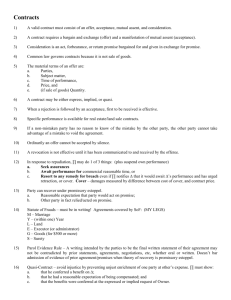

CONTRACTS – PROF. GILLETTE – FALL 2004 I I.

advertisement