TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition

advertisement

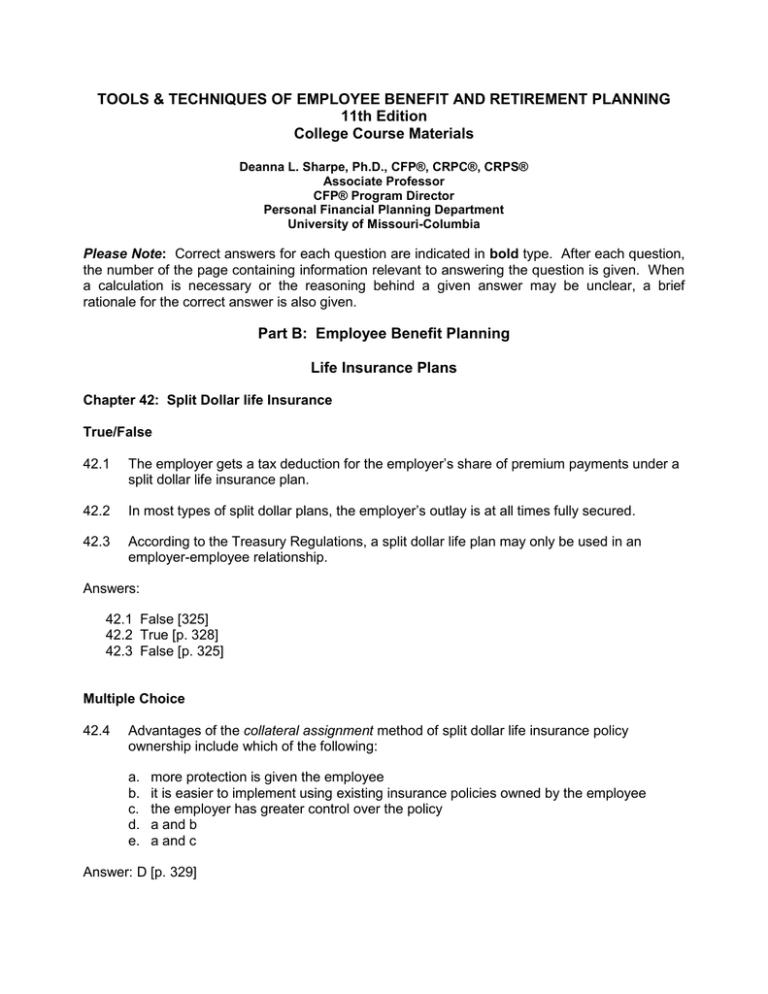

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part B: Employee Benefit Planning Life Insurance Plans Chapter 42: Split Dollar life Insurance True/False 42.1 The employer gets a tax deduction for the employer’s share of premium payments under a split dollar life insurance plan. 42.2 In most types of split dollar plans, the employer’s outlay is at all times fully secured. 42.3 According to the Treasury Regulations, a split dollar life plan may only be used in an employer-employee relationship. Answers: 42.1 False [325] 42.2 True [p. 328] 42.3 False [p. 325] Multiple Choice 42.4 Advantages of the collateral assignment method of split dollar life insurance policy ownership include which of the following: a. b. c. d. e. more protection is given the employee it is easier to implement using existing insurance policies owned by the employee the employer has greater control over the policy a and b a and c Answer: D [p. 329] 42.5 All of the following are disadvantages of split dollar life insurance except: a. b. c. d. e. the plan must remain in effect over 10 years to maximize plan benefits the employer must pay tax on the current cost of the life insurance new tax law makes use of split dollar life insurance unfavorable a and b a and c Answer: E [p. 326] 42.6 A split dollar arrangement between employer and employee can split which of the following? a. b. c. d. e. premium cost cash value policy ownership all of the above only b and c Answer: D [pp. 326, 328 Application 42. 7 Templeton Resorts established a split-dollar life insurance plan with Terrance Everton, an executive with the corporation. The disadvantages of this type of plan for Templeton Resorts include all but which of the following: a. Templeton Resorts receives no tax deduction for its share of premium payments for the split-dollar life insurance plan b. relatively few types of split dollar designs are possible, making it difficult to customize the plan to meet Templeton Resorts’ specific needs c. the plan must remain in effect for one or two decades before plan benefits are maximized d. if Terrance terminates employment with Templeton in the early years of the contract, Templeton may lose money on the premium outlay e. new tax regulations have eliminated some former benefits of split dollar life insurance plans Answer: B [p. 326] 42.8 Arlington Textiles, Inc. wants to establish a split dollar life plan for each of four top executives in the company. Arlington Textiles wants to reduce the employee’s out-ofpocket cost for the arrangement and to ‘zero out’ the executive’s’ income tax cost for the plan. Arlington Textiles should use a ______ for the premium cost split: a. employer pay all plan b. level premium plan c. classic split dollar plan with a bonus for each executive equal to employee’s payment under the split dollar plan d. standard split dollar plan e. offset plan with a bonus for each executive equal to employee’s payment under the split dollar plan Answer: E [pp. 326, 329] 42.9 Halifax Publishing, Inc. used the endorsement method to arrange policy ownership for the three split dollar life plans established for the company executives. The advantages of this arrangement for Halifax Publishing include all but which of the following: a. b. c. d. Halifax Publishing has greater control over the policy Halifax Publishing receives a tax deduction for its share of the premium payments this type of plan is simple for Halifax Publishing to install and administer Halifax could use an existing key employee policy on the employees rather than having to issue a new policy e. Halifax Publishing can avoid unfavorable consequences of having an arrangement deemed a loan under current regulations Answer: B [pp. 328-329] 42.10 Octagon Construction initiated a split dollar plan for O. B. Tuse by transferring an existing corporate-owned key employee policy to a third party beneficiary. If O. B. Tuse dies a. the policy will be deemed as ‘transferred for value’ b. the tax free nature of death benefits from the plan for Ocatgon Construction are lost c. the tax free nature of the death benefits from the plan for O. B. Tuse’s beneficiaries is lost d. all of the above e. only b and c Answer: D [pp. 329-330]