Lesson X

advertisement

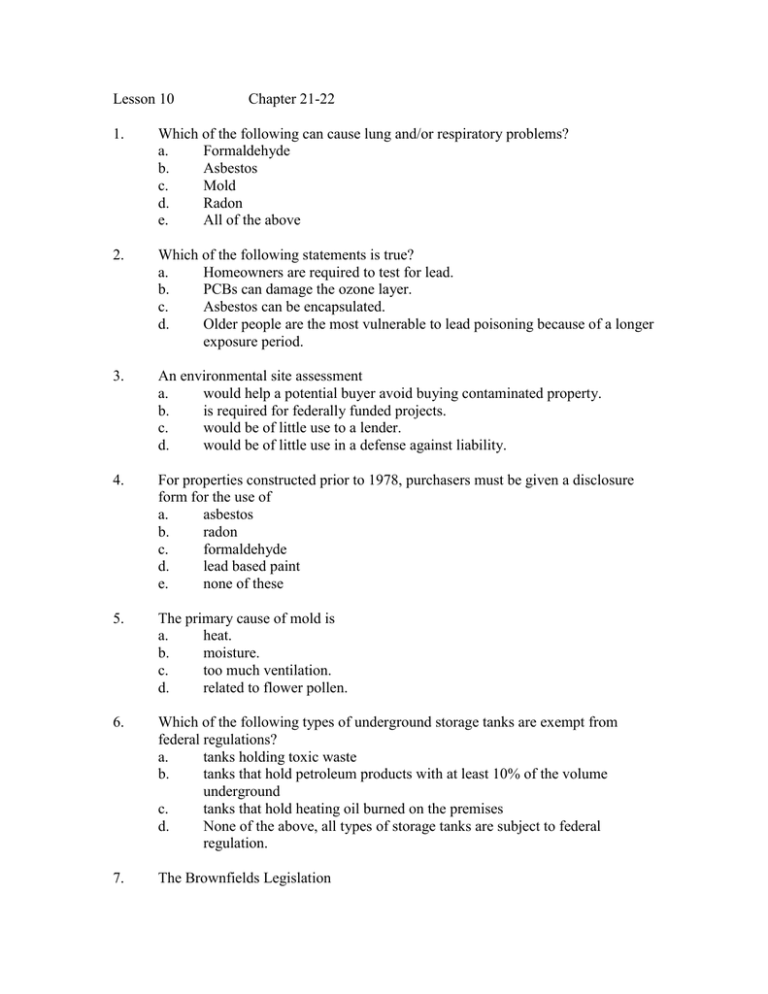

Lesson 10 Chapter 21-22 1. Which of the following can cause lung and/or respiratory problems? a. Formaldehyde b. Asbestos c. Mold d. Radon e. All of the above 2. Which of the following statements is true? a. Homeowners are required to test for lead. b. PCBs can damage the ozone layer. c. Asbestos can be encapsulated. d. Older people are the most vulnerable to lead poisoning because of a longer exposure period. 3. An environmental site assessment a. would help a potential buyer avoid buying contaminated property. b. is required for federally funded projects. c. would be of little use to a lender. d. would be of little use in a defense against liability. 4. For properties constructed prior to 1978, purchasers must be given a disclosure form for the use of a. asbestos b. radon c. formaldehyde d. lead based paint e. none of these 5. The primary cause of mold is a. heat. b. moisture. c. too much ventilation. d. related to flower pollen. 6. Which of the following types of underground storage tanks are exempt from federal regulations? a. tanks holding toxic waste b. tanks that hold petroleum products with at least 10% of the volume underground c. tanks that hold heating oil burned on the premises d. None of the above, all types of storage tanks are subject to federal regulation. 7. The Brownfields Legislation a. b. c. d. 8. An inspection of the property by the buyer shortly before closing that ensures that necessary repairs have been made and all fixtures are in place is known as a (n) a. b. c. d. e. 9. passing papers face to face closing closing in escrow all of these none of these Closing in escrow may be done by a. b. c. d. e. 12. sales contract survey appraisal RESPA Uniform Settlement Statement Closing is known by many names, including a. b. c. d. e. 11. appraisal survey walk-through open house none of these This gives information about the exact location and size of the property a. b. c. d. 10. makes developers responsible for existing site pollution. requires states to pay developers up to $250 million a year for five years to clean up polluted industrial sites. was passed to create tombs to store toxic waste. encourages the clean-up and development of abandoned industrial sites. the seller’s broker the buyer’s broker a title or trust company a or b all of these Assume a sale is to be closed September 15. Current real estate taxes are to be prorated. How much will the buyer be debited for this unpaid bill? a. b. c. d. e. $856.66 $854.88 a or b depending on the method used none of these amounts are correct none of these, the buyer should receive a credit 13. A property tax levied for a specific purpose such as paving a road or buying a water main is known as a. b. c. d. 14. Debits to the buyer usually include a. b. c. d. e. 15. a special assessment a lien a Cba none of these tenant’s security deposit buyer’s earnest money unpaid utility bills selling price of property a, b, & c Debits to the seller usually include a. b. c. d. e. tenant’s security deposit buyer’s earnest money unpaid utility bills selling price of property a and c 16. Carbon monoxide is a. easy to detect. b. a result of incomplete combustion. c. quickly absorbed in the body. d. a natural result of combustion. 17. Capping is a method of a. piling waste into a hill at surface level and covering with clay. b. compacting waste and sealing it in a container. c. laying soil over the surface of a landfill and planting vegetation. d. burying waste and covering with soil. 18. Urea formaldehyde is found in residential properties in a. lead-based paints. b. insulating foam. c. home appliances. d. electromagnetic fields. 19. All of the following are true about underground water contamination EXCEPT a. It is a minor problem in the United States. b. c. d. Any contamination of underground water can threaten the supply of pure, clean water from private wells and from public water systems. Protective state and federal laws concerning water supply have been enacted. Real estate licenses need to be aware of potential contamination sources. 20. Contamination from underground storage tanks is a. found only in petroleum stations. b. addressed by EPA regulations. c. only caused by tanks currently in use. d. easily detected and eliminated. 21. In a closing statement, a prepaid item is a(n) a. item paid in advance by the buyer. b. item that is prepaid by the seller. c. accurate expense. d. a charge to the seller. 22. The Real Estate Procedures Act (RESPA) applies to the activities of a. licensed real estate brokers when selling commercial and industrial properties. b. licensed securities salespersons when selling limited partnership interests. c. lenders financing the purchase of residential properties. d. Fannie Mae and Freddie Mac when purchasing residential mortgages. Use the following to answer 23-24. Purchase price: $125,000 cash Earnest money: $1,000 Commission rate: 7 percent Revenue stamps to be paid by seller: $125 Real estate taxes: $1,600 paid in full for the current year Title insurance policy to be paid by seller: $250 Deed recording fee: $20 Escrow fee: $350 Existing mortgage loan balance: $29,450 including credit for the reserve account Closing date: July 31st Prorate using a 30-day month and a 360-day year. Prorate the taxes as of the close of escrow. Split the escrow fee 50-50 between the parties. 23. What amount is the seller debited for the broker’s commission? a. $1,785 b. $8,088 c. $8,750 d. 24. $1,680 What are the seller’s proceeds from the sale? a. $86,395.83 b. $86,916.67 c. $95,550 d. $85, 833.34 Use the following to answer 25. Purchase price: $278,000 cash Earnest money: $5,000 Commission rate: 7 percent split 50-50 between two brokers Appraisal fee: $350 Existing mortgage loan balance: $113,576.82 Title insurance policy to be paid by the seller: $550 Attorney fee: $450 Deed recording fee: $25 Termite and wood infestation report to be paid by seller: $200 Real estate taxes: $1,950 paid in full through December 31st Closing date: August 31st Prorate using the actual number of days in the month and the year. Split the closing fee 50-50 between the parties. 25. What is the balance due from the purchaser at closing? a. $274,476.78 b. $274, 251.78 c. $279, 251.78 d. $274, 063.11 26. Which of the following describes the process of creating a landfill site? a. Waste is liquefied, treated and pumped through pipes to tombs under the water table. b. Waste and topsoil are layered in a pit, mounded up, and then covered with dirt and plants. c. Waste is compacted and sealed into a container, then placed in a tomb designed to last several thousand years. d. Waste is buried in an underground vault. 27. Radon poses the greatest potential health risk to humans when it is a. contained in insulation material used in residential properties during the 1970s. b. found in high concentrations in unimproved land. c. trapped and concentrates in inadequately ventilated areas. d. emitted by malfunctioning or inadequately ventilated appliances. 28. What do UFFI, lead-based paint and asbestos have in common? a. They all pose a risk to humans because they emit harmful gases. b. They were all banned in 1978. c. All three were used in insulating materials. d. They were all used at one time in residential construction. 29. Under the federal Lead-Based Paint Hazard Reduction Act, which of the following statements is true? a. All residential housing built prior to 1978 must be tested for the presence of lead-based paint before being listed for sale or rent. b. A disclosure statement must be attached to all sales contracts and leases involving residential properties built prior to 1978. c. A lead hazard pamphlet must be distributed to all prospective buyers, but not tenants. d. Purchasers of housing built before 1978 must be given five days to test the property for the presence of lead-based paint. 30. Which of the following is true of asbestos? a. The removal of asbestos can cause further contamination of a building. b. Asbestos causes health problems only when it is eaten. c. The level of asbestos in a building is affected by weather conditions. d. HUD requires that all asbestos-containing materials be removed from all residential buildings. 31. Liability under the Superfund is a. limited to the owner of record. b. joint and several and retroactive, but not strict. c. voluntary. d. strict, joint and several, and retroactive. 32. At the closing of a real estate transaction, the person performing the settlement gave the buyer a credit for certain accrued items. These items were a. bills relating to the property that have already been paid by the seller. b. bills relating to the property that will have to be paid by the buyer. c. all of the seller’s real estate bills. d. all of the buyer’s real estate bills. 33. Which of the following statements is true of a computerized loan origination (CLO) system? a. The mortgage broker or lender may pay any fee charged by the real estate broker in whose office the CLO terminal is located. b. Consumers must be informed of the availability of other lenders-those not shown in the real estate broker’s CLO. c. The real estate broker in whose office the CLO terminal is located may charge a fee of up to two points for the use of the system. d. The fee charged by the real estate broker for using the CLO terminal may not be financed as part of the loan. 34. Legal title always passes from seller to buyer a. on the date of the execution of the deed. b. when the closing statement has been signed. c. when the deed is placed in escrow. d. when the deed is delivered and accepted. 35. The earnest money left on deposit with a broker is a a. credit to the seller. b. credit to the buyer. c. balancing factor. d. debit to the buyer. 36. Which of the following would a lender generally require at the closing? a. Title insurance commitment b. Market value appraisal c. Application d. Credit report 37. A mortgage reduction certificate is executed by a(n) a. abstract company. b. attorney. c. lending institution. d. grantor. 38. Which of the following statements is true of real estate closings in most states? a. Closings are generally conducted by real estate salespersons. b. The buyer usually receives the rents for the day of closing. c. The buyer must reimburse the seller for any title evidence provided by the seller. d. The seller usually pays the expenses for the day of closing. 39. All encumbrances and liens shown on the report of title other than those waived or agreed to by the purchaser and listed in the contract must be removed so that the title can be delivered free and clear. The removal of such encumbrances is usually the duty of the a. buyer. b. seller. c. broker. d. title company. 40. The RESPA Uniform Settlement Statement must be used to illustrate all settlement charges for a. b. c. d. every real estate transaction. transactions financed by VA and FHA loans. residential transaction financed by federally related mortgage loans. all transactions involving commercial property. Essay questions are for your convenience to prepare for the midterm and final. You do not have to turn them in for a grade. 1. Discuss the issue of liability under the Comprehensive Environmental Response, Compensation, and Liability Act and the Superfund Amendments and Reauthorization Act. 2. List and explain the disclosure requirements at the time of loan application and loan closing. 3. Several items are split between the buyer and seller in a prorated manner. List and describe several items that are and are not prorated. 4. List and describe what items you would expect to find in a closing statement.