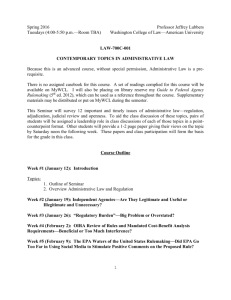

Spring 2007

advertisement