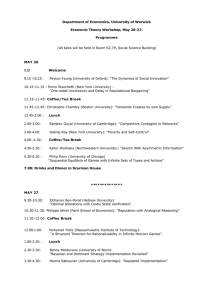

The Influence of Private Sector Participation in

advertisement