Homework 6 A

advertisement

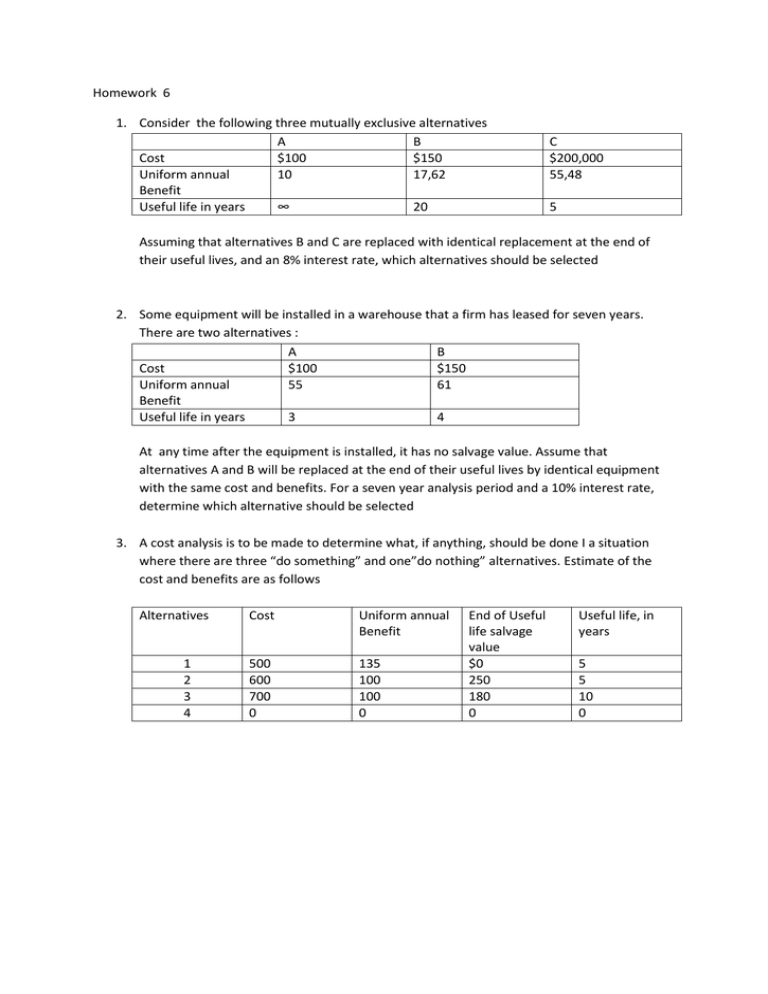

Homework 6 1. Consider the following three mutually exclusive alternatives A B Cost $100 $150 Uniform annual 10 17,62 Benefit Useful life in years ∞ 20 C $200,000 55,48 5 Assuming that alternatives B and C are replaced with identical replacement at the end of their useful lives, and an 8% interest rate, which alternatives should be selected 2. Some equipment will be installed in a warehouse that a firm has leased for seven years. There are two alternatives : A B Cost $100 $150 Uniform annual 55 61 Benefit Useful life in years 3 4 At any time after the equipment is installed, it has no salvage value. Assume that alternatives A and B will be replaced at the end of their useful lives by identical equipment with the same cost and benefits. For a seven year analysis period and a 10% interest rate, determine which alternative should be selected 3. A cost analysis is to be made to determine what, if anything, should be done I a situation where there are three “do something” and one”do nothing” alternatives. Estimate of the cost and benefits are as follows Alternatives 1 2 3 4 Cost Uniform annual Benefit 500 600 700 0 135 100 100 0 End of Useful life salvage value $0 250 180 0 Useful life, in years 5 5 10 0