Supply-Side Economics Economics at Klein Oak High School Fall 2003

Supply-Side

Economics

Economics at Klein Oak High School

Fall 2003

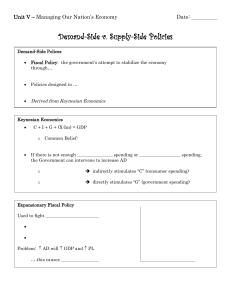

Review Keynesian Economics

focus on demand side

aggregate demand (AS) management

C+I+G+(Ex-Im)=GDP

Keynesian Recession Strategy

increase AD

increase G (government spending)

government spends more

increase C (consumption)

decrease taxes (fiscal policy)

increase money supply (monetary policy)

Keynesian Inflation Strategy

decrease AD

decrease G (government spending)

government spends less

decrease C (consumption)

increase taxes (fiscal policy)

decrease money supply (monetary policy)

Supply Side Perspective

stagflation is different

caused by decrease in AS (aggregate supply)

because lower supply lower output (GDP) and higher prices (inflation)

Cause of Decrease in AS

government policy (unintended consequences)

high taxes

discourage business investment

“tax wedge” decreases after tax rate of return

decrease savings

same reason

causes higher interest rate decreases business investment

Note on “Tax Wedge”

difference between what is paid and what is received

ex: to pay $5.50 to an employee costs a business $7.00, due to taxes

after taxes, the employee receives $4.50

difference between $7.00 cost to business and

$4.50 incentive to employee is the “tax wedge”

Cause of Decrease in AS (2)

government policy (unintended consequences)

high taxes

discourage work

“tax wedge” increases after tax cost to business

“tax wedge” decreases after tax return to employee

therefore, employment decreases and so does production

Cause of Decrease in AS (3)

government policy (unintended consequences)

excessive regulation

increases cost of production decreases supply

supply shock

little can be done about this but it isn’t a long run problem

Supply Side Goal

Supply Side Policy

increase AS

reduce taxes on business

reduce regulation on business

reduce taxes on savers

people with a high “marginal propensity to save”

i.e. people who save additional dollars

primarily high income people

The Laffer Curve

after a point the disincentive effect of higher tax rates will result in high rates reducing tax revenue

more

Implications of Laffer Curve

it’s possible to raise rates and get less revenue

the higher rates cause a “recession”

it’s possible to lower rates and get more revenue

if the lower rates stimulate the economy enough

Tax Fairness

tax cuts will give more $ to wealthy than to others because

wealthiest 50% pay 96% of income taxes

wealthiest 5% pay 53% of income taxes

Short-run vs . Long-run

Keynes: “In the long run we are all dead.”

Keynes ignored the long run complications of the policies he advocated.

Of course, it was the great depression.

Supply-side policies focus on the long run

emphasis on incentives

requires that people and businesses can depend on policies remaining in force for years

Effect of Supply–Side Ideas

Most economists still primarily Keynesian.

However, most now acknowledge that we must consider the supply-side effects of our policies.

Recommendations are now more long-run in perspective.