AGENCY Agency involves an actor (“Agent”) doing something while working for... - 3

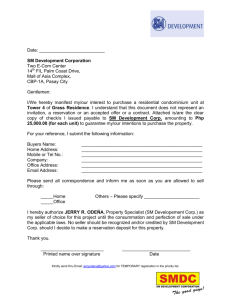

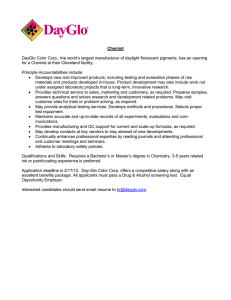

advertisement