Chapter 52 “F ” B

advertisement

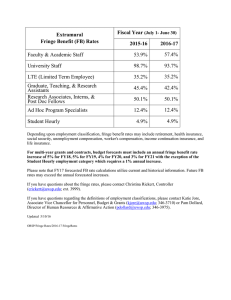

Chapter 52 “FRINGE” BENEFITS (SECTION 132) LEARNING OBJECTIVES: Have a basic understanding of employee fringe benefits REVIEW: This chapter discusses the following employee fringe benefits: employee discounts; no-additional-cost services; company cafeterias and meal plans; qualified transportation; qualified retirement planning services; gyms and athletic facilities; working condition fringes; and de minimis fringes. Advantages, tax implications, and benefits are covered. The chapter ends with a definition of highly compensated employees in respect to fringe benefits. CHAPTER OUTLINE: I. What Are They? II. Employee Discounts A. Advantages B. Tax Implications III. No-Additional-Cost Services A. Advantages B. Tax Implications IV. Company Cafeterias And Meal Plans V. Qualified Transportation A. Advantages B. Benefits VI. Qualified Retirement Planning Services VII. Gyms and Athletic Facilities VIII. Working Condition Fringes IX. De Minimis Fringes X. Definition of Highly Compensated XI. Chapter Endnotes 1 Chapter 52 FEATURED TOPICS: Employee fringe benefits FIGURES: Figure 52.1 IRS De Minimis Guidelines CFP® CERTIFICATION EXAMINATION TOPIC: Topic 30: Other employee benefits B. Fringe benefits COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Have a basic understanding of employee fringe benefits DISCUSSION: 1. Discuss advantages, tax implications, and benefits of employee fringe benefits. 2. Discuss qualification as a de minimis fringe benefit. KEY WORDS: Fringe benefits (Internal Revenue Code Section 132) Employee discounts No-additional-cost services Company cafeterias Meal plans Qualified transportation Chapter 52 Qualified retirement planning services Gyms and athletic facilities Working condition fringes De minimis fringes Commuter highway vehicle Transit pass Parking QUESTIONS: 1. Which of the following meal-related benefits do not result in extra taxable income to employees? (1) meals furnished to employees working away from home (2) IRC Section 119 “on-premises” plan (3) IRC Section 132(e)(2) “on-or-near” plan (4) meals for the convenience of the employee a. b. c. d. (1) and (2) only (1), (2), and (3) only (2), (3), and (4) only (1), (2), (3), and (4) Chapter 52, pp. 390, 391 2. Which of the following benefits may be provided as a qualified transportation fringe benefit? (1) daily use of a company car for commuting purposes (2) transportation in a commuter highway vehicle (3) a transit pass (4) qualified parking a. b. c. d. (1) and (3) only (2) and (4) only (1), (2), and (3) only (2), (3), and (4) only Chapter 52, pp. 391, 392 Chapter 52 3. Which one of the following is required for an athletic facility to be available to employees on a tax-free basis? a. b. c. d. facility is located on the premises of the employer use by employees and non-employees is about evenly divided the facility is operated by a third party only non-highly compensated employees may use the facility Chapter 52, pp. 392, 393 4. Which of the following would not be considered taxable as a de minimis fringe benefit? (1) commuting use of company car for three days each month (2) occasional typing of personal letters by company secretary (3) occasional use of copying machine (4) local telephone calls a. b. c. d. (1) and (3) only (1), (2), and (3) only (2), (3), and (4) only (1), (2), (3), and (4) Chapter 52, p. 393 ANSWERS: 1. b 2. d 3. a 4. c