The Influence of Private Sector Participation in

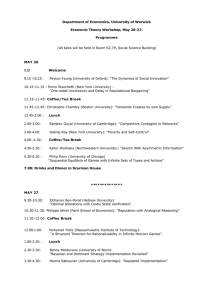

advertisement