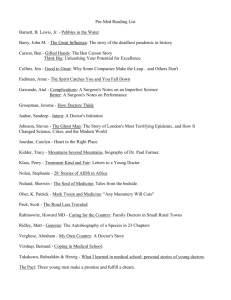

I. H L II. I

advertisement