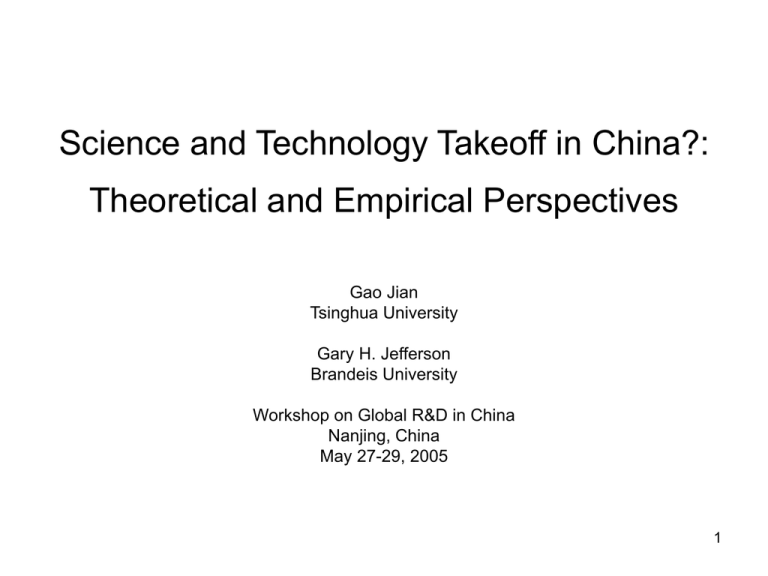

Science and Technology Takeoff in China? Historical and Theoretical Perspectives

advertisement

Science and Technology Takeoff in China?: Theoretical and Empirical Perspectives Gao Jian Tsinghua University Gary H. Jefferson Brandeis University Workshop on Global R&D in China Nanjing, China May 27-29, 2005 1 Has China begun its “Science and Technology Takeoff”? • Most large OECD nations experienced S&T takeoff in which R&D/GDP rose rapidly from < 1% to > 2%. • R&D/GDP has risen from 0.06% in 1996 to 1.3% in 2003. • This is a measure only of R&D intensity, not quality 2 Scatterplot: R&D/GDP vs. log GDP/capita 3 S&T takeoff in 10 countries (vertical axis: R&D/GDP) 4 Changes in firm-level R&D intensity, 1995-2001 Distribution of R&D/VA (r), all L&M enterprises (%) Year 1995 2001 0 79.8 70.9 % -11.1 increase (45.6) 0<r≤1 1<r≤2 2<r≤4 4<r≤6 6<r≤10 r>10 7.2 3.2 3.4 1.4 1.7 3.3 6.7 4.0 4.8 3.0 3.5 7.1 -7.5 22.8 40.8 108.0 110.8 119.1 5 What factors motivate firms to spend more on R&D, i.e. increase the ratio of R&D labor to the total workforce? 1. The demand for technology intensive intermediate inputs rises in relation to that of production labor, 2. The productivity of R&D labor rises, 3. The ability to convert the existing stock of knowledge grow into new innovations grows, 4. Subsidies to R&D labor increase. 6 #1. An increase in the share of GDP dedicated to technology-intensive intermediate goods Industry Elec. and telecom equip. Elec. equip. and machinery Instruments and meters Total industry R&D/VA R&D/VA R&D/VA 1995 (%) 2000 (%) 2000/1995 Sales share 2000/1995 2.97 7.34 2.49 1.91 1.71 4.98 2.91 1.15 2.86 1.52 4.65 1.98 1.63 1.29 1.28 1.00 7 #2. The growing availability of complements to R&D personnel, i.e. factors that significantly expand the productivity of R&D personnel Human capital Level of management’s education % of workforce with foreign experience % of workers using the internet R&D network Receive external R&D assistance Provide design or R&D services IT assets/total fixed assets Institutional quality Share of public ownership Number of competitors Purchase of outside technology + + + + + + + 8 #3. Expanding the knowledge base from which innovation (and imitation) is drawn: a quickening of international technology diffusion Measures of international technology diffusion Share of foreign ownership (FDI) Industrial park/export processing zone Purchase a foreign license sign + + + 9 #4. Deepening subsidies to R&D labor City Seoul Shanghai Guangzhou Beijing Chengdu Tianjin Estimated returns to R&D personnel ($) (1) 37,639 24,086 14,984 13,479 9,676 8,818 R&D personnel wage ($) (2) 20,847 5,655 3,249 3,494 3,102 1,569 ratio 1:2 1.81 4.26 4.62 3.86 3.12 5.62 10 Conclusions and discussion Other factors affecting the timing of China’s S&T takeoff: Size – market size motivates investors to locate (achieve scale economies) in China rather than depend on imports. Geographic location (e.g. proximity to Japan, S. Korea, H.K., and Taiwan Domestic S&T policy, e.g. technology for markets 11 • The following slides are available for a discussion session if relevant 12 Composite measures of city complementarities lnZi = 1i + 2i LOCj + 3k INDk Openness (int’l tech diffusion) (1) complementarities Composite measure: Human capital (2) R&D network (3) Seoul 2.93 21.30 1.48 5.62 31.18 Beijing 0.00 0.00 0.00 0.00 0.00 Chengdu -8.37 0.44 8.07 -2.79 -7.92 Guangzhou 6.71 1.06 3.25 4.52 6.63 Shanghai 10.65 1.38 8.46 7.48 25.15 Tianjin -0.93 -6.30 -7.64 2.59 -10.76 Institutiona quality (1)+(2)+(3)+(4) (4) 13 Composite measures of R&D complements and estimated returns to R&D personnel City Composite Estimated returns index of to R&D personnel complements to ($) R&D Seoul 31.88 37,639 Shanghai 25.15 24,086 Guangzhou 6.63 14,984 Beijing 0.00 13,479 Chengdu -7.92 9,676 Tianjin -10.26 8,818 14 composite measure of the MP of R&D personnel Relationship between returns to R&D and R&D complements (R-sq = 0.910) 40000 35000 30000 25000 20000 15000 10000 5000 0 -20 -10 0 10 20 30 40 composite measure of R&D complements 15