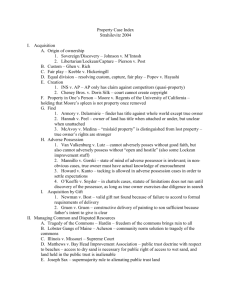

Property Course Outline

advertisement