Presentation (582 KB )

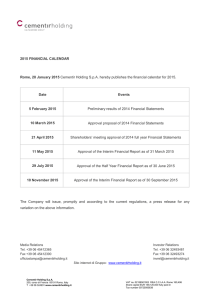

advertisement

Università degli Studi di Torino Whence Policy? Government Policies, Finance, and Economic Integration Giuseppe Bertola ; Anna Lo Prete Università di Torino and CEPR; Università di Torino TRENDS 1980s – early 2000s : MORE Economic integration MORE Finance LESS Government policies …aftermath of 2008-09 crisis ? Panel OECD, 1980-2007, 5-year averages of standard country-level data: FINANCE and OPENNESS Financial Development Openness ? 200 0 100 -50 50 0 -100 150 200 -40 -20 Levels 100 Openness 0 Openness -50 100 Openness Deviations from country means -100 50 100 0 50 100 Deviations from country means Financial Development Financial Development 150 0 100 150 50 200 100 Levels 0 (Rajan Zingales,2003) (Do Levchenko,2007) (Beck,2002) 50 Financial Development Financial Development 200 Levels 20 Deviations from country means 0 20 Openness 5 10 Financial Structure 0 5 10 Financial Structure -40 -20 40 20 -10 -5 0 Financial Structure 5 10 -100 15 0 -100 -50 50 0 100 Deviations from country means -50 0 200 50 150 Financial Development Financial Development 150 100 0 150 50 200 100 Levels 50 (Tressel Detragiache, 2008) 50 0 Financial Development Financial Development Financial Development Financial Structure ? 0 40 15 20 -10 -5 0 Financial Structure 5 10 GOVERNMENT POLICIES and OPENNESS Openness Government Size ? Deviations from country means 100 Openness 2 4 -2 2 -4 200 5 50 100 Openness 150 -20 0 Openness 20 40 Deviations from country means 200 -40 -20 0 Openness 20 40 5 Social Policy 0 10 Deviations from country means 50 100 Openness 150 5 -5 0 Social Policy 0 200 -40 -20 -40 -20 0 Openness 20 40 0 -5 10 020 10 30 20 40 Levels Social Policy (Agell, 2002) Social Policy 30 0 -40 10-4 Levels Openness Social Policy ? 40 0 Government Size 150 0 50 -2 0 Deviations from country means Government Size 15 5 20 10 25 Levels 15 Government Size (Rodrik,1997) (Sinn,2003) (Bertola Lo Prete,2008) 10 Government Size 20 25 4 Levels (Rodrik,1998) 0 50 100 Openness 150 200 0 Openness 20 40 FINANCE and GOVERNMENT POLICIES Financial Development Government Size ? 50 100 0 0 -50 50 -100 15 Government Size 20 Levels 15 Government Size 20 25 -4 -2 2 4 0 10 20 Social Policy Deviations from country means 2 -2 0 Government Size 4 50 100 -4 -100 0 -50 50 0 100 Deviations from country means 30 40 -5 0 5 10 Social Policy -100 50 0 100 Levels 25 -50 150 100200 150 50 10 0 Financial Development Financial Development 200 5 Financial Development Financial Development Financial Development Social Policy ? Substitution/ complement? 0 Government Size -100 10 Deviations from country means -50 100200 150 50 100 0 5 Financial Development Financial Development 150 100 Deviations from country means 0 Substitution (Bertola Koeniger, 2007) Levels 50 Financial Development Financial Development 200 Levels 0 10 20 Social Policy 30 40 -5 0 5 Social Policy 10 t A SIMPLE MODEL Two periods/contingencies: perfect financial markets? full smoothing: cH = cL = yL + yH /2 financial transaction unit cost μ? Constraint: Max log utility: t Financial market yields welfare Can be improved by (costly) redistribution τ: max With set Government redistribution: less needed if smaller μ, more costly if larger λ (deadweight loss). t yields welfare Decreasing in λ, and also in μ as long as positive finance, i.e. If lowering λ and μ is possible but costly (lower output if close the economy, more instability if spur finance?) do it, depending on shape of costs and benefits. THEORETICAL MECHANISMS Openness, larger mean of market incomes perhaps larger dispersion less effective national government policies: larger deadweight losses Financial market liberalization: smaller transaction costs More private finance Less government What drives related changes? Financial market development’s policy roots: Financial structure Openness Government size Social policy Country specific choices, Shaped by exogenous conditions WHENCE POLICIES? international trade opportunities differ across countries/over time: Country characteristics… Natural Openness (i) …global trends Global Trade (t) Legal Origin (l) “Globalization”(it) Globalization by legal origin (l) GLOBALIZATION and OPENNESS by Legal Origin English German Scandinavian 17.67634 107.0593 25.95957 175.2211 French 219.2012 2323.224 730.1363 1958.635 Globalization Graphs by legor Potentially useful instruments GLOBALIZATION and FINANCIAL STRUCTURE by Legal Origin English German Scandinavian 7.5 20 2.8 21.15115 French 219.2012 2323.224 730.1363 1958.635 Globalization Graphs by legor Potentially useful instruments: correlated with policies, GLOBALIZATION and GOVERNMENT SIZE by Legal Origin English German Scandinavian 6.363288 15.20475 11.33991 18.67999 French 219.2012 2323.224 730.1363 1958.635 Globalization Graphs by legor Potentially useful instruments differently correlated with different policies, GLOBALIZATION and SOCIAL POLICY by Legal Origin English German Scandinavian 11.22097 27.19834 1.901056 32.33488 French 219.2012 730.1363 2323.224 1958.635 Globalization Graphs by legor Potentially useful instruments along with main effects (can’t show). Potentially useful instruments. Financial Development, Determinants of policies: = Legal Origin (l) Globalization (it) Global Trade (t) Natural Openness(i) Globalization*Legal Origin (lit) Not the most important! but: exogenous. Table 3. OLS regressions -1.30 -3.263 -3.29 -5.000 -4.93 50 -0.59 0 -1.01 -50 -0.146 -100 -0.059 -20 -4 -2 0 Openness 20 40 0 2 Government Size 4 132 0.298 132 0.303 132 0.367 132 0.414 -10 -5 0 Financial Structure -5 0 5 Social Policy 5 50 0 -50 50 0 -100 1.991 3.16 -50 Social Policy -100 Government Size Financial Development 100 -40 100 -0.106 Financial Development 100 3.878 5.30 50 4.965 7.75 0 5.445 7.99 -50 5.227 8.13 insignificant 4 -100 3 Openness Observations R2 Financial Development 2 Financial Development Financial Structure 1 100 with country dummies Dependent Variable: Financial Development 10 Table 4. IV regressions Dependent Variable: Financial Development 1 2 Endogenous: Financial Structure 7.092 7.598 5.98 5.36 Openness -0.097 -0.79 Government Size 3 4 5 6 7 8 8.643 4.81 -0.122 -0.91 3.738 0.94 10.393 4.35 0.041 0.18 6.776 1.38 -2.599 -1.02 7.643 7.10 8.349 7.31 -0.182 -1.49 7.364 6.68 -0.127 -1.08 -3.264 -2.75 5.936 5.03 -0.334 -2.18 -5.795 -4.98 2.982 3.12 Social Policy Exogenous: English Common Law German Commercial Code Scandinavian Commercial Code Statistics: Over-identifying restrictions a Similar to OLS but larger and statistically different 9.609 1.20 45.288 5.10 1.690 0.17 7.305 0.81 43.796 4.78 1.221 0.12 8.019 0.83 55.347 3.11 -19.060 -0.75 3.239 0.26 70.499 2.85 -14.950 -0.59 3.435 (0.633) 2.429 (0.657) 1.214 (0.750) 0.386 (0.824) 18.549 (0.017) 17.088 (0.017) 14.546 (0.024) 6.452 (0.265) Specification test b 6.966 (0.008) 9.041 (0.011) 9.638 (0.022) 10.493 (0.033) 14.394 (0.000) 14.902 (0.001) 13.827 (0.003) 14.039 (0.007) Relevance of the instruments c Observations 18.261 13.958 3.960 6.232 12.993 10.840 9.088 16.824 132 132 132 132 132 132 132 132 Table A.1. ROBUSTNESS Dependent Variable: Financial Development Different Sets of Instrumental Variables Endogenous: Financial Structure Openness Government Size Social Policy Statistics: Over-identifying restrictions a Specification test b Relevance of the instruments c Observations Different exogenous time-varying trends Different dependent variable Add per capita GDP Add dummy for Advanced countries Country dummies instead of Legal Origin indicators 6.121 5.22 -0.372 -2.69 -6.112 -5.10 3.308 3.68 5.872 4.88 -0.356 -2.86 -6.007 -5.08 3.235 4.45 6.950 6.24 -0.218 -2.02 -4.345 -4.12 1.659 2.28 3.079 3.51 -0.388 -2.48 -6.608 -5.43 3.993 4.06 5.044 4.57 -0.279 -1.72 -6.328 -4.85 2.616 2.56 7.864 5.55 -0.356 -2.90 -2.810 -0.95 2.588 1.55 6.479 (0.372) 26.129 (0.000) 9.780 6.580 (0.361) 29.986 (0.000) 8.742 49.797 (0.001) 4.132 (0.388) 5.955 15.132 (0.010) 6.852 (0.144) 10.738 8.549 (0.128) 10.583 (0.032) 14.676 4.348 (0.500) 28.593 (0.000) 16.824 132 132 132 132 132 132 Shipment Costs World Trade Volume Stock Market Capitalization Structural policy determinants of Financial Development: Financial Structure Negative (small), Openness 5.936 5.03 -0.334 Govt. Size -2.18 -5.795 Social Policy -4.98 2.982 3.12 Indirect effects through other policies. Structural estimates, What if an instrument changes? 10 p.p. decline of Global Trade (…after crisis?) Predicted change in Countries Financial Structure Openness Government Size Social Policy Financial Portugal (French) -3.36 -10.68 0.70 -1.97 -26.32 United Kingdom -3.12 -11.06 0.97 -1.32 -24.43 -3.05 -9.21 1.15 -1.68 -26.75 -3.02 -7.09 1.86 -0.04 -26.45 (Legal Origin) Develop. (English) Germany (German) Finland (Scandinavian) Causes and effects of policies We use exogenous “Globalization” to identify roots of Financial Development in policies. • Can assess implications of any possible change in policy for Financial Development …instability, fragility… • Future work: welfare (growth, distribution, …)