Cotton Situation and Outlook for the 2001-02 Crop

advertisement

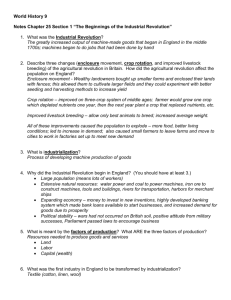

COTTON Situation and Outlook for the 2001-02 Crop Charles Curtis, Jr. Professor & Extension Economist Department of Agricultural & Applied Economics Clemson University 2001-02 Cotton Crop Highlights US plantings (all cotton) are estimated at 16.19 million acres with acreage increases in virtually every state beltwide. (Only Virginia had a slight decrease.) Harvest acres (all cotton) are estimated at 14.14 million reflecting approximately normal abandonment of acres. U. S. cotton production is estimated at just under 20 million bales with a yield of 679 pounds per acre, which makes the 2001-02 crop supplies the largest on record. Estimated carry-in (all cotton) for 2001 of 6.03 million bales is 71 percent above the 1990’s average. Mill use of cotton is projected at a weak 8.3 million bales of offtake, down significantly from the 90’s average. Export disappearance is projected a strong 9 million bales well above the 1990’s export average of 6.79 million bales. December cotton futures for the 2000 crop are below 36¢ (9/21/01) reflecting huge supplies and weaker off take. Producers will be dependent upon loan deficiency payments for income protection for the foreseeable future. Sale at harvest for LDP eligible cotton and replaced with 42¢July ’02 calls is suggested as a strong potential alternative. US Cotton Acreage, Yield and Production The USDA currently estimates that 16.19 million acres were planted to all cotton in 2001. Upland plantings were up 13 percent from 2000 plantings. This acreage increase occurred despite significantly lower prices that prevailed for the 2000 crop. This increased acreage has been attributed to the relative projected profitability of cotton with its LDP as compared to the other spring crops available for planting. All cotton production is forecast at 19.99 million 480-pound bales, up 15 percent from 2000. The yield is expected to average 679 pounds per harvested acre, up 47 pounds from last year. If realized, this would be the largest production on record. The record production is a combination of the second highest harvested acreage since 1962, coupled with above average yields throughout most of the cotton belt. Nationwide, 1 producers expect to harvest 14.14 million acres, nine percent above last year. Upland cotton accounts for 14.0 million harvested acres, over 9 percent above 2000. Upland cotton production is forecast at 19.4 million 480-pound bales, a 16 percent increase from 2000. USDA’s September 2001 upland harvested acre estimates for selected Southern Region states appear in table 1. Upland harvested acreage is projected to increased 7 percent to 14 million acres beltwide. In the Southeastern states (Alabama, Florida, Georgia, North Carolina, and South Carolina), plantings were behind average for most of the season. The weather was hot and dry while plantings were completed. Prevented plantings in the Southeast were significant with Alabama, Florida, Georgia and South Carolina most affected. For the crop that did get planted, timely beneficial rains have occurred in most areas. Area harvested in the region is expected to be up from last year in all states except Virginia. The Delta (especially Louisiana and Mississippi) is expected to have a huge harvested acreage increase. Table 2 shows the percent of a state’s cotton that was rated poor or very poor in mid-August 2001 and its comparison value in 2000. Crop condition through August 6 showed Texas with 45 percent of its acreage in very poor to poor condition. The North Carolina, Tennessee and Virginia crops are exhibiting reduced crop conditions but are compared to rather favorable conditions last year. The USDA, NASS reported that the remaining states rated most of their cotton acreage in a significantly improved condition in early August as compared to last year. Table 3 indicates the yields projected for the Southern Region states for the 2001 crop. Only North Carolina’s yield is expected to average less than the 2000 crop but will remain above 700 pounds per acre. Alabama, Florida and Mississippi are the states in which 2001 yields are expected to up by over 100 pounds from last year. US yield for all cotton is expected to average 670 pounds per harvested acre, up 38 pounds from last year. Upland yield is set at 661pounds per acre. Only Florida and Texas are expected to yield less than the nation average. Beltwide yields will be 25 pounds as compared to average yields over the last ten years. US upland cotton production is forecast at 19.410 million bales for 2001, up 16% from 2000 (Table 4). States that comprise the Southern Region increased market share of the US upland production at 74 percent of the US crop. US Cotton Supply, Use and Price Prospects USDA currently forecasts the 2001 US crop at 20 million bales. This will be the largest crop on record and results from both increased acreage and yield prospects. The 2001 crop is pegged at 15 percent higher than the 90’s average crop of 17.3 million bales. This production combined with a 6 million bale carry-in projects a U.S. supply at 25.5 million bales. This would be the largest total supply on record beating the previous record, set in 1994, by 2.8 million bales. This is a huge crop for U.S. and world mills to absorb. 2 Table 1. Upland Cotton Area Harvested, Selected States, 2000 and 2001 State 2000 2001 --- (1,000 Acres) --- Change (%) Alabama Florida Georgia Louisiana Mississippi North Carolina South Carolina Tennessee Virginia Texas 530 106 1,350 695 1,280 925 290 565 108 4,400 605 124 1,490 900 1,680 1,055 296 605 104 4,500 14.2% 17.0% 10.4% 29.5% 31.3% 14.1% 2.1% 7.1% -3.7% 2.3% Total Southern Region 10,249 11,359 10.8% Total US 12,884 14,104 9.5% Percent Southern Region 79.6% 80.5% Source: USDA, NASS, Crop Production, August 10, 2001 Table 2. Upland Cotton Crop Percent Poor or Very Poor Comparison, 2000 to 2001. State 8/7 2000 8/6 2001 Difference Alabama Florida Georgia Louisiana Mississippi North Carolina South Carolina Tennessee Texas Virginia 41% N/A 30% 20% 13% 3% 13% 2% 24% 0% 9% N/A 6% 4% 8% 4% 3% 7% 45% 5% -32% N/A -24% -16% -5% 1% -10% 5% 21% 5% US (14 States) 18% 23% 5% Source: USDA, NASS, Crop Progress, August 7, 2000, and August 6, 2001. US mill use disappearance is projected to take only 8.3 million bales of available supplies. This is well below the average for the 90’s and is much smaller than we’d grown accustom to in the mid-nineties. This is assumed to reflect three factors including flat product demand, a strong US dollar, and little incentive to buy now in a falling market. With numerous plant closings and layoffs recently, the US milling industry appears in disarray. One could expect to see the more labor-intensive activities in the textile manufacturing process to continue its move to cheaper labor markets such as Mexico. Hopefully, these overseas mills will continue to value US cotton and be a source of export demand. 3 Table 3. Upland Cotton Forecasted Yield by Selected Southern Region State, 2000 and 2001 State 2000 2001 Change (Pounds per Acre) Alabama Florida Georgia Louisiana Mississippi North Carolina South Carolina Tennessee Texas Virginia 492 480 591 629 642 742 627 603 430 738 682 650 680 693 743 701 681 643 469 743 190 170 89 64 101 -41 54 40 39 5 Total US 626 661 35 Source: USDA, NASS, Crop Production, August 6, 2001 Table 4. Upland Cotton Estimated Production by Southern Region State, 2000 and 2001. State 2000 2001 (Thousand Bales) Change (%) Alabama Florida Georgia Louisiana Mississippi N. Carolina S. Carolina Tennessee Texas Virginia 543 106 1,663 911 1,731 1,429 379 710 3,940 166 860 168 2,110 1,300 2,600 1,540 420 810 4,400 161 58% 58% 27% 43% 50% 8% 11% 14% 12% -3% Total Southern Region Total US Percent Southern Region of US 11,578 16,799 72% 14,369 19,410 74% 24% 16% Source: USDA, NASS, Crop Production, August 6, 2001 Exports are projected to be substantially higher than what has been typical for the 90’s and up significantly from 2000. On average, we’ve come to expect exports being around 6.8 million bales. The current forecast of 9 million bales reflects tighter global stocks and increased consumption. Projected export market strength has been attributed to reduced price supports and a dramatic draw down of Chinese cotton stocks as well as reduced production expected in southern hemisphere nations. Ending stocks, at 8.7 million bales, are projected and are HUGE relative to the 90’s average of 3.85 million bales. A stocks-to-use ratio of 50 percent is expected for the 2001 crop. This is well above the “desired” 30 percent or less implied in US farm policy. 4 It is fair to say that we have seen substantially lower cotton prices than we’ve typically seen at the market. (December 2001 Futures are below 36 ¢ at this writing.) If export prospects falter and we return to more typical patterns, even the huge level of stocks would be viewed as optimistic and price levels would continue to erode for this crop. With 2001 crop futures at 36 cents, one would expect that producers would be attempting to maximize loan deficiency payments for this year’s crop. Two questions I’m often asked are “How can we predict the level of loan deficiency payment (LDP) payment rates?” and “When will they be the highest?” We at Clemson began keeping records of LDP rates available in June 1999 and have been posting and archiving them on the web at: http://cherokee.agecon.clemson.edu/ldp_page.htm (Note: there is an “underscore” between the “ldp” and “page” in the above address or “ldp_page.”) From these data Table 6 was developed. Table 6 is a monthly average basis of the Adjusted World Price (AWP) minus the Nearby NYBoT Cotton Futures. This table allows a prediction of the AWP, which can then be compared, to the Loan Rate of 51.92 cents/lb to calculate a predicted LDP. For example, if one wanted a prediction of the LDP level that might prevail next January, you proceed as follows: 1. 2. 3. The Jan basis from Table 6 is –16.7 relative to the March futures. At this writing, Mar ’02 futures are at 40.85 cents so the predicted AWP would be 24.15 cents. Subtracting the predicted AWP from 51.92 Loan Rate yields a January 2002 LDP prediction of 27.77 cents per pound. Note with global stocks tight and larger U.S. stocks, the AWP and U.S. futures converged somewhat in 2001. If this continues the above prediction method would overstate the predicted LDP rate. The basis information in Table 6 should be view with a degree of caution because we have had only a short period of LDP experience. Figure 1 shows current market-based probabilities for prices out to next June. It is important to note that the prospects of prices recovering such that there is no LDP by then is effectively nil. However, prices recovering to a level so that a 42 ¢ July 2002 call moving in the money are near 45 percent. A strongly suggested strategy then would be to accept the harvest market value (30¢ and LDP 27 ¢ at ginning) and reinvest 200 to 250 points into the July ’02 call. With a 45% plus probability of gain on the option there’s a good chance of adding to the net captured 55 ¢ for 2001 cotton. Any “excess” (over payment limit) cotton should go to the loan. 5 Table 5. U.S. Cotton Supply and Utilization, 1999 through 2001 and 1991 to 2000 Averages. 1999 (99-00) Estimated 2000 (00-01) Projected 2001 (01-02) 91-00 Recent Average 2001 Percent of Average 14.87 13.42 15.52 13.05 16.19 14.14 14.37 12.97 113% 111% 607 632 679 645 104% Carry In (MBls) Production (MBls) Total Supply (MBls) 3.94 16.97 21.00 3.92 17.19 21.13 6.03 19.99 25.56 3.52 17.33 20.99 158% 115% 122% Mill Use (MBls) Exports (MBls) Total Use (MBls) 10.24 6.75 16.99 8.87 6.70 15.57 8.30 9.00 17.30 10.41 6.79 17.21 82% 133% 102% Ending Stks (MBls) Stks to Use (%) 3.92 23% 6.03 36% 8.70 50% 3.85 23% 211% 202% Price ($/Lb) 0.450 0.551 n/a 0.614 n/a Item (Units) Planted (MA) Harvested (MA) Yield (Lbs/Ac) Table 6. Monthly Average Basis of the Adjusted World Price minus the Nearby NYBoT Cotton Futures, Crop Years 1998 through 2001. Months Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Futures Contract Month Oct Oct Dec Dec Mar Mar Mar May May Jul Jul Oct 98-99 -19.56 -19.99 -21.11 -21.63 -19.28 -17.63 -17.51 -20.81 -16.26 -12.21 -11.16 -9.96 99-00 -15.13 -14.89 -19.39 -18.27 -19.31 -22.69 -17.71 -17.60 -11.33 -14.01 -9.92 -11.81 6 00-01 -15.33 -15.56 -16.21 -15.51 -12.98 -9.78 -10.71 -8.76 -7.66 -7.25 -7.07 -9.36 98 to 00 Average -16.67 -16.81 -18.90 -18.47 -17.19 -16.70 -15.31 -15.72 -11.75 -11.16 -9.39 -10.38 Figure 1. Market-based probability estimates of July 2002 futures price by June 20, 2002 as established in the market September 21, 2001. Cumulative Probability of Futures Price Occurring at Expiration Probability That Futures Price Will Be Less Than: 95.9% 92.2% 100% 86.3% 90% 77.3% 80% 65.0% 70% 60% 50.0% 50% 33.9% 40% 30% 19.2% 20% 8.5% 10%0.5% 2.6% 0% $0.25 $0.31 $0.37 $0.43 $0.49 Futures Price at Option Expiration 7 $0.55