Helen Kwan

advertisement

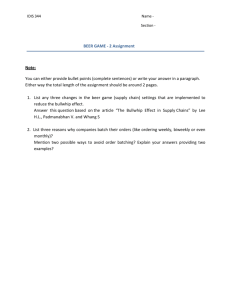

Caroline Fung (9) Helen Kwan (11) F.4A Economics Pair Work: Newspaper Cutting 28th May, 2007 香港啤酒聯盟宣布減價 (明報) 05 月 26 日 星期六 03:45PM 在財政司長唐英年呼籲啤酒商減價後,代表 8 成啤酒商的「香港啤酒聯盟」宣布, 下月按減稅幅度減價。 「香港啤酒聯盟」宣布,屬下 40 多個牌子的啤酒在下月 1 日起,調低批發價, 細支裝啤酒劃一減 2.9 角,新價將減稅後所節省稅款全數回贈消費者。不過零售 層面,例如超市、食肆等,就自行決定零售價。 唐英年今早表示,希望啤酒商履行承諾,在短期內減價。他又說,立法會已經成 立委員會跟進。 唐英年表示,他在財政預算案中提出減酒稅,是要加強經濟活動,惠及市民。目 前一般葡萄酒商已減價,但啤酒商未有相應減價,他希望他們履行承諾,減價回 饋市民。 他又說,立法會已組成委員會關注事件,至於立法會是否通過相關法例,要由立 法會決定。 P S2 S1 Tax C P2 Consumers’ Burden D P1 Producers’ Burden B A Net Revenue D 0 Q2 Q1 Q Beer before the reduction of tax A same amount of sales tax is imposed on every bottle or can of beer; this is known as the per-unit sales tax. At each quantity supplied, price is raised by the amount of tax. The supply curved shifted to the left (S1 to S2). The per-unit sales tax is measured by the vertical distance between S1 and S2 (Tax). The equilibrium price increases (P1 to P2), the equilibrium quantity decreases (Q1 to Q2). Tax rate x quantity (Q2) = tax burden (P2ABC) Change in price (P2 – P1) x quantity (Q2) = Consumers’ tax burden (P1P2CD) Tax Burden (P2ABC) – Consumers’ Burden (P1P2CD) = Producers’ burden (P1ABD) Total revenue - tax burden= net revenue (ABQ20) However, the tax incidence is uncertain; it depends on the elasticity of demand and supply of beer. P S2 S3 S1 Tax 2 Tax 1 P2 P3 C Consumers’ Burden D P1 Producers’ Burden B A Net Revenue 0 Q2 Q3 Q1 Q Beer after reduction of tax After the reduction of tax, the per unit tax imposed on each bottle of beer reduces. The vertical distance between the original supply curve and the new supply curve reduces. (Tax 1 to Tax 2). The shift of supply curve reduces. (From “S1 to S2” to “S1 to S3”) The price decreases (P2 to P3) and the quantity increases (Q2 to Q3). As a result, the tax burden reduces, and the net revenue increases. Now we are able to know the tax incidence. As the news mentioned that “All benefits of tax reduction should be enjoyed by the consumers”, we know that a large proportion of tax burden is beard by the producers. But it is impossible for the producers to bear the entire burden unless the supply is perfectly inelastic and there is no change in price and quantity. We assume that the demand for beer is more elastic than the supply of it. As the elasticity of demand for beer is larger than the elasticity of supply, the producers’ burden (P1ABD) is larger than the consumers’ burden (P3P1CD). There is reduction in price, and consumers enjoy the benefit of tax reduction, while producers may have to bear a larger tax burden. However, the reduction in price just referred to the wholesale price. May we, the consumers really enjoy the decreases in price, still depends on the decision of retail sellers. Integration In order to reduce risk and lower average cost of production, firms prefer to expand business. They usually expand its existing plants, setting up new plants or combining with other firms, called integration of firms. It could be divided into horizontal integration, backward vertical integration, forward vertical integration, lateral integration and conglomerate integration. For horizontal integration, beer factory can combine with other beer factories as they are firms producing beer and in the same stage of production, the integration enables the firms to control the market supply and enlarges their market power, so as to influence the market price of beer and reduce competition from other beer factory. For backward vertical integration, beer factory can combine with a farm since it provides the raw materials needed for making beer, which is the preceding stage of production; it helps the firm to ensure the steady supply of raw materials, so as to stabilize cost of production. For forward vertical integration, beer factory can combine with barrooms since they are the main selling points of beer and are in the next stage of production; this ensures enough market outlets of beer and helps collecting information about the market demand. For lateral integration, beer factory can combine with snacks factories like potato chips factories since people usually enjoy beer and snacks together. They are firms producing related but not competitive products, it can help the beer firm to extend brand name to another products, and hence saves much advertising costs. Also the firm’s income will be stable. For conglomerate integration, beer factory can combine with bus companies since they are firms producing unrelated products, it helps diversifying products, and the firms can get profits from other products if one product fails.