 20A MC 5 5 5@1 10 @ .5 5 Animated Problems Problems Problems Problems Problems Problems Problems Problems Problems Problems Total 4 5 Quiz Matching Animated Problem Quiz Matching Problems 1A 2A 3A 4A 5A 7A 8A 9A 16A 17A 1A 2A 7A 10A Total MC 1A 4A 5A 9A 11A Total 6 Quiz Matching Problem Problem Problem Problem Problem MC 1A 3A 4A 8A 11A Total 4 10 3 2 1 24 2 2 17 3 22 100 4@1 Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic 40 20 8 12 10 7 4 101 20 @ 2 10 @ 2 4@2 Algorithmic Algorithmic Algorithmic 40 20 9 12 6 4 9 100 20 @ 2 10 @ 2 Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic 20 20 2 18 15 16 9 100 20 MC @ 1 10@ 2 Algorithmic Algorithmic Algorithmic Algorithmic Algorithmic 6 Course Student Learning Outcomes (CLO): Students will: 1. Students will prepare payroll registers 2. Students will maintain employees’ earnings records 3. Students will journalize and post payroll and payroll tax entries 4. Students will complete federal, state, and city tax deposit forms and journalize transactions Learning objectives: Students will prepare payroll registers 1. Students will calculate regular and overtime pay 2. Students will apply current tax rates and wage base for FICA and SECA purposes 3. Students will compute amount of federal income tax to be withheld Students will maintain employees’ earnings records 1. Students will show understanding of purpose and use of Form W-4 2. Students will compute Advance Earned Income Credit 3. Students will prepare Form W-2 Students will journalize and post payroll and payroll tax entries 1. Students will complete reports required by federal unemployment tax act. 2. Students will describe types of information reports under various state unemployment compensation laws 3. Students will journalize entries to record payroll and payroll taxes 4. Students will show understanding of end-of-period adjustments Students will complete federal, state, and city tax deposit forms and journalize transactions 1. Students will complete Form 941, Employer’s Quarterly Federal Tax Return 2. Students will complete Form 8109, Federal Tax Deposit Coupon SCANS or Core Curriculum Statement: The Secretary’s Commission on Achieving Necessary Skills (SCANS) from the U.S. Department of Labor was asked to examine the demands of the workplace and whether our students are capable of meeting those demands. Specifically, the Commission was directed to advise the Secretary on the level of skills required to enter employment. In carrying out this charge, the Commission was asked to do the following: Define the skills needed for employment Propose acceptable levels of proficiency Suggest effective ways to assess proficiency, and Develop a dissemination strategy for the nation’s schools, businesses, and homes 7 Textbook and Related Material (Required): Text: Payroll Accounting, 2014 edition, by Bernard J. Bieg and Judith A. Toland, SouthWestern Cengage Learning, 2014. Bieg and Toland, Payroll Accounting 2014, 24e, Cengage, Payroll Software CD with CNOW Access Code, 9781305127760 (CD is not required) *****Do not attempt this course without this exact book***** The Cengage CNOW access code is bundled with the book at Houston Community College bookstores. If you buy your book from another source instead of the Houston Community College bookstore you must also buy the Cengage CNOW access code separately from Cengage direct. Please Note: See next page for student registration 8 Student Registration Information Dear Student, Welcome to CengageNOW, for Houston CC, your instructor has created the following course. Acnt 1329 Spring 2014 Course Key : E-TWQN3UB6PZHL4 Your instructor would like you to enroll in this course. To do so, use the following steps. Go to http://login.cengagebrain.com. Already Have an Account? Don’t Already Have an Account? 1) Click “Create an Account.” 1) Log in. a. If you have an access code from your bookstore, submit it in the “Have another Product to Register?” box. a. If you have purchased an access code, submit it and follow the prompts until you reach the "My Home" page. b. If you have not purchased an access code, in the “Have Another Product to Register?” textbox, submit the Course Key shown in green above. b. If you have not purchased an access code, submit the Course Key shown in green above, and then follow the prompts until you reach the "My Home" page. i. ii. If "grace period" days remain for the course, you will see an Open button that gives you access to the course. If "grace period" days do not remain for the course, you will see an invitation to purchase the product that will give you access to the course. i. ii. If "grace period" days remain for the course, you will see an Open button that gives you access to the course. If "grace period" days do not remain for the course, you will see an invitation to purchase the product that will give you access to the course. Once you have the product on your “My Home” page, click the “Open” button for CengageNOW. If you did not already enter your access code, you will notice an ORANGE reminder of when your payment is due. 9