Multiple Linear Regression - Television Station Prices (Model Building Diagnostics)

advertisement

Case Study – Regression Model Building/Diagnostics

Television Station Prices

Data: 31 stations sold during the late 1950s and early 1960s

Dependent Variable: PRICE (less replacement costs in $1000s)

Candidate Independent Variables:

Market Retail Sales ($1M) – RETAIL

Market Buying Income ($1M) – INCOME

TV Homes per Station in Market – HOMES

Network Hourly Advertising Rate ($) – NETRATE

National Spot Rate ($) – SPOTRATE

Age of Station (1=started after 1/1/1952, 0=before) – AGENEW

Number of Ties with Major Networks – NETWORKS

Percent of Market Population in Urban Areas – PCTURBAN

Summary Statistics:

De scri ptive Statistics

N

PRICE

RETAIL

INCOME

HOMES

NETRATE

SPOTRATE

AGENEW

NETW ORKS

PCTURBAN

Valid N (lis twis e)

31

31

31

31

31

31

31

31

31

31

Minimum

13.00

85.00

136.00

15.00

60.00

25.00

0

0

23.10

Maximum

Mean

12634. 00 1981.7742

8472.00 1873.5161

13733. 00 2473.9032

1553.00

206.1290

3500.00

684.0323

750.00

143.7742

1

.77

2

.90

88.30

52.9742

St d. Deviat ion

2530.73471

2037.01059

2729.92404

288.62025

670.02415

139.22014

.425

.831

17.52246

Source: H. Levin (1964). “Economic Effects of Broadcast Licensing”, Journal of

Political Economy, Vol.72, #4, pp152-162.

Pairwise Correlations:

Correlations

PRICE

PRICE

RETAIL

INCOME

HOMES

NETRATE

SPOTRATE

AGENEW

NETWORKS

PCTURBAN

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

Pearson Correlation

Sig. (2-tailed)

N

1

.

31

.681**

.000

31

.838**

.000

31

.475**

.007

31

.892**

.000

31

.903**

.000

31

-.390*

.030

31

-.167

.369

31

.412*

.021

31

RETAIL

INCOME

.681**

.838**

.000

.000

31

31

1

.933**

.

.000

31

31

.933**

1

.000

.

31

31

.399*

.454*

.026

.010

31

31

.719**

.877**

.000

.000

31

31

.675**

.835**

.000

.000

31

31

-.132

-.242

.480

.190

31

31

-.003

-.038

.988

.839

31

31

.405*

.441*

.024

.013

31

31

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

HOMES

NETRATE SPOTRATE

AGENEW NETWORKS

.475**

.892**

.903**

-.390*

-.167

.007

.000

.000

.030

.369

31

31

31

31

31

.399*

.719**

.675**

-.132

-.003

.026

.000

.000

.480

.988

31

31

31

31

31

.454*

.877**

.835**

-.242

-.038

.010

.000

.000

.190

.839

31

31

31

31

31

1

.471**

.449*

-.419*

.243

.

.008

.011

.019

.187

31

31

31

31

31

.471**

1

.979**

-.440*

-.032

.008

.

.000

.013

.865

31

31

31

31

31

.449*

.979**

1

-.475**

-.068

.011

.000

.

.007

.717

31

31

31

31

31

-.419*

-.440*

-.475**

1

.030

.019

.013

.007

.

.871

31

31

31

31

31

.243

-.032

-.068

.030

1

.187

.865

.717

.871

.

31

31

31

31

31

.305

.402*

.357*

-.511**

-.255

.095

.025

.049

.003

.167

31

31

31

31

31

PCTURBAN

.412*

.021

31

.405*

.024

31

.441*

.013

31

.305

.095

31

.402*

.025

31

.357*

.049

31

-.511**

.003

31

-.255

.167

31

1

.

31

Scatterplot Matrix:

PRICE

RETAIL

INCOME

HOMES

NETRATE

SPOTRATE

AGENEW

NETWORKS

PCTURBAN

Results of Stepwise Regression with SLE=0.2000 and SLS=0.2001:

Coefficientsa

Model

1

2

3

(Constant)

SPOTRATE

(Constant)

SPOTRATE

INCOME

(Constant)

SPOTRATE

INCOME

NETWORKS

Unstandardized

Coefficients

B

Std. Error

-378.467

287.848

16.416

1.450

-408.807

274.561

12.234

2.512

.255

.128

-83.318

345.897

11.992

2.463

.262

.125

-339.312

227.060

Standardized

Coefficients

Beta

.903

.673

.275

.660

.282

-.111

t

-1.315

11.324

-1.489

4.871

1.993

-.241

4.868

2.086

-1.494

Sig.

.199

.000

.148

.000

.056

.811

.000

.047

.147

a. Dependent Variable: PRICE

Fitted Model:

Price = -83.32 + 12.0*SPOTRATE + 0.26*INCOME – 339.3*NETWORKS

Observed Prices, Predicted Prices, and Residuals (Observed-Predicted):

Y

Y-hat

e=Y-Yhat

3620.00

257.00

900.00

2246.00

449.00

145.00

13.00

630.00

1854.00

898.00

765.00

5156.00

3375.00

2681.00

1258.00

233.00

38.00

547.00

70.00

264.00

211.00

330.00

1968.00

1785.00

1705.00

4818.00

513.00

4374.00

12634.00

3485.00

3270.90

995.46

1971.65

1746.45

70.86

692.15

70.11

1032.85

3851.61

1745.44

1406.31

3312.51

3444.30

3829.83

1170.67

596.63

61.74

-184.48

11.98

312.04

894.54

669.09

2706.16

1287.93

2354.04

4073.59

1052.97

3050.49

12504.64

2341.76

349.10

-738.46

-1071.65

499.55

378.14

-547.15

-57.11

-402.85

-1997.61

-847.44

-641.31

1843.49

-69.30

-1148.83

87.33

-363.63

-23.74

731.48

58.02

-48.04

-683.54

-339.09

-738.16

497.07

-649.04

744.41

-539.97

1323.51

129.36

1143.24

4213.00

1090.79

3122.21

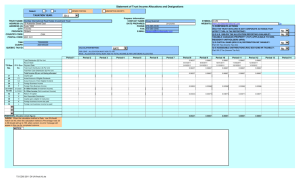

All Possible Regressions: Cp (First Page of output based on all 255 models)

C(p) Selection Method

Number in

Model

3

2

3

4

4

5

4

3

3

3

3

4

4

4

5

4

4

3

1

2

5

5

6

3

5

4

5

4

5

2

2

5

5

4

6

4

3

6

4

2

4

3

C(p) R-Square Variables in Model

3.0549 0.8508 income spotrate networks

(3.0549 < 3+1 =4) Best model based on Cp

3.2099 0.8385 income spotrate

3.4697 0.8485 retail income spotrate

3.5371 0.8595 income homes spotrate networks

3.5540 0.8594 retail income spotrate networks

4.1051 0.8677 retail income homes spotrate networks

4.3810 0.8547 retail income netrate spotrate

4.6526 0.8417 income spotrate pcturban

4.6860 0.8415 income homes spotrate

4.7706 0.8410 income netrate spotrate

4.8850 0.8403 homes spotrate networks

4.8906 0.8518 income netrate spotrate networks

4.9200 0.8516 income spotrate networks pcturban

4.9498 0.8514 retail income homes spotrate

4.9509 0.8629 retail income netrate spotrate networks

4.9837 0.8512 retail income spotrate pcturban

5.0501 0.8509 income spotrate agenew networks

5.2075 0.8385 income spotrate agenew

5.2127 0.8156 spotrate

5.2557 0.8268 spotrate networks

5.3156 0.8608 income homes netrate spotrate networks

5.3910 0.8604 income homes spotrate agenew networks

5.4074 0.8717 retail income homes netrate spotrate networks

5.4221 0.8373 retail spotrate networks

5.4374 0.8601 retail income spotrate networks pcturban

5.4674 0.8485 retail income spotrate agenew

5.5313 0.8595 income homes spotrate networks pcturban

5.5428 0.8480 retail homes spotrate networks

5.5494 0.8594 retail income spotrate agenew networks

5.5929 0.8248 spotrate pcturban

5.5996 0.8248 retail spotrate

5.6263 0.8590 retail income netrate spotrate pcturban

5.6786 0.8587 retail income homes netrate spotrate

5.7739 0.8467 homes spotrate agenew networks

5.9655 0.8685 retail income homes spotrate agenew networks

6.0261 0.8453 income netrate spotrate pcturban

6.0712 0.8336 spotrate agenew pcturban

6.1019 0.8677 retail income homes spotrate networks pcturban

6.1350 0.8446 income homes netrate spotrate

6.1408 0.8217 homes spotrate

6.2585 0.8439 income homes spotrate pcturban

6.3410 0.8320 spotrate networks pcturban

Model Assumptions:

1) Normality of Errors: Histogram of Residuals

12

10

8

6

4

2

Std. Dev = 977.45

Mean = 0.0

N = 31.00

0

-2000.0

-1000.0

-1500.0

0.0

-500.0

1000.0

500.0

2000.0

1500.0

3000.0

2500.0

Unstandardized Residual

Comment: Appears to be one outlier…a few too many in first negative cell below 0.

2) Constant Error Variance: Plot of Residuals versus Predicted Values

4000

3000

2000

1000

0

-1000

-2000

-3000

-2000

0

2000

4000

6000

8000

10000

12000

14000

Unstandardized Predicted V alue

Comment: With exception of one very extreme observation, residuals appear to be

increasing (in absolute value) with the mean.

3) Plots of Residuals versus Independent Variables:

4000

3000

2000

Unstandardized Residual

1000

0

-1000

-2000

-3000

0

2000

4000

6000

8000

10000

12000

14000

INCOME

4000

3000

2000

Unstandardized Residual

1000

0

-1000

-2000

-3000

0

200

400

600

800

SPOTRA TE

4000

3000

2000

Unstandardized Residual

1000

0

-1000

-2000

-3000

-.5

0.0

NETWORKS

.5

1.0

1.5

2.0

2.5

Comment: No evidence of nonlinear relationships.

Observation (Station) Specific Diagnostic Measures:

1) Studentized Residuals (Residual divided by its estimated standard

error):

ri

ei

^

MSE (1 vii )

ei Yi Y i

vii i th diagonal element of X ( X ' X ) 1 X matrix

Values above t(.05/2n) , n-k-1 (in absolute value) are considered to be outliers (some

practicioners use 3 as a critical value.

2) Leverage Values – Measures how far an observation is from the others with

respect to the independent variables. Large values have the potential to highly

effect the least squares estimates

vii i th diagonal element of X ( X ' X ) 1 X matrix

Values above 2(k+1)/n are considered to be potentially highly influential (where k=# of predictor

variables)

3) DFFITS – Measures how much an observation has influenced its own fitted

value.

^

DFFITS i

^

Y i Y i (i )

s (i ) vii

^

wh ere Y i ( i ) is the fitted value for the i th observatio n when it was not included in

the model and s (i ) is the square root of MSE when the observatio n was not included in model.

DFFITS represents the number of standard errors that the fitted value for a data point has

shifted when it was not used in the regression fit. Values above 2 (k 1) / n in absolute value are

considered highly influential.

4) DFBETAS – Measure of how much an observation has effected the

estimate of a regression coefficient (there is one DFBETA for each

regression coefficient, including the intercept). Values larger than

2

in absolute value are considered highly influential.

n

^

DFBETAS j (i )

^

j j (i )

c jj ( j 1) st diagonal element of ( X ' X ) 1

s(i ) c jj

Note that DFBETASj(i) measures the number of standard errors that the regression

coefficient for the jth predictor variable has shifted when the ith case was not used in the

regression fit.

5) Cook’s D – Measure of aggregate impact of each observation on the

group of regression coefficients, as well as the group of fitted values.

Values larger than F.50,k 1,n k 1, are considered highly influential.

'

^

Di

^

^

^

( (i ) )' ( X ' X )( (i ) )

(k 1) s 2

^

^

^

^

Y (i ) Y Y (i ) Y

2

ri vii

2

(k 1) 1 vii

(k 1) s

Note that Di is like an F-statistic used for testing K ' m where K’=I. It can also

be thought of as the shift in a 100(1-)100% confidence ellipse when Di Fa , p ',n p '

when the ith case is not used to fit the regression model.

6) COVRATIO – Measure of the impact of each observation on the

variances (and standard errors) of the regression coefficients and

their covariances. Values outside the interval 1

considered highly influential.

COVRATIO i

det( s(2i ) ( X (' i ) X (i ) ) 1 )

det( s 2 ( X ' X ) 1 )

3( k 1)

are

n

7) Variance Inflation Factor (VIF) – Measure of how highly correlated each

independent variable is with the other predictors in the model. Values

larger than 10 for a predictor imply large inflation of standard errors of

regression coefficients due to this variable being in model.

VIFk

1

where R 2j is the coefficient of multiple determination when Xj is

1 R 2j

regressed on the k-1 remaining independent variables.

Obtaining Influence Statistics and Studentized Residuals in SPSS

A. Choose ANALYZE, REGRESSION, LINEAR, and input the Dependent variable

and set of Independent variables from your model of interest (possibly having been

chosen via an automated model selection method).

B. Under STATISTICS, select Collinearity Diagnostics, Casewise Diagnostics and

All Cases and CONTINUE

C. Under PLOTS, select Y:*SRESID and X:*ZPRED. Also choose HISTOGRAM.

These give a plot of studentized residuals versus standardized predicted values, and a

histogram of standardized residuals (residual/sqrt(MSE)). Select CONTINUE.

D. Under SAVE, select Studentized Residuals, Cook’s, Leverage Values, Covariance

Ratio, Standardized DFBETAS, Standardized DFFITS. Select CONTINUE. The

results will be added to your original data worksheet.

Critical Values for Television station data (n=31, k=3):

Studentized Residuals: t.05/(2(31)) , 31-4 = t.0008,27 = 4.04

Leverge Values: 2(3+1)/31 = 0.258

DFFITS: 2 (3 1) / 31 = 0.718

DFBETAS: 2 / 31 = 0.359

Cook’s D: F.50,3+1,31-3-1 = F.50,3,27 = 0.861

COVRATIO: 1

3(3 1)

31

1 0.387 outside (0.613 , 1.387)

SPSS Output:

.

stresid

Cooks D

Leverage COVRAT DFFITS

DFB0

DFB_INC DFB_SPT DFB_NET

1.5660

0.3978

0.0150

0.2424

0.2409

0.0272

0.2259

-0.1829

0.0028

-0.7528

0.0146

0.0612

1.1785

-0.2397

0.0176

-0.0296

0.0424

-0.1852

-1.0707

0.0171

0.0241

1.0361

-0.2624

-0.0764

0.1669

-0.1572

-0.0313

0.5049

0.0054

0.0456

1.2142

0.1447

0.1254

-0.0338

0.0155

-0.1030

0.3775

0.0021

0.0225

1.2046

0.0894

0.0661

-0.0048

-0.0271

0.0044

-0.5570

0.0078

0.0587

1.2216

-0.1739

-0.1710

0.0146

0.0312

0.1190

-0.0570

0.0001

0.0231

1.2305

-0.0135

-0.0098

0.0029

0.0020

-0.0008

-0.4115

0.0046

0.0650

1.2563

-0.1330

-0.1156

0.0563

-0.0257

0.0851

-0.9992

0.4397

0.3699

-0.6119

-0.6472

-2.1175

0.2162

0.1294

0.6709

-0.8695

0.0222

0.0729

1.1600

-0.2966

0.0475

-0.1111

0.0903

-0.2164

-0.6485

0.0090

0.0465

1.1855

-0.1875

-0.1765

-0.0026

0.0331

0.1362

1.0263

-0.7552

0.7937

-0.4190

1.9892

0.2334

0.1587

0.7626

0.3390

-0.0701

0.0001

0.0460

1.2607

-0.0200

-0.0120

-0.0020

-0.0013

0.0139

0.2755

-0.9075

0.6318

-0.7627

-0.4437

-1.3401

0.1996

1.2756

0.3200

0.0889

0.0002

0.0594

1.2787

0.0277

-0.0034

-0.0030

0.0017

0.0220

-0.3710

0.0036

0.0630

1.2593

-0.1184

-0.1141

0.0268

0.0065

0.0786

-0.0237

0.0000

0.0235

1.2315

-0.0057

-0.0041

0.0013

0.0008

-0.0003

0.7539

0.0181

0.0809

1.2043

0.2670

0.0291

0.0452

-0.0988

0.1817

0.0580

0.0001

0.0240

1.2316

0.0139

0.0102

-0.0023

-0.0028

0.0007

-0.0492

0.0001

0.0685

1.2929

-0.0162

-0.0159

0.0026

0.0024

0.0106

-0.6945

0.0115

0.0551

1.1856

-0.2128

-0.2051

0.0322

0.0194

0.1471

-0.3365

0.0013

0.0110

1.1952

-0.0703

-0.0480

0.0126

0.0073

-0.0054

0.2840

-0.5544

0.4802

-0.8664

0.0868

1.5194

-0.5864

-0.0939

-0.0011

0.4915

0.0023

0.0042

1.1643

0.0942

0.0577

0.0116

-0.0249

0.0082

-0.6538

0.0083

0.0395

1.1754

-0.1799

-0.1456

0.0066

-0.0035

0.1329

0.7744

0.0223

0.0974

1.2213

0.2966

0.1255

0.1828

-0.1105

-0.1641

-0.5564

0.0099

0.0807

1.2519

-0.1960

0.0097

-0.0818

0.0857

-0.1352

1.3215

0.0255

0.0229

0.9420

0.3240

0.0283

-0.1430

0.2015

0.0443

0.6808

4.0201

0.2344

0.0341

0.3630

-0.1129

0.0717

0.1253

-0.0647

1.1744

0.0414

0.0750

1.0562

0.4101

-0.1238

-0.1172

0.1601

0.3126

0.1962

1.2489

0.9852

3.1787

0.2534

0.0589

-0.1226

0.0259

-0.0853

Station

WNHC

WHTN

WHAM

WTVT

WSVA

KOSA

WDAM

KOB

WJZ

KOVR

WKJG

WBRC

WDAF

KMOX

KOCO

KNAC

WJDM

WTVC

KCTV

WAGM

WLBZ

WWTV

WTRF

WKTV

KFRE

WPRO

WLOS

WSOC

WCAU

WVUE

WITI

Highlighted measures are considered influential. Six stations appear to be quite different from

the rest.

Coefficientsa

Model

1

(Constant)

INCOME

SPOTRATE

NETWORKS

Unstandardized

Coefficients

B

Std. Error

-83.318

345.897

.262

.125

11.992

2.463

-339.312

227.060

a. Dependent Variable: PRICE

Standardized

Coefficients

Beta

.282

.660

-.111

t

-.241

2.086

4.868

-1.494

Sig.

.811

.047

.000

.147

Collinearity Statistics

Tolerance

VIF

.302

.301

.994

3.313

3.324

1.006

All VIF’s are well below 10, Multicollinearity is not a problem in this model.