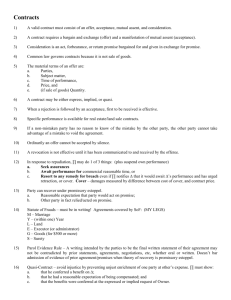

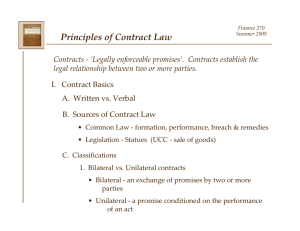

Contracts Outline: Fall 2003 Remedies

advertisement