Document 14997490

advertisement

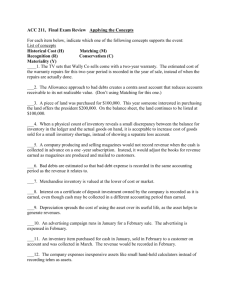

Matakuliah Tahun : V0232 – Akuntansi Keuangan Hotel : 2009 Hospitality Financial Accounting Week 13 Review Meeting Week 1 Review TRUE OR FALSE STATEMENT 1. Hospitality managers are the only people who need financial accounting information. 2. Accounting communicates financial information about a business enterprise to both internal and external users. 3. Accountants rely on a fundamental business concept—ethical behavior—in reporting financial information. 4. The Securities and Exchange Commission has the power to enforce the form and content of financial statements of all businesses. 5. The cost principle states that assets should be recorded at their fair market value. Week 2 Review TRUE OR FALSE STATEMENT 1. When the volume of transactions is large, recording them in tabular form is more efficient than using journals and ledgers. 2. A debit to an account always indicates an increase in that account. 3. 3. The dividends account is a subdivision of the retained earnings account and appears as an expense on the income statement. 4. Transactions are entered in the ledger accounts and then transferred to journals. 5. A compound journal entry requires several debits to one account and several credits to one account. Week 3 Review TRUE OR FALSE STATEMENT 1. The time period assumption is often referred to as the matching principle. 2. Expense recognition often follows revenue recognition. 3. Adjusting entries are not necessary if the trial balance debit and credit columns balances are equal. 4. An adjusting entry always involves two balance sheet accounts. 5. Accrued revenues are revenues which have been received but not yet earned. Week 4 Review TRUE OR FALSE STATEMENT 1. If total credits in the income statement columns of a work sheet exceed total debits, the enterprise has net income. 2. The adjusted trial balance columns of a work sheet are obtained by subtracting the adjustment columns from the trial balance columns. 3. After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances. 4. The Dividends account is a permanent account whose balance is carried forward to the next accounting period. 5. Closing entries are journalized after adjusting entries have been journalized. Week 5 Review TRUE OR FALSE STATEMENT 1. 2. 3. 4. 5. Selling expenses relate to general operating activities such as personnel management. Merchandise inventory is classified as a current asset on a classified balance sheet. Gross profit is a measure of the overall profitability of a company. A consolidated income statement is a summary statement of all the departmental income statements of a property. For external reporting, a company must prepare either an income statement or a statement of cash flows, but not both. Week 6 Review TRUE OR FALSE STATEMENT 1. Intracompany comparisons of the same financial statement items can often detect changes in financial relationships and significant trends. 2. Measures of a company's liquidity are concerned with the company’s ability to service long-term debt. 3. Horizontal, vertical, and circular analyses are the most common tools of financial statement analysis. 4. In a vertical analysis of an income statement, each item on the income statement is expressed as a percentage of sales. 5. Common size analysis expresses each item within a financial statement in terms of a percent of a base amount. Week 7 Review TRUE OR FALSE STATEMENT 1. Retailers and wholesalers are both considered merchandisers. 2. The steps in the accounting cycle are different for a merchandiser than for a service enterprise. 3. Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs. 4. A periodic inventory system requires a detailed inventory record of inventory items. 5. Sales revenues are earned during the period cash is collected from the buyer. Week 8 Review TRUE OR FALSE STATEMENT 1. Transactions that affect inventories on hand have an effect on both the balance sheet and the income statement. 2. Consigned goods are goods held for sale by one party although ownership of the goods is retained by another party. 3. Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company. 4. Freight-in is an account that is subtracted from the Purchases account to arrive at cost of goods purchased. 5. The cost of goods sold section of an income statement prepared under a periodic inventory system will contain more detail than under a perpetual inventory system. Week 9 Review TRUE OR FALSE STATEMENT 1. A highly automated computerized system of accounting eliminates the need for internal control. 2. A business’s assets need to be safeguarded from employee theft and unauthorized use. 3. Requiring employees to take vacations is a weakness in the system of internal controls because it does not promote operational efficiency. 4. Segregation of duties means that employees should duplicate efforts so that one employee can evaluate the work of the other. 5. For efficiency of operations and better control over cash, a company should maintain only one bank account. Week 10 Review TRUE OR FALSE STATEMENT 1. Other receivables include nontrade receivables such as loans to company officers. 2. Accounts receivable are the result of cash and credit sales. 3. The percentage of receivables basis of estimating expected uncollectible accounts emphasizes income statement relationships. 4. The percentage of sales basis for estimating uncollectible accounts always results in more Bad Debts Expense being recognized than the percentage of receivables basis. 5. A factor purchases receivables from businesses for a fee and collects the remittances directly from customers. Week 11 Review TRUE OR FALSE STATEMENT 1. When purchasing delivery equipment, sales taxes and motor vehicle licenses should be charged to Delivery Equipment. 2. The depreciable cost of a long-term asset is its original cost minus obsolescence. 3. The Accumulated Depreciation account represents a cash fund available to replace long-term assets. 4. The declining-balance method of depreciation is called an accelerated depreciation method because it depreciates an asset in a shorter period of time than the asset's useful life. 5. To determine a new depreciation amount after a change in estimate of a long-term asset's useful life, the asset's remaining depreciable cost is divided by its remaining useful life. Week 12 Review TRUE OR FALSE STATEMENT 1. In a partnership each partner is personally and individually liable for all partnership liabilities. 2. Each partner’s initial investment in a partnership should be recorded at the book value of the asset at the date of their transfer to the partnership. 3. In a partnership the same basis of division usually applies to both net income and net loss. 4. If a corporation pays taxes on its income, then stockholders will not have to pay taxes on the dividends received from that corporation. 5. Organization costs are expensed immediately, even though they conceptually benefit the corporation over its entire life.