TOC LP View

advertisement

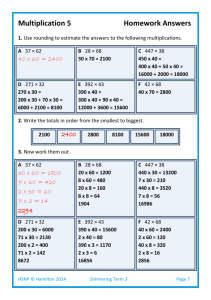

Systems Thinking and the Theory of Constraints Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius -and a lot of courage -- to move in the opposite direction. Albert Einstein These sides and note were prepared using 1. The book Streamlined: 14 Principles for Building and Managing the Lean Supply Chain. 2004. Srinivasan. TOMPSON ISBN: 978-0-324-23277-6. 2. The original were prepared by Professor M. M. Srinivasan. Practice; Follow the 5 Steps Process Two products, P and Q. Weekly demand for P is 100 units & for Q is 50 units. $90 / unit Q: P: 100 units / week $100 / unit 50 units / week D 5 min. D 15 min. Purchased Part $5 / unit C 10 min. C 5 min. B 15 min. Operating expenses per week: $6,000. It includes A A B $2000 administrative costs 15 min. 15 min. 10 min. for the manager who works as operations, RM1 RM2 RM3 $20 per $20 per $20 per finances, and marketing unit unit unit manager, and $4000 non-administrative costs for the 4 operators working at the work-centers A, B, C, and D. Time available at each work center is 2,400 minutes per week. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 2 Facility Layout : Job Shop RM 2 RM1 RM3 A C B D Product A P 15 Q 10 B 15 30 C 15 5 D 15 5 Profit Margin 45 60 Product 1 Product 2 PP Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 3 Financial Throughput and Fixed Operating Costs We define financial throughput as the rate at which the enterprise generates money. By selling one unit of product we generate P dollars, at the same time we incur V dollars pure variable cost. Pure variable cost is the cost directly related to the production of one additional unit - such as raw material. It does not include fixed costs such as salary, rent, and depreciation. Since we produce and sell X units per unit of time. The financial throughput is X(P-V). Fixed Operating Expenses (F) include all costs not directly related to production of one additional unit. That includes costs such as human and capital resources. In our example, F = $6,000 per week, P1= 90, P2= $100, V1= 45, V2= 40, and therefore, incoming $$ per unit of product is $45 for product P and $60 for product Q. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 4 2. Exploit the Constraint : LP Formulation Decision Variables x1 : Volume of Product P x2 : Volume of Product Q Resource A 15 x1 + 10 x2 2400 Resource B 15 x1 + 30 x2 2400 Resource C 15 x1 + 5 x2 2400 Resource D 15 x1 + 5 x2 2400 Theory of Constraints 1- Basics Product A B C D P Q Capacity 15 10 15 30 15 5 15 5 Profit Margin Demand 45 60 100 50 2400 2400 2400 2400 Market for P x1 100 Market for Q x2 50 Objective Function Maximize Z = 45 x 1 +60 x2 -6000 Nonnegativity x1 0, x2 0 Ardavan Asef-Vaziri Nov-2010 5 2. Exploit the Constraint : LP Formulation and Solution Resource Resource A Resource B Resource C Resource D Market P Market Q Product P Product Q 15 10 15 30 15 5 15 5 Needed 0 0 0 0 <= <= <= <= Available 2400 2400 2400 2400 1 0 0 <= <= 100 50 60 -6000 1 45 Resource Resource A Resource B Resource C Resource D Market P Market Q Theory of Constraints 1- Basics Product P Product Q 15 10 15 30 15 5 15 5 1 1 45 60 100 30 Ardavan Asef-Vaziri Needed 1800 2400 1650 1650 100 30 <= <= <= <= <= <= Available 2400 2400 2400 2400 100 50 300 Nov-2010 6 Step 3: Subordinate Everything Else to This Decision Keep Resource B running at all times. Resource B can first work on RM2 for products P and Q, during which Resource A would be processing RM3 to feed Resource B to process RM3 for Q. Do not allow starvation of B by purchased material RM2 or by output of Process A. Do not allow blockage of B by D. Minimize the number of switches (Setups) of Process B from RM2 to RM3-Through-A and vice versa. Minimize variability at Process B. Minimize variability at Process A and also in purchasing and arrival of RM2. Do not miss even a single order of Product P. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 7 Step 4 : Elevate the Constraint(s) The bottleneck has now been exploited Besides Resource B, we have found a market bottleneck. Generate more demand for Product P Buy another Resource B The Marketing Director: A Great Market in Japan ! But the price discount, transportation cost, and other out of country costs adds up to 20% of the domestic sales price. Production costs remains as before. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 8 Step 4 : Elevate the Constraint(s). Do We Try To Sell In Japan? Processing Times A C B 15 15 15 10 5 30 Product P Q D 15 5 Product Costs and Profits Product Selling Price P (domestic) 90 Q (domestic) 100 P (Japan) 72 Q (Japan) 80 Theory of Constraints 1- Basics Manufg. Cost 45 40 45 40 Profit per $/Constraint Minute unit 45 3 2 60 1.8 27 40 1.33 Ardavan Asef-Vaziri Nov-2010 9 Step 4 : Elevate the Constraint(s). Do We Try To Sell In Japan? Right now, we can get at least $ 2 per constraint minute in the domestic market. So, should we go to Japan at all? Perhaps not. Okay, suppose we do not go to Japan. Is there something else we can do? Let’s buy another machine! Which one? B Cost of the machine = $100,000. Cost of operator: $400 per week. What is weekly operating expense now? $6,400 What is the pay-nack period (PBP)? Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 10 Step 5: If a Constraint Was Broken in previous Steps, Go to Step 1 Resource Resource A Resource B Resource C Resource D Market P Market Q Product P Product Q Product PJ Product QJ Needed 15 15 15 15 1 Resource A Resource B Resource C Resource D Market P Market Q 15 15 15 15 10 30 5 5 0 0 0 0 0 0 27 40 -6400 1 45 Resource 10 30 5 5 60 Available <= <= <= <= <= <= Product P Product Q Product PJ Product QJ Needed 15 15 15 15 1 10 30 5 5 15 15 15 15 10 30 5 5 2400 4800 1800 1800 80 50 3000 1 45 60 27 40 80 50 0 70 Theory of Constraints 1- Basics Ardavan Asef-Vaziri 2400 4800 2400 2400 100 50 Available <= <= <= <= <= <= Nov-2010 2400 4800 2400 2400 100 50 11 Step 5: If a Constraint Was Broken in previous Steps, Go to Step 1 80P, 50Q,0PJ, 70QJ Total Profit = 3000 What is the payback period? 100000/3000 = 33.33 weeks What is the payback period? 100000/(3000-300) = 37.03 weeks The domestic P had the max profit per minute on B. Why we have not satisfied all the domestic demand. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 12 Practice: A Production System Manufacturing Two Products, P and Q $90 / unit P: 110 units / week Q: $100 / unit 60 units / week D 5 min. D 10 min. Purchased Part $5 / unit C 10 min. C 5 min. B 25 min. A 15 min. B 10 min. A 10 min. RM1 $20 per unit RM2 $20 per unit RM3 $25 per unit Time available at each work center: 2,400 minutes per week. Operating expenses per week: $6,000. All the resources cost the same. Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 13 A Practice on Sensitivity Analysis – What is the value of the objective function? Z= 45(100) + 60(?)-6000! Adjustable Cells Cell Name $B$10 Product P $C$10 Product Q Final Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease 100.00 0.00 45 1E+30 15 0 60 30 60 Constraints Shadow prices? Cell $D$3 $D$4 $D$5 $D$6 $D$7 $D$8 Name Resource A Needed Resource B Needed Resource C Needed Resource D Needed Market P Needed Market Q Needed Final Shadow Constraint Allowable Allowable Value Price R.H. Side Increase Decrease 1800.0 2400 1E+30 600 2400.0 2.0 2400 600 900 1650.0 2400 1E+30 750 1650.0 2400 1E+30 750 100.0 15.0 100 60 40 30.0 50 1E+30 20 2400(Shadow Price A)+ 2400(Shadow Price C)+2400(Shadow Price C) + 2400(Shadow Price D)+100(Shadow Price P) + 50(Shadow Price Q). 2400(0)+ 2400(2)+2400(0) +2400(0)+100(15)+ 50(0). 4800+1500 = 6300 Is the objective function Z = 6300? 6300-6000 = 300 Theory of Constraints 1- Basics Ardavan Asef-Vaziri Nov-2010 14 A Practice on Sensitivity Analysis How many units of product Q? What is the value of the objective function? Z= 45(100) + 60(?)-6000 = 300. 4500+60X2-6000=300 60X2 = 1800 Adjustable Cells X2 = 30 Final Cell Name $B$10 Product P $C$10 Product Q Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease 100.00 0.00 45 1E+30 15 ????? 0 60 30 60 Constraints Cell $D$3 $D$4 $D$5 $D$6 $D$7 $D$8 Theory of Constraints 1- Basics Name Resource A Needed Resource B Needed Resource C Needed Resource D Needed Market P Needed Market Q Needed Final Shadow Constraint Allowable Allowable Value Price R.H. Side Increase Decrease 1800.0 2400 1E+30 600 2400.0 2.0 2400 600 900 1650.0 2400 1E+30 750 1650.0 2400 1E+30 750 100.0 15.0 100 60 40 30.0 50 1E+30 20 Ardavan Asef-Vaziri Nov-2010 15