ACCJC Recommendation #5Use

advertisement

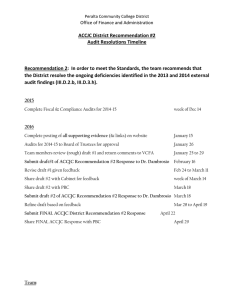

PCCD Planning and Budgeting Council ACCJC Recommendation #5 While evidence identifies progress, the District/Colleges have not achieved compliance with Standard III.D and Eligibility Requirements #5 and #17. Specifically the District/Colleges do not demonstrate the fiscal capacity to adequately support student learning programs and services. Therefore, in order to meet Standards and Eligibility Requirements, the District/Colleges must evaluate the impact of financial decisions on the educational quality and implement actions to resolve any deficiencies. A Strategy to Address ACCJC Recommendation #5 Response (Recommendations identified by the College Presidents and Dr. White, Presented by Dr. Webb) I. Focus on the Salient Issue: “…do not demonstrate the fiscal capacity to adequately support student learning programs and services.” & Requirement: Evaluate the impact of financial decisions on the educational quality and implement actions to resolve any deficiencies. Be careful to convey how the College has responded or adapted to district-driven decisions and to the resources that it has available now. Proposed questions to answer in addressing this recommendation: How are the district’s actions [affecting operations] at the College? How has the district responded to the College’s needs? Are deficiencies evident? If so, what action/s has the College taken to resolve each? What [actions have] the college taken [in response to] District decisions? What is the impact of district policies and procedures on the College? II. Steps for Developing the College’s Response Employ a sound shared governance & communications processes collegewide. For example: 1. Engage the college’s council or committee responsible for addressing accreditation related matters to facilitate all efforts to address this recommendation. Depending on the college, this will be the institutional effectiveness committee or accreditation committee. 2. Clarify the recommendation and seek input on a response plan from the central shared governance body of the college i.e., College Council, Round Table. 3. Communicate to the college community the expectation that this recommendation will be addressed within the college’s Mid-term Report. Welcome input to inform the plan of action for accomplishing this effort. 4. Develop and disseminate the action plan collegewide via shared governance groups, the college’s electronic FAS, associated students, accreditation web-page, etc. in order to ensure the opportunity for on-going input among all stakeholders. 5. Ensure that all pertinent documents are on the accreditation webpage of the college’s website. Those documents should include the June 2011 ACCJC Letter, the most recent Self Study of the college, the ACCJC eligibility requirements and standards, and other appropriate documents especially those deemed most helpful to inform sound college response. 6. Develop work teams e.g., standard sub-committees focused on each of the standards to address matters pertinent to each of the recommendations, the planning agenda and the progress report (updates) on the 2006 ACCJC Visiting Team’s recommendations. In doing so, require that the Standard III work team address Recommendation #5, yet relies on all other sub-committees to inform its information. Page 1 of 4 Cont. A Strategy to Address ACCJC Recommendation #5 Response 7. Administer a survey—via efficient, electronic free service such as SurveyMonkey—to College community to obtain input on this recommendation. 8. Develop a timeline to produce the final response for review/approval by Chancellor, Board of Trustees and submittal to ACCJC by March 15, 2012. (see page 3) III. Types of Institutional Documents to Gather, Analyze and Use of Inform Responses (see table on page 4) STANDARD & ELIGIBILITY REQUIREMENTS Standard III.D: Financial Resources Financial resources are sufficient to support student learning programs and services and to improve institutional effectiveness. The distribution of resources supports the development, maintenance, and enhancement of programs and services. The institution plans and manages its financial affairs with integrity and in a manner that ensures financial stability. The level of financial resources provides a reasonable expectation of both short-term and long-term financial solvency. Financial resources planning is integrated with institutional planning. 1. The institution relies upon its mission and goals as the foundation for financial planning. a. Financial planning is integrated with and supports all institutional planning. b. Institutional planning reflects realistic assessment of financial resource availability, development of financial resources, partnerships, and expenditure requirements. c. When making short-range financial plans, the institution considers its long-range financial priorities to assure financial stability. The institution clearly identifies and plans for payment of liabilities and future obligations. d. The institution clearly defines and follows its guidelines and processes for financial planning and budget development, with all constituencies having appropriate opportunities to participate in the development of institutional plans and budgets. Eligibility Requirement #5: Administrative Capacity - The institution has sufficient staff, with appropriate preparation and experience to provide the administrative services necessary to support its mission and purpose. Eligibility Requirement #17: Financial Resources - The institution documents a funding base, financial resources, and plans for financial development adequate to support student learning programs and services, to improve institutional effectiveness, and to assure financial stability. http://www.accjc.org/eligibility-requirements-standards/ Page 2 of 4