Accounting Information Systems:

A Business Process Approach

Chapter Eight: Using Accounting

Applications

1

Learning Objectives

After completing this chapter, you should

understand:

Accounting application and modules

Typical elements in an AIS menu

The four processing modes

The use of accounting packages for real-time and

batch processing

Posting to the general ledger

The purging of record

2

Learning Objectives (Continue)

After completing this chapter, you should be able

to:

Identify menu option required for an application

Identify the effect of various processing option on

events and master tables

Identify the effect of various processing option on

reports

Identify controls used to address risks under

various processing option

3

Exhibits: 8.5

Tables: 8.1 - 8.11

4

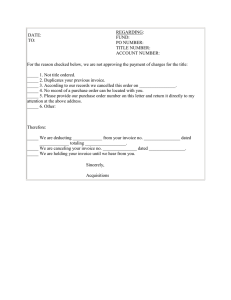

Exhibit 8.5 Caution when Purging

The following are excerpts from the rules concerning what is not purged when using the

purge process in Peachtree, v.6.0:

If the transaction is dated after the purge date, then it is saved.

If the transaction is a payroll check and it is in or after the current payroll year, then

it is

saved.

If the transaction is a purchase or sale invoice and it is not fully paid off as of the

purge

date, then it is saved.

If the transaction is a cash receipt or cash disbursement and it is applied to a

saved invoice, then it is also saved.

If the transaction is a sale or purchase and has related payments that have already

been

saved, then it is also saved.

Source: Peachtree Accounting Help, Copyright © 1992–1998, Peachtree Software, Inc. All rights reserved.

5

Table 8.1 Similarities between Modules and Application Menus

Master records to

maintain

Events to record

Purchasing

Module

Module

Module

Module

Supplier

Customer

Product

G/L Account

Purchase order

Receipt of goods

or services

Payment

Examples of event Daily list of

reports

purchases

Examples of status Open payables

reports

Sales

Inventory

Genera

Customer order

Inventory adjustments Journal entries

Delivery of goods

or services

Collection of cash

Daily list of sales

Adjustments report General journal

Aged accounts

receivable

Inventory stock status Trial balance

6

Table 8.2 Requirement for Event Tables for H & J Tax Preparation Service

E1

Event

Make appointment

E2

Request service

Possible

Table

Appointment

calendar

Service

Request

secretary

after the

complete.

E3

Complete tax return

accountant.

E4

Bill client

customer’s

Event Tables Used

No.

Updates to

Master Tables

No. The narrative suggests

that service request information is not entered into

the computer. The

enters information into the

computer only

service is

Service

Provided

No. Tax return tables are

stored by Mega-Tax, and

paper evidence of

completion of tax return is

given to the secretary by

the

Invoice

Yes. Service details are Narrative suggests

entered into the computer

Balance is

increased, and the

at this time, and the

invoice is prepared.

the

are

E5

Collect cash

Cash Receipt

Narrative suggests customer’s

Year-to-Date_Revenues

amount for each service

provided is updated. Thus,

Client and Service tables

updated.

Yes. The Collection_Date

Invoice#, Amount, and

Thus,

7

Balance is decreased.

Table 8.3 Sample Data for H & J Tax Preparation Service

Service Table

Service#

Service Description

Fee

Year-to-Date

_Revenues

1040

Sch-A

Sch-B

Federal Individual Income Tax Form 1040 (long form)

1040 Schedule A (itemized deductions)

1040 Schedule B (interest & dividend earnings)

$53,300

1040 Schedule C (sole proprietorship)

$84,000

State Income Tax Return

$81,000

Corporate Income Tax

$103,000

$100

$50

$120,000

$51,000

Sch-C

State

Corp

$50

$110

$80

$30 (per hr.)

Client Table

Client#

Client_Name

Address

1001

1002

1003

242 Greene St., St. Louis, MO

314-222-3333

$0

123 Walnut St., St. Louis, MO

314-541-3322

$0

565 Lakeside, St. Louis, MO

314-541-6785

Robert Barton

Donna Brown

Sue Conrad

Accountant Table

Accountant#

405-60-2234

512-50-1236

Telephone

Balance_Due

$390

Accountant_Name

Jane Smith

Michael Speer

8

Table 8.3 Sample Data for H & J Tax Preparation Service (Concluded)

Invoice Table

Invoice#

Request#

Client#

Invoice

Accountant# _Date

Amount

Status

Post

_Date

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

02/23/03

02/28/03

Post_Date = date that invoice information was posted to tables in the sales module (Services and Client tables); G/L_Post_Date =

date that invoice information was used to update the general ledger module; Status = “closed” if paid, “open” if not

Cash_Receipt Table

Receipt# Invoice# Collection_Date

Check#

Amount

Post_Date G/L_Post_Date

275

276

125

316

$230

$180

03/01/03

03/03/03

305

307

03/01/03

03/03/03

Invoice_Detail Table

Invoice# Service# Fee

305

305

305

306

306

306

306

306

307

307

1040

Sch-A

State

1040

Sch-A

Sch-B

Sch-C

State

1040

State

$100

$50

$80

$100

$50

$50

$110

$80

$100

$80

9

Table 8.4 Additional Data for H&J Tax Preparation Service

Information obtained about new clients:

Balance

Client#

Client Name

_Due

Address

Telephone

1004

Roger Longman

922 Carlton, St. Louis, MO

314-986-1234

1005

Jeff Parker

198 Hillside Dr., St. Louis, MO

314-689-5454

1006

Jane Kimball

461 Tucker Rd., St. Louis, MO

314-322-4554

Information about service requests recently completed:

Request# Client#

Accountant#

Invoice_Date

Amount

107

109

108

Request#

1004

1006

1005

Service#

512-50-1236

405-60-2234

512-50-1236

Fee

107

107

107

107

109

109

108

108

1040

Sch-A

Sch-B

State

1040

State

1040

State

$100

$50

$50

$80

$100

$80

$100

$80

03/03/03

03/03/03

03/03/03

$0

$0

$0

$280

$180

$180

10

Table 8.5 Effect of Recording Invoice# 308—Real-Time System

Service Table

Service#

Service_Description

Fee

Year-to-Date

_Revenues

1040

Sch-A

Sch-B

Federal Individual Income Tax Form 1040 (long form)

1040 Schedule A (itemized deductions)

1040 Schedule B (interest & dividend earnings)

$53,350

1040 Schedule C (sole proprietorship)

$84,000

State Income Tax Return

$81,080

Corporate Income Tax

$103,000

$100

$50

$120,100

$51,050

Sch-C

State

Corp

$50

$110

$80

$30 (per hr.)

Client Table

Client#

Client_Name

Address

1001

1002

1003

242 Greene St., St. Louis, MO

314-222-3333

$0

123 Walnut St., St. Louis, MO

314-541-3322

$180

565 Lakeside, St. Louis, MO

314-541-6785

1004

Robert Barton

Donna Brown

Sue Conrad

$390

Roger Longman

Accountant Table

Accountant#

405-60-2234

922 Carlton, St. Louis, MO

Accountant_Name

Jane Smith

Telephone

314-986-1234

Balance_Due

$280

11

Table 8.5 Effect of Recording Invoice# 308—Real-Time System (Continued)

Invoice Table

Invoice#

Request#

Client#

Invoice

Accountant# _Date

Amount

Status

Post

_Date

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

02/23/03

02/28/03

308

107

1004

512-50-1236 03/03/03

$280

open

03/03/03

Post_Date = date that invoice information was posted to tables in the sales module (Services and Client tables); G/L_Post_Date =

date that invoice information was used to update the general ledger module; Status = “open” if not paid, “closed” if paid

Invoice_Detail Table

Invoice# Service# Fee

305

305

305

306

306

306

306

306

307

307

308

308

308

308

1040

Sch-A

State

1040

Sch-A

Sch-B

Sch-C

State

1040

State

1040

Sch-A

Sch-B

State

$100

$50

$80

$100

$50

$50

$110

$80

$100

$80

$100

$50

$50

$80

12

Table 8.5 Effect of Recording Invoice# 308—Real-Time System (Concluded)

Cash_Receipt Table

Receipt# Invoice# Collection_Date

Check#

Amount

Post_Date G/L_Post_Date

275

276

305

307

03/01/03

03/03/03

125

316

$230

$180

03/01/03

03/03/03

Recording and posting Invoice# 308 caused three changes to tables in the sales module.

1. File maintenance: Because this is an event for a new customer, a record has been added to the Client

Table for Roger Longman.

2. Event recording: One record was added to the Invoice Table (#308) and four records to Invoice_Detail

Table. Invoice table now shows the posting date (PostDt)

3. Master file update: Year-to-Date_Revenues (in the Service Table) for the four services used per

Invoice# 308 increased by $100, $50, $50, and $80.

13

Table 8.6 Invoice Table—Before Batch Recording

Invoice#

Request#

Client#

Invoice

Accountant# _Date

Amount

Status

Batch#

Post

_Date

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

1070

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

1071

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

1072

02/23/03

02/28/03

Post_Date = date that invoice information was posted to tables in the sales module (Services and Client tables); G/L_Post_Date =

date that invoice information was used to update the general ledger module; Status = “open” if not yet paid, “closed” if paid

14

Table 8.7.A Invoice Table—After Batch Recording

Invoice#

Request#

Client#

Accountant# _Date

Invoice

Amount

Status

Batch#

Post

_Date

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

1070

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

1071

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

1072

02/23/03

02/28/03

308

107

1004

512-50-1236 03/03/03

$280

open

1073

309

109

1006

405-60-2234 03/03/03

$180

open

1073

310

108

1005

512-50-1236 03/03/03

$180

open

1073

15

Table 8.7.B Invoice_Detail Table—After Batch Recording

Invoice#

305

305

305

305

306

306

306

306

306

307

307

308

308

308

308

309

309

310

310

Service#

1040

Sch-A

Sch-B

State

1040

Sch-A

Sch-B

Sch-C

State

1040

State

1040

Sch-A

Sch-B

State

1040

State

1040

State

Fee

$100

$50

$50

$80

$100

$50

$50

$110

$80

$100

$80

$100

$50

$50

$80

$100

$80

$100

$80

16

Table 8.8 Batch Recording: Tables After Posting Batch# 1073

(Compare to Table 8.3 which shows the tables before posting.)

Service Table

Service#

Service_Description

Fee

Year-to-Date

_Revenues

1040

Sch-A

Sch-B

Federal Individual Income Tax Form 1040 (long form)

1040 Schedule A (itemized deductions)

1040 Schedule B (interest & dividend earnings)

$53,350

1040 Schedule C (sole proprietorship)

$84,000

State Income Tax Return

$81,240

Corporate Income Tax

$103,000

$100

$50

$120,300

$51,050

Sch-C

State

Corp

$50

$110

$80

$30 (per hr.)

Client Table

Client#

Client_Name

Address

1001

1002

1003

1004

1005

1006

242 Greene St., St. Louis, MO

314-222-3333

$0

123 Walnut St., St. Louis, MO

314-541-3322

$180

565 Lakeside, St. Louis, MO

314-541-6785

922 Carlton, St. Louis, MO

314-986-1234

$280

198 Hillside Dr., St. Louis, MO

314-689-5454

$180

461 Tucker Rd., St. Louis, MO

314-322-4554

$180

Robert Barton

Donna Brown

Sue Conrad

Roger Longman

Jeff Parker

Jane Kimball

Telephone

Balance_Due

$390

17

Table 8.8 Batch Recording: Tables After Posting Batch# 1073

Invoice Table

Invoice#

Request#

Client#

Invoice

Accountant# _Date

Amount

Status

Batch#

Post

_Date

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

1070

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

1071

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

1072

02/23/03

02/28/03

308

107

1004

512-50-1236 03/03/03

$280

open

1073

03/03/03

309

109

1006

405-60-2234 03/03/03

$180

open

1073

03/03/03

310

108

1005

512-50-1236 03/03/03

$180

open

1073

03/03/03

The Invoice_Detail and Cash_Receipt tables are not shown here because the records were unchanged by the process of posting

the purchase invoices.

18

Table 8.9 Immediate and Batch Recording Configurations

Immediate Recording

Batch

Recording

Real-time

Data entry: Are event data recorded in an event Yes

table as soon as an event occurs?

Edit: Are data edited at the time of data entry?

Yes

Edit report: Is an edit report required before posting?

Yes

Update: Are summary fields in resource or agent Yes

records updated close to the time when the event

occurred?

Status report: Are events included in resource or Yes

agent status reports close to the time when they

occurred?

Batch Update

On-line Off-line

Yes

No

No

Yes

No

Yes

No

No

No

No

No

No

Yes

No

Yes

19

Table 8.10 Invoice Table

Invoice#

Request#

Client#

Accountant#

Invoice

_Date

Amount

Status

Post

Batch#

G/L_Post

_Date

305

104

1001

405-60-2234 02/13/03

$280

closed

1070

02/13/03

02/28/03

306

106

1003

405-60-2234 02/22/03

$390

open

1071

02/22/03

02/28/03

307

105

1002

512-50-1236 02/23/03

$180

closed

1072

02/23/03

02/28/03

308

107

1004

512-50-1236 03/03/03

$280

open

1073

03/03/03

309

109

1006

405-60-2234 03/03/03

$180

open

1073

03/03/03

310

108

1005

512-50-1236 03/03/03

$180

open

1073

03/03/03

20

Table 8.11 Recording and Updating Alternatives—Modules and General Ledger

Process

Recording

Event

Update

Module*

Update

General Ledger

Real-time

Real-time

Batch update

Batch recording

I

I

I

B

I

I

B

B

I

B

B

B

I = immediate (as soon as the event occurs), B = batch

*Update of the module where the event was initially recorded

21