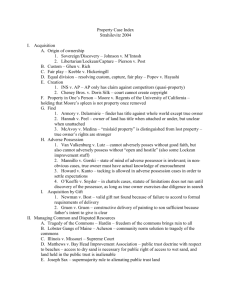

Part I – Acquiring Property Property Theory (Not separate Syllabus Section)

advertisement