IRS Form W-9 and 1099 Income Reporting Information

advertisement

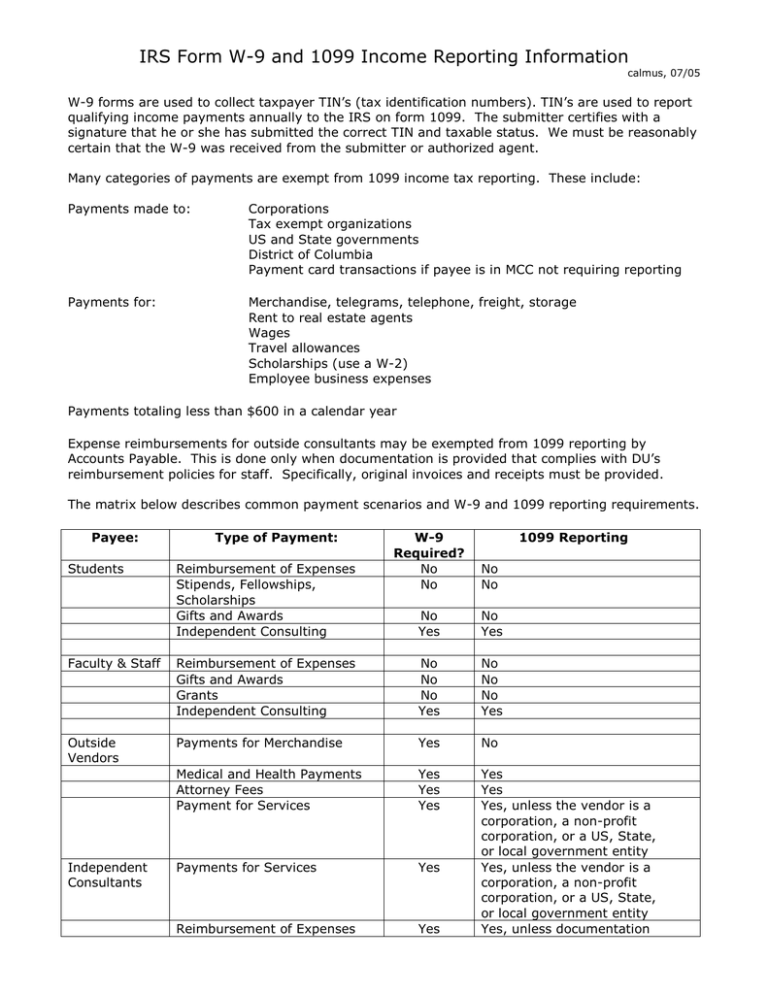

IRS Form W-9 and 1099 Income Reporting Information calmus, 07/05 W-9 forms are used to collect taxpayer TIN’s (tax identification numbers). TIN’s are used to report qualifying income payments annually to the IRS on form 1099. The submitter certifies with a signature that he or she has submitted the correct TIN and taxable status. We must be reasonably certain that the W-9 was received from the submitter or authorized agent. Many categories of payments are exempt from 1099 income tax reporting. These include: Payments made to: Corporations Tax exempt organizations US and State governments District of Columbia Payment card transactions if payee is in MCC not requiring reporting Payments for: Merchandise, telegrams, telephone, freight, storage Rent to real estate agents Wages Travel allowances Scholarships (use a W-2) Employee business expenses Payments totaling less than $600 in a calendar year Expense reimbursements for outside consultants may be exempted from 1099 reporting by Accounts Payable. This is done only when documentation is provided that complies with DU’s reimbursement policies for staff. Specifically, original invoices and receipts must be provided. The matrix below describes common payment scenarios and W-9 and 1099 reporting requirements. Payee: Students Type of Payment: Reimbursement of Expenses Stipends, Fellowships, Scholarships Gifts and Awards Independent Consulting W-9 Required? No No 1099 Reporting No No No Yes No Yes Faculty & Staff Reimbursement of Expenses Gifts and Awards Grants Independent Consulting No No No Yes No No No Yes Outside Vendors Payments for Merchandise Yes No Medical and Health Payments Attorney Fees Payment for Services Yes Yes Yes Payments for Services Yes Reimbursement of Expenses Yes Yes Yes Yes, unless the vendor is a corporation, a non-profit corporation, or a US, State, or local government entity Yes, unless the vendor is a corporation, a non-profit corporation, or a US, State, or local government entity Yes, unless documentation Independent Consultants Payee: Type of Payment: complies with DU policies 1099 Reporting Medical and Health Payments Attorney Fees W-9 Required? Yes Yes Affiliates Honorariums Payments for Services Reimbursement of Expenses Yes Yes Yes Yes Yes Yes, unless documentation complies with DU policies Foreign Service Providers (Individuals) Foreign Services No No Domestic Services W-8 BEN Req’d Yes Yes 30% withholding applies, unless exempted or reduced by treaty as listed on form 8233