Energy Risk Management Considerations

advertisement

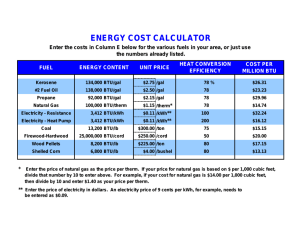

ENERGY RISK MANAGEMENT CONSIDERATIONS John Robinson Texas Cooperative Extension Context of higher energy prices Hearings & calls for government policy intervention On-farm risk mgmt. steps Evaluate the risk exposure Identify alternative strategies including hedging possibilities Evaluate the cost of each alternative (i.e., is it a good insurance buy?) Identify public & private resources to implement alternatives Available Public Resources Extension crop budgets, energy crop profiles, and detailed machinery analysis, e.g, U. Florida series, http://www.agen.ufl.edu/~fees/pubs/agcrop.html Purdue publication analyzing tillage systems http://www.agcom.purdue.edu/AgCom/Pubs/NCR/NCR-202.html Extension info. on energy saving tips, bmp’s, and new technology USDA-ERS & OCE analysis of energy fundamentals/Ag impacts Help Producers Size Up Their Situation: Energy Inventory Source: Florida Energy Extension Service: http://www.agen.ufl.edu/~fees/pubs/agcrop.html Evaluate Risk Exposure: Total Energy Use in Btu’s Do an inventory of total energy use with a Btu Conversion Chart Gasoline Diesel fuel LP gas Nat. gas Electricity Nitrogen Phosphate Potash Pesticides 125,000 Btu’s/gal 138,690 Btu’s/gal 98,300 Btu’s/gal 1,030 Btu’s/ft3 3,413 Btu’s/kwh 55.21M Btu’s/ton 12.34M Btu’s/ton 10.43M Btu’s/ton 215.41M Btu’s/ton Source: ERS Evaluate Risk Exposure: Input Energy Use in DFE’s Urea, solid 28% N liquid NH4NO3, solid NH4NO3, sol’n Anh. Ammonia 0.233 0.229 0.248 0.225 0.177 gal/lb gal/lb gal/lb gal/lb gal/lb Total N for typical corn 26.6 gal DFE/ac Machinery fuel (conv. til.) 5.0 gal DFE/ac Machinery fuel (no. til.) 1.8 gal DFE/ac Herbicides (conv. til.) 1.7 gal DFE/ac Herbicides (no. til.) 2.9 gal DFE/ac Source: http://www.agcom.purdue.edu/AgCom/Pubs/NCR/NCR-202.html Evaluating Risk Exposure: Sensitivity Analysis Repfarm analysis of higher natural gas prices and crop prices on irrigated farms: “Effects of Energy and commodity Prices on Irrigation in the Kansas High Plains (SRP611) http://www.oznet.ksu.edu/ library/engy2/samplers/srp611.htm Agric. Energy Risk Management Alternatives Technology Approaches Reduced Tillage Proper equipment selection, R&M Substitution away from crops with higher nitrogen requirements Purchase and storage of fuel Forward contracting and/or hedging input costs with energy futures/options Available Private Resources for Contracting Alternatives Trading consultants and brokers Energy hedging consultants NYMEX exchange information Agricultural Cooperatives Theory & Practice of Agric. Energy Hedging Correlation of fuel and fertilizer prices with NYMEX futures Natural Gas (very actively traded) Also a proxy for anhydrous ammonia Home Heating Oil (for diesel fuel) Propane Whole new set of fundamentals and seasonality considerations Scale Considerations Contract Information NYMEX Natural Gas Futures: 10,000 million Btu’s Oct. ‘01 Futures: $2.103/mmBtu At-the-money call: $0.080/mmBtu, or about $800 premium for one contract NYMEX No. 2 Fuel Oil One Futures Contract: 42,000 gallons Oct. ‘01 Futures: $0.7087/gal At-the-money call: $0.024/gal, or $1,008 premium for one contract On-Farm Energy Hedging Considerations What is the impact of a 2X or 3X or 4X rise in natural gas or diesel price? Is the impact of this risk significant relative to other risks that need managing? Is hedging nat. gas or heating oil futures realistic in terms of type and scale of the enterprise? Is it feasible in terms of correlation between futures and farm-gate energy prices? What to hedging alternatives cost? Are they a good insurance buy? Example: Diesel Fuel for Delta Cotton Operation Typical Delta operation with conv. tillage uses 18.3 gallons of diesel per acre, or over $20 per acre. Need 2,300 acres to match the size of one No. 2 heating oil contract An Oct. ‘01 at-the-money call on NYMEX No. 2 Heating Oil futures costs about $0.44 per acre Questions: How well does this contract track on-farm fuel prices, and what basis are we facing? Example: Hedging Nitrogen costs Typical Delta operation uses 400 lbs of N32 per acre, or $37 per acre. Need 2,300 acres to match the size of one No. 2 heating oil contract An Oct. ‘01 at-the-money call on NYMEX No. 2 Heating Oil futures costs about $0.44 per acre Questions: How well does this contract track on-farm prices, and what basis are we facing?