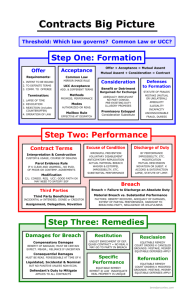

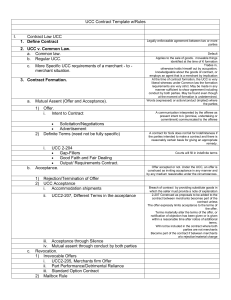

A. Contracts defined Introduction to Contract Law

advertisement