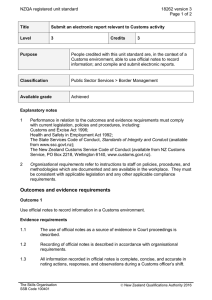

NZQA registered unit standard 18639 version 2 Page 1 of 4

advertisement

NZQA registered unit standard 18639 version 2 Page 1 of 4 Title Demonstrate knowledge and use the transaction method to value goods for Customs purposes Level 4 Purpose Credits 6 This unit standard applies to Customs officers who are required to offer a valuation opinion as part of their regular job role. Requirements of this unit standard do not extend to Customs rulings which are provided only through the Customs National Tariff Advisory Unit. People credited with this unit standard are able to: demonstrate knowledge of the valuation of goods for Customs purposes; demonstrate knowledge of the transaction value method as the primary basis for determining Customs value in accordance with the Second Schedule of the Customs and Excise Act 1996; identify and explain documentation required when using the transaction method to determine the Customs value in accordance with the Second Schedule of the Customs and Excise Act 1996; and apply the transaction method to value imported goods. Classification Public Sector Services > Customs and Excise Available grade Achieved Explanatory notes 1 Legislation, policies and procedures relevant to this unit standard include: Second Schedule of the Customs and Excise Act 1996; Customs and Excise Regulations 1996; Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994; World Trade Organisation Valuation Agreement (WTOVA); Various Publications as published by the World Customs Organisation Technical Committee on Customs Valuation including - WCO Customs Valuation Compendium - WCO Customs Valuation Control Handbook; The State Services Code of Conduct, Standards of Integrity and Conduct (available from www.ssc.govt.nz); New Zealand Customs Service Code of Conduct (available from NZ Customs Service, PO Box 2218, Wellington 6140, www.customs.govt.nz). The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA registered unit standard 2 18639 version 2 Page 2 of 4 Definitions Customs value means the Customs value of those goods determined in accordance with the Second Schedule of the Customs and Excise Act 1996. Organisational requirements refer to instructions to staff on policies, procedures, and methodologies which are documented and are available in the workplace. They must be consistent with applicable legislation and any other applicable compliance requirements. Outcomes and evidence requirements Outcome 1 Demonstrate knowledge of the valuation of goods for Customs purposes. Evidence requirements 1.1 Customs value is explained in accordance with the Customs and Excise Act 1996. 1.2 The determination of Customs value is explained in accordance with the Second Schedule of the Customs and Excise Act 1996. 1.3 Requirements of importers to specify a Customs value and to supply supporting documentation are explained in accordance with legislation. 1.4 The power of Customs to amend the Customs value on an import entry is explained in accordance with legislation. 1.5 The use of foreign currency rates in determining Customs value is explained in accordance with legislation. Outcome 2 Demonstrate knowledge of the transaction value method as the primary basis for determining Customs value in accordance with the Second Schedule of the Customs and Excise Act 1996. Evidence requirements 2.1 Transaction value is explained. 2.2 Price paid and payable is explained. 2.3 Adjustments that may be made to transaction value are described. Range additions and reductions. 2.4 The four conditions that restrict the use of the transaction value method are explained. 2.5 The application of test values to determine the acceptability of the transaction value between related parties is explained. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA registered unit standard 18639 version 2 Page 3 of 4 Outcome 3 Identify and explain documentation required when using the transaction method to determine the Customs value in accordance with the Second Schedule of the Customs and Excise Act 1996. Evidence requirements 3.1 Types of information provided by invoices accompanying goods are identified. Range 3.2 Additional documents required to support a Customs value declaration are identified and explained. Range 3.3 five types of documentation. International terms of trade (Incoterm) are explained. Range 3.4 ten types of information. free on board (FOB), costs and freight (C&F), costs insurance and freight (CIF), ex-works (EXW), deliver duty unpaid (DDU), deliver duty paid (DDP). The methods of payment for goods are identified and explained. Range six methods of payment. Outcome 4 Apply the transaction method to value imported goods. Range five valuations. Evidence requirements 4.1 Invoices relating to the goods are checked for accuracy in accordance with organisational requirements. 4.2 Payment details are checked in accordance with organisational requirements. Range amount paid, date paid, method of payment, to whom payment was made. 4.3 Shipping documents are checked in accordance with organisational requirements. 4.4 Adjustments are identified and explained where required The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA registered unit standard 18639 version 2 Page 4 of 4 Status and review information Registration date 16 July 2010 Date version published 16 July 2010 Planned review date 1 February 2015 Accreditation and Moderation Action Plan (AMAP) reference 0121 This AMAP can be accessed at http://www.nzqa.govt.nz/framework/search/index.do. Please note Providers must be granted consent to assess against standards (accredited) by NZQA, or an inter-institutional body with delegated authority for quality assurance, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are assessing against unit standards must engage with the moderation system that applies to those standards. Consent requirements and an outline of the moderation system that applies to this standard are outlined in the Accreditation and Moderation Action Plan (AMAP). The AMAP also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements. Comments on this unit standard Please contact The Skills Organisation info@skills.org.nz if you wish to suggest changes to the content of this unit standard. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016