Module 4.2. Import and Export Parity Pricing.

advertisement

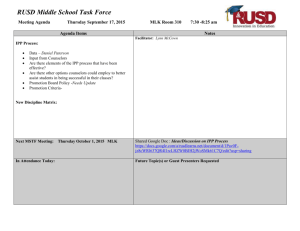

AAMP Training Materials Module 4.2: Import & Export Parity Pricing Steven Haggblade (MSU) blade@msu.edu Module Contents • • • • Objectives Background material Exercises Conclusions Objectives • Understand border prices’ ability to moderate food price fluctuations – Import parity price (IPP) – Export parity price (EPP) • Be able to compute border prices • Examine policies that undermine the moderating effects of IPP and EPP Background Material • Discuss domestic price under two scenarios – Scenario 1: Drought reduces maize supply below normal – Scenario 2: Bumper harvest expands maize supply above normal • Examine the impact of these two scenarios with and without open borders Domestic Price Price $ / ton D S0 300 200 100 Quantity Scenario 1: Drought Price $ / ton D S1 S0 300 200 100 Quantity Drought + Closed Borders Price $ / ton D S1 S0 300 200 100 Quantity Drought + Open Borders Price $ / ton D S1 S0 300 Pm 200 100 Quantity Domestic Price Price $ / ton D S0 300 200 100 Quantity Scenario 2: Bumper Harvest Price $ / ton D S0 S2 300 200 100 Quantity Bumper Harvest + Closed Border Price $ / ton D S0 S2 300 200 100 Quantity Bumper Harvest + Open Border Price $ / ton D S0 S2 300 200 Pe 100 Quantity Border Prices Reduce Price Volatility Price $ / ton D S1 S0 S2 300 Pm 200 Pe 100 Quantity Discussion Questions • When will IPP influence domestic price? • When will EPP influence domestic price? South Africa domestic and border prices for white maize, 1992 - 2006 300 200 100 SAFEX Price Import Parity Price Export Parity 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 19 93 19 19 92 0 price ($/ton) Zambia, domestic & border prices for white maize, 2000 - 2006 $400 $350 $300 $250 $200 $150 $100 $50 $0 Drought Lusaka wholesale price import parity Saudi Arabia, domestic and border prices for wheat, 1980 - 2008 $1,750 $1,500 $1,250 $1,000 $750 $500 $250 $0 import parity price domestic price Mechanics of computing border prices • Domestic reference price = price in Country 1 – Country 1 is the “home” country • Import parity price = price from Country X – Country X is a potential exporter to Country 1 • Export parity price = price to Country M – Country M is a potential importer from Country 1 Mechanics of Computing IPP • IPP = the price at which purchases in Country X can be delivered to market in Country 1 – Country 1 is home country – Country X produces the good we want at a low price To Calculate IPP, Need to Include Price in Country X = Transport to Country 1 + Duties and Fees + Handling Costs + IPP from Country X to Country 1 = For example… Price in Country X = $200 Transport to Country 1 + $100 Duties and Fees + $ 50 Handling Costs + $ 34 IPP from Country X to Country 1 = $ 384 Mechanics of computing (EPP) • EPP = the price at which purchases would have to be purchased in Country 1 in order to be sold at market price in Country M – Country 1 is the home country – Country M is a potential importer of the good we have to sell To Calculate EPP, Need to Include Price in Country M = Transport to Country 1 - Duties and Fees - Handling Costs - EPP to Country M from Country 1 = For example… Price in Country M = $275 Transport to Country 1 - $ 60 Duties and Fees - $ 0 Handling Costs - $ 25 EPP to Country M from Country 1 = $190 3 Exercises: Computing Border Prices • Use Excel workbook entitled: Module 4.2 – Import and Export Parity Pricing.xls • Exercise 1: Nairobi IPP & EPP Trends – Calculate domestic maize price – Compute and compare IPP Durban & EPP Durban • Exercise 2: Nairobi IPP & EPP Graph – Calculate and graph IPP & EPP Durban – Calculate and graph IPP & EPP Uganda • Exercise 3: Southern Malawi IPP & EPP – Calculate and graph IPP & EPP from N. Mozambique Discussion Questions • When, if ever, has import parity capped domestic price increases? • Can domestic price ever exceed import parity? – If so, when and why? – If not, why not? Empirical Conclusions • Open borders reduce price volatility – IPP becomes the upper limit to price fluctuations – EPP becomes lower limit to price fluctuations Policy Conclusions • Openness to international trade is an effective way to reduce price volatility. • Export bans harm producers by limiting their ability to gain maximum revenue from their sales – Creates disincentive to produce in future • Limiting imports harms consumers by requiring them to purchase high-priced domestic goods – Unnecessary cut into household incomes References • Dorosh, P.A., Dradri, S. and Haggblade, S. 2009. Regional trade, government policy and food security: Recent evidence from Zambia. Food Policy 34 (2009) 350–366. • Traub, L.N. 2008. South Africa Maize Trade Country Profile. Background report prepared for the World Bank under contract No. 7144132, Strengthening Food Security in SubSaharan Africa through Trade Liberalization and Regional Integration. Washington, DC: The World Bank. • Tschirley, D. and Jayne, T.S. 2010. Exploring the Logic behind Southern Africa’s Food Crises. World Development 38(1):7687.