ACCOUNTING RECORD Maxitech, which has the following standard costs:

advertisement

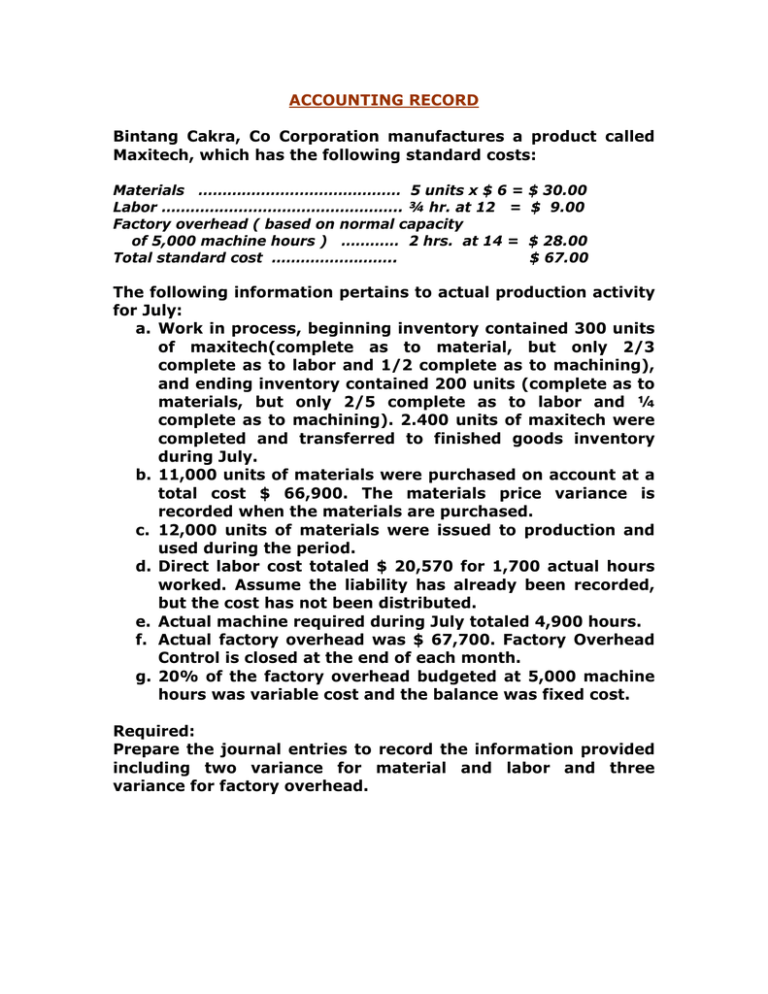

ACCOUNTING RECORD Bintang Cakra, Co Corporation manufactures a product called Maxitech, which has the following standard costs: Materials …………………………………… 5 units x $ 6 = Labor ………………………………………….. ¾ hr. at 12 = Factory overhead ( based on normal capacity of 5,000 machine hours ) ………… 2 hrs. at 14 = Total standard cost …………………….. $ 30.00 $ 9.00 $ 28.00 $ 67.00 The following information pertains to actual production activity for July: a. Work in process, beginning inventory contained 300 units of maxitech(complete as to material, but only 2/3 complete as to labor and 1/2 complete as to machining), and ending inventory contained 200 units (complete as to materials, but only 2/5 complete as to labor and ¼ complete as to machining). 2.400 units of maxitech were completed and transferred to finished goods inventory during July. b. 11,000 units of materials were purchased on account at a total cost $ 66,900. The materials price variance is recorded when the materials are purchased. c. 12,000 units of materials were issued to production and used during the period. d. Direct labor cost totaled $ 20,570 for 1,700 actual hours worked. Assume the liability has already been recorded, but the cost has not been distributed. e. Actual machine required during July totaled 4,900 hours. f. Actual factory overhead was $ 67,700. Factory Overhead Control is closed at the end of each month. g. 20% of the factory overhead budgeted at 5,000 machine hours was variable cost and the balance was fixed cost. Required: Prepare the journal entries to record the information provided including two variance for material and labor and three variance for factory overhead. Answer : Material Labor Overhead Units completed and transferred out this period 2,400 2,400 2,400 Less all units in beginning inventory 300 300 300 Equivalent units started and completed This period 2,100 2,100 2,100 Add equivalent units required to complete Beginning inventory 0 100 150 Add equivalent units in ending inventory 200 100 50 Equivalent units of production this period 2,300 2,300 2,300 Multiply by standard quantity of input Per unit of product 5 units ¾ DLH 2 MH Standard quantity of input allowed for Work produced during the period 11,500 1,725 4,600 Materials(11,000 AQ purchased x $26SP) $ 66,000 Materials Purchase Price variance …… 1,000 Account Payable ……………………….. $ 67,000 Work In Process ($6SPx11,500 SQ allowed) 69,000 Materials Quantity Variance ……………. 3,000 Materials ($6x 12,000 AQ issued) .. $ 72,000 Work In Process ($12x1,725 SH allowed) Labor Rate Variance ( $12.10 AR - $ 12 SR)x 1,700 AH) Labor Efficiency Variance ($12 SR x (1,700 AH – 1,725 SH) Payroll ……………………………………… 20,700 Factory Overhead Control……………….. Various Credits …………………………. 69,000 170 300 20,570 69,000 Work In Process ($14 FO rate x 4,600 SH allowed Applied Factory Overhead ………….. 64,400 Applied Factory Overhead ………………. Variable Efficiency Variance 64,400 ($2.80 var. rate* x (4,900 AH -4,600 SH) Volume variance ( $11.20 fix.rate** x (5,000BH-4,600 SH Spending variance …………………… Factory Overhead Control …………. 64,400 840 4,480 720 69,000 *). $14 FO rate x 20% variable = $ 2,80 variable rate **). $14 FO rate – 2.8 variable rate = $11,20 fixed rate.