The following 2012 information is available for the Desreumaux Company: Sales 9,000

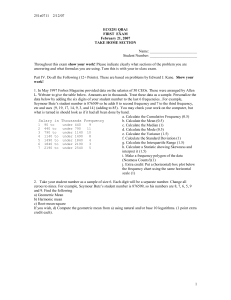

advertisement

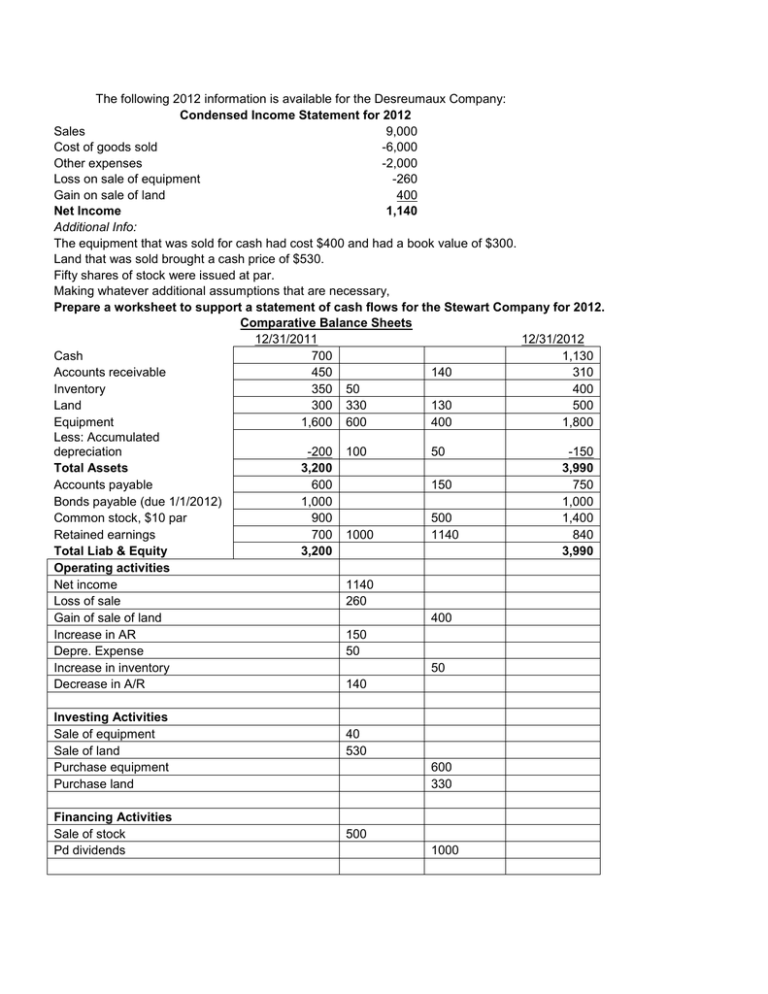

The following 2012 information is available for the Desreumaux Company: Condensed Income Statement for 2012 Sales 9,000 Cost of goods sold -6,000 Other expenses -2,000 Loss on sale of equipment -260 Gain on sale of land 400 Net Income 1,140 Additional Info: The equipment that was sold for cash had cost $400 and had a book value of $300. Land that was sold brought a cash price of $530. Fifty shares of stock were issued at par. Making whatever additional assumptions that are necessary, Prepare a worksheet to support a statement of cash flows for the Stewart Company for 2012. Comparative Balance Sheets 12/31/2011 12/31/2012 Cash 700 1,130 Accounts receivable 450 140 310 Inventory 350 50 400 Land 300 330 130 500 Equipment 1,600 600 400 1,800 Less: Accumulated depreciation -200 100 50 -150 Total Assets 3,200 3,990 Accounts payable 600 150 750 Bonds payable (due 1/1/2012) 1,000 1,000 Common stock, $10 par 900 500 1,400 Retained earnings 700 1000 1140 840 Total Liab & Equity 3,200 3,990 Operating activities Net income 1140 Loss of sale 260 Gain of sale of land 400 Increase in AR 150 Depre. Expense 50 Increase in inventory 50 Decrease in A/R 140 Investing Activities Sale of equipment Sale of land Purchase equipment Purchase land Financing Activities Sale of stock Pd dividends 40 530 600 330 500 1000