Federal/Ohio State Tax Withholding Tables efffective 8/1/2015

advertisement

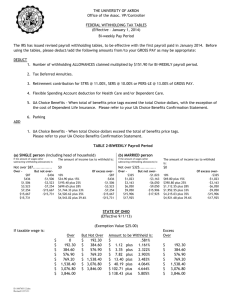

THE UNIVERSITY OF AKRON Office of the Assoc. VP/Controller FEDERAL WITHHOLDING TAX TABLES (Effective – January 1, 2015) Bi-weekly Pay Period The IRS has issued revised payroll withholding tables, to be effective with the first payroll paid in January 2015. Before using the tables, please deduct/add the following amounts from/to your GROSS PAY as may be appropriate: DEDUCT 1. Number of withholding ALLOWANCES claimed multiplied by $153.80 for BI-WEEKLY payroll period. 2. Tax Deferred Annuities and Deferred Compensation. 3. Retirement contribution for STRS @ 13.00%, SERS @ 10.00% or PERS-LE @ 13.00% of GROSS PAY. 4. Flexible Spending Account deduction for Health Care and/or Dependent Care and Vision. 5. UA Choice Benefits - When total of benefits price tags exceed the total Choice dollars, with the exception of the cost of Dependent Life Insurance and Short Term Disability. Please refer to your UA Choice Benefits Confirmation Statement. 6. Parking ADD 1. Taxable benefits such as taxable life and graduate fee remission. TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is: If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is: Not over $88............... $0 Not over $331............. $0 Over $88 $443 $1,529 $3,579 $7,369 $15,915 $15,981 But not over-$443 -$1,529 -$3,579 -$7,369 -$15,915 -$15,981 $0.00 plus 10% $35.50 plus 15% $198.40 plus 25% $710.90 plus 28% $1,772.10 plus 33% $4,592.28 plus 35% $4,615.38 plus 39.6% Of excess over-$88 -$443 -$1,529 -$3,579 -$7,369 -$15,915 -$15,981 Over $331 $1,040 $3,212 $6,146 $9,194 $16,158 $18,210 But not over-$1,040 -$3,212 -$6,146 -$9,194 -$16,158 -$18,210 10% $70.90 plus 15% $396.70 plus 25% $1,130.20 plus 28% $1,983.64 plus 33% $4,281.76 plus 35% $4,999.96 plus 39.6% STATE OF OHIO (Effective 8/1/15) (Exemption Value $25.00) If taxable wage is: $ $ $ $ $ $ $ $ D:\401282074.doc Over 0 192.30 384.60 576.90 769.20 1,538.40 3,076.80 3,846.00 But Not Over $ 192.30 $ 384.60 $ 576.90 $ 769.20 $ 1,538.40 $ 3,076.80 $ 3,846.00 Amount to be Withheld is: $ .556% $ 1.07 plus 1.112% $ 3.21 plus 2.226% $ 7.49 plus 2.782% $ 12.84 plus 3.338% $ 38.52 plus 3.894% $ 98.43 plus 4.451% $ 132.67 plus 5.563% Excess Over $ $ $ $ $ $ $ 192.30 384.60 576.90 769.20 1,538.40 3,076.80 3,846.00 Of excess over-$331 -$1,040 -$3,212 -$6,146 -$9,194 -$16,158 -$18,210 THE UNIVERSITY OF AKRON Office of the Assoc. VP/Controller FEDERAL WITHHOLDING TAX TABLES (Effective – January 1, 2015) Monthly Pay Period The IRS has issued revised payroll withholding tables, to be effective with the first payroll paid in January, 2015. Before using the tables, please deduct/add the following amounts from/to your GROSS PAY as may be appropriate: DEDUCT 1. Number of withholding ALLOWANCES claimed multiplied by $333.30 for MONTHLY payroll period. 2. Tax Deferred Annuities and Deferred Compensation. 3. Retirement contribution for STRS @ 13.00%, SERS @ 10.00% or PERS-LE @ 13.00% of GROSS PAY. 4. Flexible Spending Account deduction for Health Care and/or Dependent Care and Vision. 5. UA Choice Benefits - When total of benefits price tags exceed the total Choice dollars, with the exception of the cost of Dependent Life Insurance and Short Term Disability. Please refer to your UA Choice Benefits Confirmation Statement. 6. Parking ADD 1. Taxable benefits such as taxable life and graduate fee remission. TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is: If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is: Not over $192............... $0 Not over $717........... $0 Over $192 $960 $3,313 $7,754 $15,967 $34,483 $34,625 But not over-$960 -$3,313 -$7,754 -$15,967 -$34,483 -$34,625 10% $76.80 plus 15% $429.75 plus 25% $1,540.00 plus 28% $3,839.64 plus 33% $9,949.92 plus 35% $9,999.62 plus 39.6% Of excess over-$192 -$960 -$3,313 -$7,754 -$15,967 -$34,483 -$34,625 Over $717 $2,254 $6,958 $13,317 $19,921 $35,008 $39,454 But not over$2,254 -$6,958 -$13,317 -$19,921 -$35,008 -$39,454 10% $153.70 plus 15% $859.30 plus 25% $2,449.05 plus 28% $4,298.17 plus 33% $9,276.88 plus 35% $10,832.98 + 39.6% STATE OF OHIO (Effective 8/1/15) (Exemption Value $54.16) If taxable wage is: $ $ $ $ $ $ $ $ D:\401282074.doc Over 0 416.66 833.32 1249.98 1666.64 3333.28 6666.56 8333.20 But Not Over $ 416.66 $ 833.32 $ 1249.98 $ 1666.64 $ 3333.28 $ 6666.56 $ 8333.20 Amount to be Withheld is: $ .556% $ 2.32 plus 1.112% $ 6.95 plus 2.226% $ 16.22 plus 2.782% $ 27.81 plus 3.338% $ 83.44 plus 3.894% $ 213.24 plus 4.451% $ 287.42 plus 5.563% Excess Over $ $ $ $ $ $ $ 416.66 833.32 1249.98 1666.64 3333.28 6666.56 8333.20 Of excess over-$717 -$2,254 -$6,958 -$13,317 -$19,921 -$35,008 -$39,454